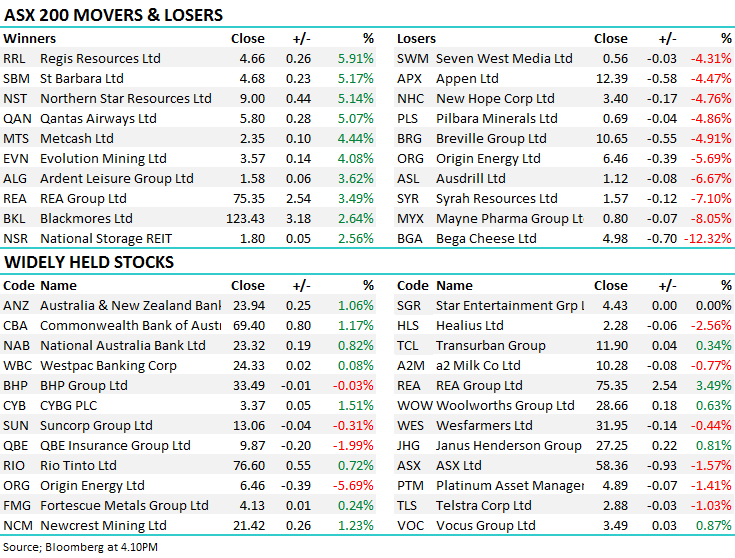

Traders remain cautious ahead of the Fed (BGA)

WHAT MATTERED TODAY

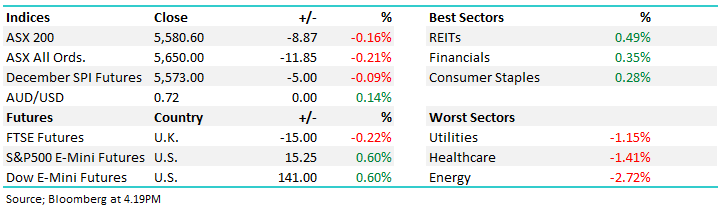

Another fairly choppy session in Australia today similar to what we saw on Wall Street overnight, and as one client suggested– seems to be the new normal. The market was sold early, recovered up until lunch, dipped into the afternoon before a late rally into the close as buyers stepped up on the back of a positive move in US Futures.

The banks were in focus, and we write about them in the Income Report today with the removal of APRA imposed cap on interest only and investment loans. Originally the cap was put in place to try and take some heat out of the property market and improve credit standards – now that has been done, there seems to be no need for the limit. In essence, it now means that the proportion of new loans which are interest only will stop falling which should support house prices – a clear risk factor the banks at the moment. This should also be beneficial for loan growth and therefore earnings growth for the banks, which is the first piece of bullish banking news we’ve seen in a long period of time. We covered the banks today in the Income Note – click here.

That news supported the financial sector today, however all else was fairly soggy, particularly the energy and high value growth areas of the market.

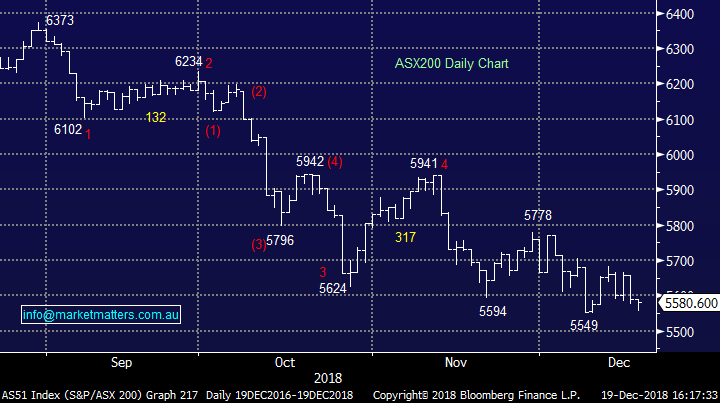

Overall today, the ASX 200 closed down -8 points or -0.16% to 5580. Dow Futures are currently trading up 141 points or +0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

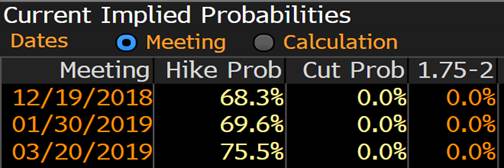

The US Fed; A very influential Fed meeting tonight with the outcome discussed at a 6am (our time) news conference tomorrow morning with Federal Reserve Jerome Powell in the hot seat. As we suggested this am, its proving to be a difficult job with the state of markets pulling one way, yet the U.S economy is actually performing pretty well. The market is pricing a 68% chance for a rate hike which is far from a certainty, however a lot of focus will be put on the likely path forward into 2019. We think they’ll hike tonight, but downplay future activity in 2019.

Broker Moves; Not a lot in terms of broker moves today with Morningstar seemingly the only firm making major changes…Christmas holidays have started, yet it still feels like there’s a lot left in the year still!

ELSEWHERE:

· Carnarvon Reinstated at Macquarie With Outperform; PT A$0.40

· Premier Investments Upgraded to Buy at Blue Ocean; PT A$17

· Abacus Property Downgraded to Hold at Morningstar

· SkyCity Entertainment Upgraded to Buy at Morningstar

· Flight Centre Upgraded to Hold at Morningstar

· Magellan Financial Upgraded to Buy at Morningstar

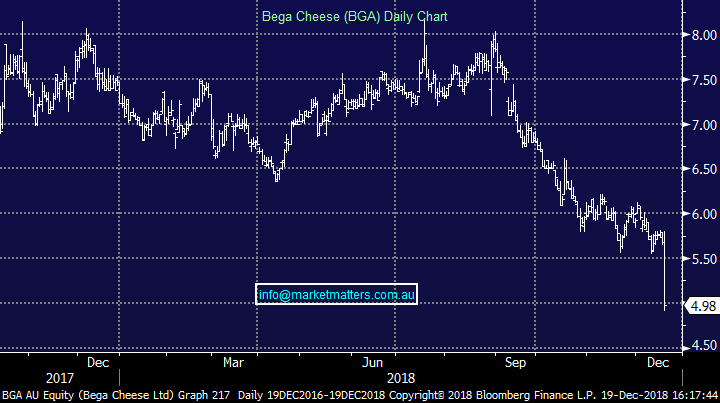

Bega Cheese (ASX: BGA) $4.98 / -12.32%; was the worst performer in the ASX200 today after updating the market with soft guidance for FY19 half way through the year. As with many companies with leverage to the agriculture sector, Bega has blamed the drought for its woes. A lack of rainfall has seen milk production fall and costs increase, eating away at Bega’s production and margins, with milk supply across the industry expected to fall 5% over FY19.

The company guided to $123m-$130m EBITDA in the current financial year, which translates to a net profit of $44m-$48m. EBITDA guidance suggests growth of 12-19% over the year, but this impressive number falls short of market expectations. Analysts’ EBITDA consensus was set at $135.3m for the year, along with a $55.75m net profit number, meaning new guidance has missed EBITDA by 6.5% and profit by over 17%. Today’s fall pushes the stock to near 2-year lows and is languishing well below the $7.10 price they raised capital at back in September. We have previously talked about the value in buying agriculture related stocks into weather related weakness. Bega is trading on a lofty PE of 21.5x forward earnings, but will only manage ~5% growth for the year so by that metric BGA could still have some way to fall.

Bega Cheese (ASX: BGA) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.