Tough October ends on a high note!

What Mattered Today

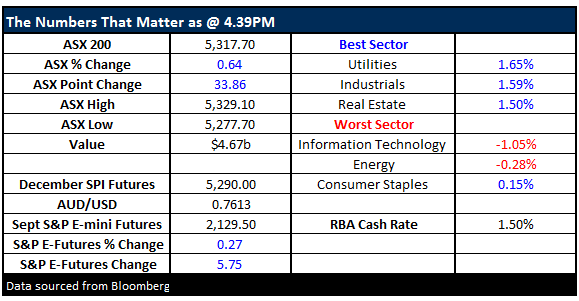

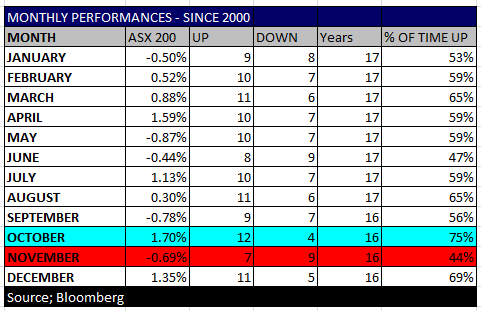

A positive end to a pretty tough month with the index down -2.17% which goes against the historical trends for October. Since 2000, October has been up 12 times, and down 4 for an average return of +1.70% - which is an important stat. Markets are all about probabilities rather than certainties and clearly the outcome with lower expectancy happened this year. The material stocks were best on ground – followed by the banks with a 0.71% gain – which is good relative to the market but poor relative to history. As we’ve often quoted this month, banks typically put on around +4% in October but importantly, they have a weak November as 3 of the big 4 trade ex-dividend.

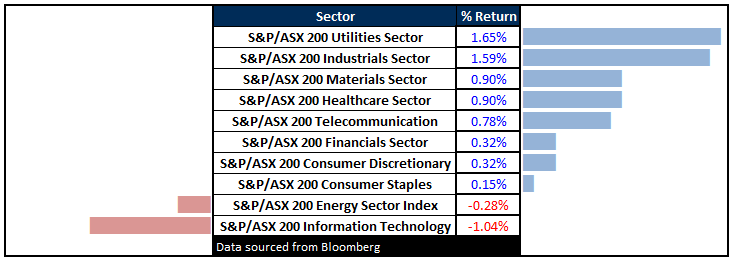

Most pain this month was felt in those defensive names. If you’re holding a ‘low risk’ portfolio of bonds and ‘bond like equities’ then you’ve done it tough in October. These assets are highly correlated so diversification within asset classes that seem different on paper but are clearly impacted by the same market forces makes little sense to us. Just on that, the performance below highlights the risks of the changing market we’re in. At the start of the year, no one wanted to touch resources yet they’ve rallied strongly. A few months ago, the most popular ‘go to’ trade was defensive infrastructure and realestate. Trends in markets do change and if you get on the wrong side of a crowded trade that starts to come unstuck, it can hurt.

Source; Bloomberg

Clearly – from the chart above October has been a tough month with some big changes to longer term trends. The other important aspect to hit markets this month has been some large one off stock specific incidents as we touched on in our weekend report on Sunday. As we highlighted then….AMP -11.4%, Wesfarmers -8.7%, Cochlear -10.9%, Ramsay Healthcare -10.3%, Healthscope -28.2%, Sirtex -12.3% TPG Telecom -16.8%, Sydney Airports -13%, Westfield -10.3%, Transurban -10.4%, Crown -18.5%, Star Entertainment -17.4% and Ardent Leisure -26.3%. – all house hold names that have been hit very hard during one month of trade.

Moving into November, it’s typically a weak month although saying that, the level of weakness is often dependent on the level of positivity that played out in the month prior - so the below stats do lose some relevance after the weakness we’ve seen in October. Still, the big takeout is around the low percentage for a positive month – which sits at 44%. Overall, some caution is clearly warranted leading into November, and we’ve made some moves in our portfolio by increasing cash to 21%.

On the market today, we had a range of +/- 52 points, a high of 5329, a low of 5277 and a close of 5283, up 33pts or +0.64%.

ASX 200 daily chart

Sectors

ASX 200 Movers

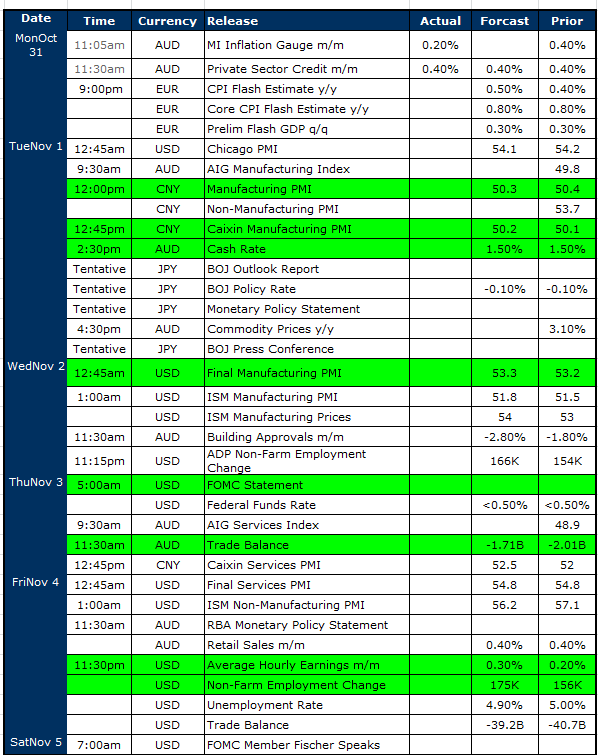

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

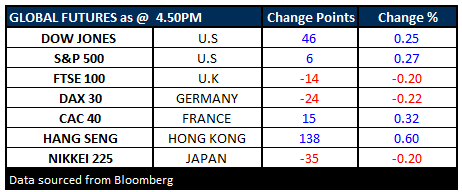

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/10/2016 5.25PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here