Trump accepts Republican nomination (PBH, CGC)

WHAT MATTERED TODAY

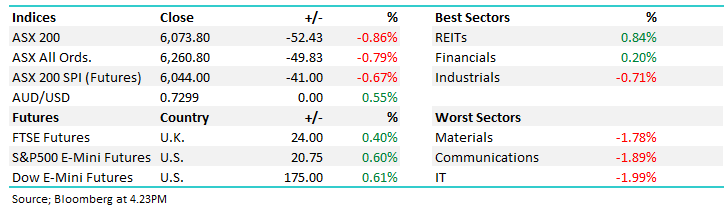

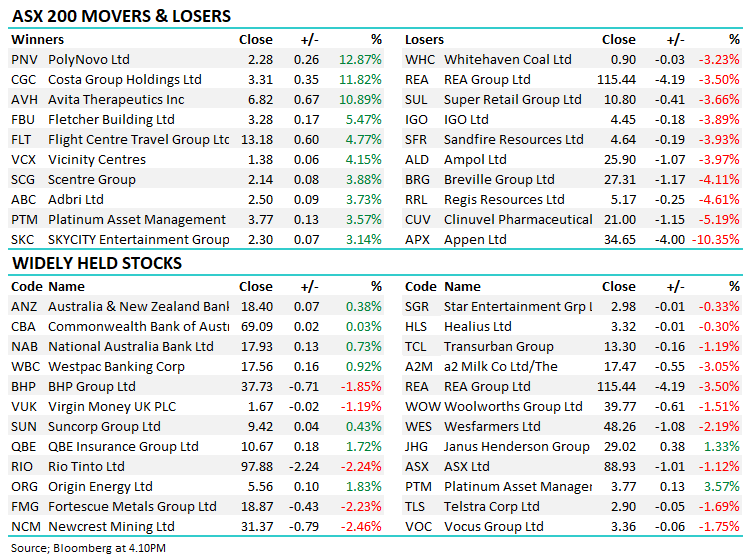

A softer session today to mark what is more or less then end of reporting season here. Equities got off to a lacklustre start following a pretty vague Jackson Hole talk which focussed more on employment than any changes to inflation targets which the market was hoping for. There was a brief reprieve in the early afternoon as President Trump took the mic at the Republican convention, talking a big game ahead of the election as he officially accepted the Republican nomination. From there though, local equities eased into the close with today’s fall accounting for all of the week’s softness in the local index. Real estate & Financials were higher today while tech was the weakest sector.

Overall, the ASX 200 closed down -52pts or -0.86% to 6073 today. US Futures are lower, with Dow Futures up 175pts/0.61%.

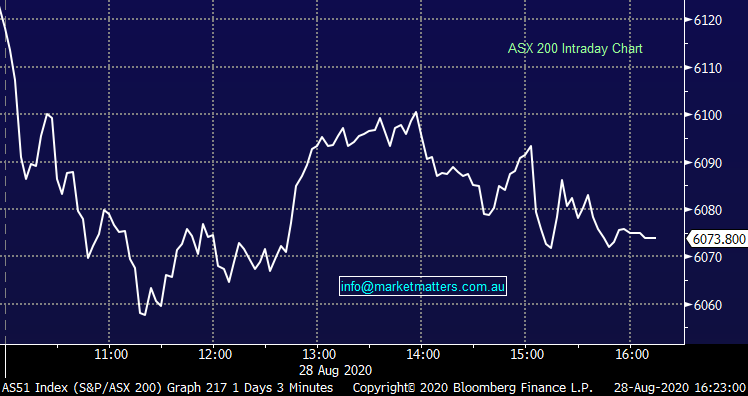

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

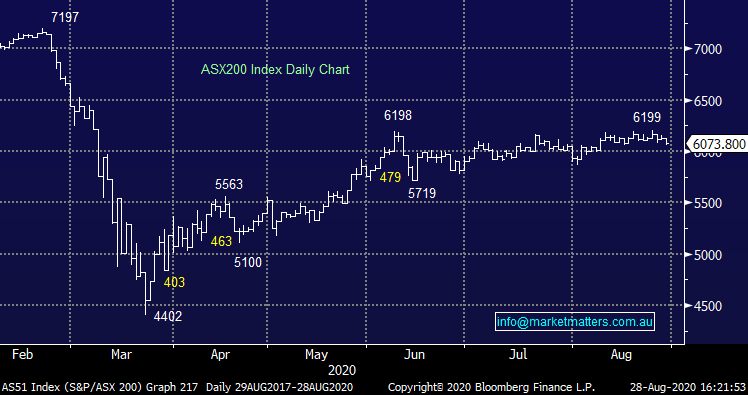

Pointsbet (PBH) +86.67%: full year results were largely in line with expectations, if not a little better despite the EBTIDA loss increasing to -$37.6m. Pointsbet has been focussing on winning market share in the US, and spending big to do it so it wasn’t a huge surprise that it printed another loss for the financial year. The stock popped today, to put it lightly, after it partnered with major US network NBC. The network has the largest sports audience in the US with over 184m viewers with PointsBet holding exclusive rights for “pre-game, postgame and in-game promotional enhancements” as well as integration into television and digital platforms of NBC. For its trouble, NBC will collect a 4.9% stake in PBH as well as nearly 67m options maturing in 5 years’ time. PointsBet also intend to undertake a capital raise though renounceable entitlement offer for shareholders, to be launched after market on Wednesday next week. A win for the punters.

PointsBet (PBH) Chart

Costa Group (CGC) +11.82%: CGC is a December year end so today was their 1H results. The rhetoric being the most optimistic I’ve heard in a few years, although in fairness, the bar was set low. Revenue of $612.4m was as expected however profit for the half was stronger by a decent margin. Market expectations for the full year were sitting at profit of $52.1m & CGC delivered $45.8m for the half. They do have a big 1H skew in terms of their earnings – normally around 80/20 and that is obvious in these numbers, however given the commentary about momentum for the second half and the problems around drought, water, crop issues and the like being fixed. I was expecting we’ll see decent upgrades on this one and being a cyclical business with a lot of leverage in it, this one could run hard post this result. The 11% gain today is nice, but likely more to come in our view.

Costs Group (CGC) Chart

Sectors this week

Stocks this week

OUR CALLS

No changes today

Have a great night

Harry and the Market Matters team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.