Three cracking results, the market rebounds strongly (NCK, TLS, QBE)

WHAT MATTERED TODAY

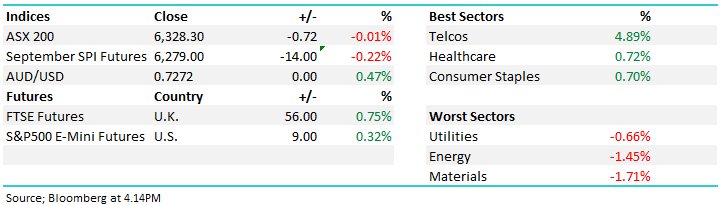

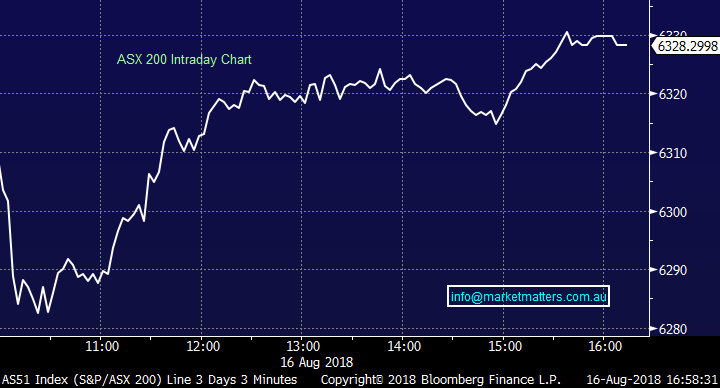

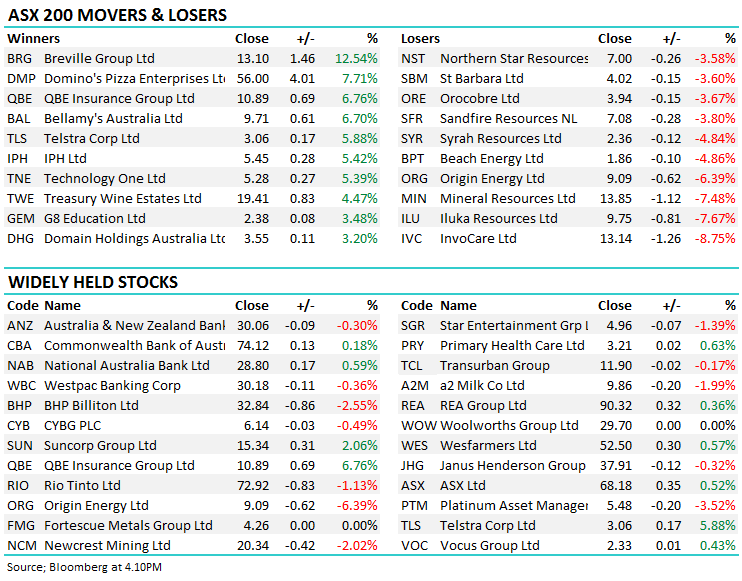

An impressive performance from the local market today after some very poor leads overnight. The index rallied strongly from the early morning low of -47pts / -0.74% before the banks and some recovery from the hard hit resources saw the index close less than a point lower. Telstra was the biggest addition to the index following a good result, adding 6.5pts on its own. Other holdings of ours QBE & Nick Scali also reported well – more on these names later on. On the flipside, Iluka was weak, as was Invocare and Origin.

Telstra the star today was the reason telcos strongly topped the leader board, while weakness in materials stemmed from soft oil and resource prices overnight.

Overall, the ASX200 fell -1 point today or -0.01% to close at 6328

Reporting will be a little quieter tomorrow with just Abacus and Goodman. For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· ANZ Bank (ANZ AU): Downgraded to Hold at Morgans Financial; PT A$30

· Bellamy’s (BAL AU): Upgraded to Add at Morgans Financial; PT A$13

· Dexus (DXS AU): Downgraded to Neutral at JPMorgan; PT A$10.50

· Infomedia (IFM AU): Downgraded to Hold at Bell Potter; PT A$1.25

· Insurance Australia (IAG AU): Upgraded to Buy at Bell Potter; PT A$8.40

· Pact Group (PGH AU): Downgraded to Neutral at Credit Suisse; PT A$4.35

· Wesfarmers (WES AU): Upgraded to Neutral at JPMorgan; PT A$50

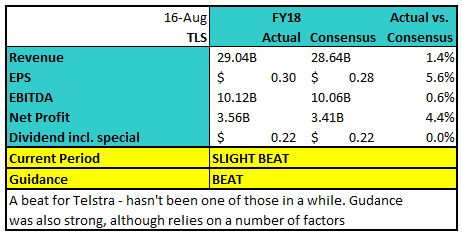

Telstra (TLS) $3.06 / +5.88%; Telstra’s result this morning lead to a wave of buying throughout the day, pushing the stock price through $3 again – congratulations to James for winning the pineapple in his office bet! The result itself was strong, beating recently downgraded guidance, and guidance was above market. Key to the result was an improvement in the mobile market, something Telstra has struggled with recently. EBITDA guidance for FY19 was set at $8.8b-$9.5b with consensus at $8.97b – a 2% beat to the mid-point.

Telstra (TLS) Chart

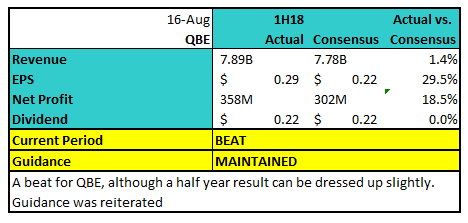

QBE Insurance (QBE) $10.89 / +6.76%; An ‘not bad’ result from QBE was taken well by the market after years of consistently disappointing investors. The half year result saw a tax break, premium rate rises, recommitment to buybacks, dividends and lowering gearing – all an investor asks for! The result, particularly the premium rate rising, shows the improving nature of the insurance market, and hopefully the improving ability for QBE to execute effectively, something they have failed to do for a while. The market’s reaction clearly showed the negative views on the stock took a big hit.

QBE Insurance (QBE) Chart

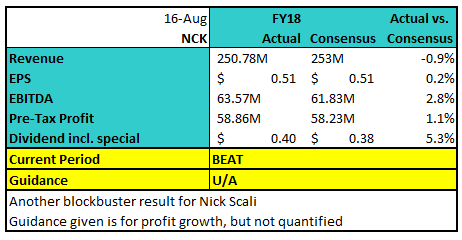

Nick Scali (NCK) $6.78 / +13%; a bumper FY18 result as Nick Scali once again under promise and over deliver – it is becoming habitual for the furniture retailer. The stock was sold off into the result as investors feared a housing downturn and soft retail numbers meant a soft result for NCK, however the result was a beat across most metrics. The market was also a big fan of lowering of costs – shown in the miss to revenue but big beat in EBITDA. No exact guidance was given, but commentary for general profit growth was taken well. The dividend beat was also great for the Income Portfolio which holds NCK.

Nick Scali (NCK) Chart

OUR CALLS

We sold Orocobre and added the USD ETF in the Growth Portfolio today. We are keeping a close eye on Mineral Resources. A view is slowly being built around yesterday’s result which will guide whether the position is cut or held.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here