The ‘yield play’ starts to unwind

A very tough day for Aussie stocks with the market weak on open with the early selling intensifying throughout the day – and particularly after the RBA held rates unchanged at 1.50%. The RBA's statement kept the same tune as prior months saying "holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time". They reiterated their global view saying that "The broad-based pick-up in the global economy is continuing", and "Labour markets have tightened further", however they were less upbeat about the local economic picture flagging weaker than expected Q1 GDP expectations. As is normally the case though with central bank rhetoric, they more or less said near term weakness is a short term thematic and we’ll get back on track towards their reasonably bullish +3% growth projection over the next couple of years. Whatever the case, the local economy is clearly going through a bit of a flat spot (just ask the retailers), and this is dampening near term expectations for economic growth.

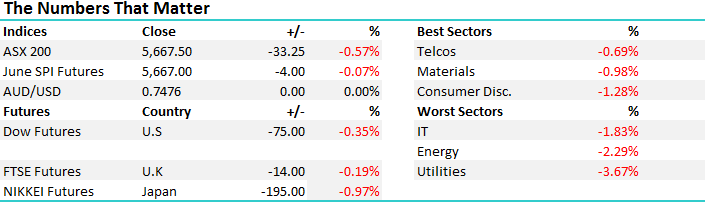

Banks are a leveraged play on Aussie GDP and weakness here is just another factor in the ‘sell the banks’ trade that has played out in May / early June. As subscribers would know, we sold banks before May however we’ve been buying back into the sector more recently, a touch early it would seem after today’s sell off. As a group, the banks were hit hard on the session (-20pts of the index) but they weren’t the main drag today. That was left to the defensive areas like the utilities which were smashed, down by -3.67% and energy was also on the nose dropping by more than -2%.

On the broader market today, we were sold on open, saw sustained selling thereafter and then another leg lower after the RBA decisions and associated release. An overall range of +/- 81 points, a high of 5749, a low of 5668 and a close of 5668, off -87pts or -1.52%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

This morning we wrote about the yield theme as it related to the banks in a note titled; Is the yield curve playing the tune of the ASX200? A timely piece in hindsight following today’s moves. The main point of the note was to highlight the recent change of trend for interest rates (bond yields declining) which has become a headwind for bank earnings. Earlier in the year, rising yields were a tailwind for the sector but those trends have changed.

Building on that theme, we’ve seen falling yields become a headwind for banks but a tailwind for the ‘yield play’ stocks on the ASX which are primarily those defensive infrastructure type plays. Although banks were lower today, they weren’t the main target of the selling which is interesting. Instead the likes of Sydney Airports (SYD), the pipeline operator APA Group (APA) & Spark Infrastructure (SKI) for example were hit fairly hard. Thinking about that trend for a moment, falling yields should be supportive of these guys but today they were dumped after a strong rally in recent weeks.

We continue to think that recent strength in these names such as SYD is a selling opportunity rather than a buying opportunity as interest rates overall grind higher. That suggests that despite the near term negativity of the banks, being on the buy side here into weakness continues to make sense, and todays moves help to support that outlook. We do not own SYD or APA

Sydney Airports (SYD) Daily Chart

APA Group (APA) Daily Chart

The other interesting area of the market today was the Energy stocks which were also clobbered by more than -2%. Origin (ORG), Woodside (WPL) & Santos (STO) all look like shorts at this juncture + it’s the primary reason why we’re seeing BHP underperform RIO and Fortescue. We’re in BHP from $24.29 so slightly underwater versus the $23.34 close today, while RIO was bought below $60 – versus todays price of $61.46. BHP was down -1.35% today while RIO was off by -0.85% and Fortescue (FMG), a stock we bought earlier in the week at $4.665 was off by 0.84% to $4.75. We own BHP, RIO and FMG

Fortescue Metals (FMG) Daily Chart

We’ve owned Origin Energy (ORG) in the past taking good profits on the position end of last year / earlier this year, however right now, this would be a stock to avoid, along with Woodside (WPL) and in particularly Santos (STO). Over time we’ve been very critical of Santos in terms of both their balance sheet and importantly decisions made by the Board along with Management. In December of 2016, they raised capital at $4.06 after knocking back a takeover offer at $6.88 in October of 2015. Today the shares are trading at $3.15 and on our numbers (if we plug in the forward curve in oil prices) we get a value closer to ~$2.00 than ~$3.00. If Oil stays around current levels then STO will continue to struggle. We do not own Energy Stocks (other than BHP)

Santos (STO) Daily Chart

Healthcare stocks were also under pressure today – obviously most things were – however you often see the likes of RHC, CSL and even HSO become places to hide. Not the case today and again, these look like stocks to avoid at the current point in time. We do not own Healthcare stocks

Ramsay Healthcare (RHC) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here