The Trump Trade gets a shot in the arm… (SRX, IGO)

WHAT MATTERED TODAY

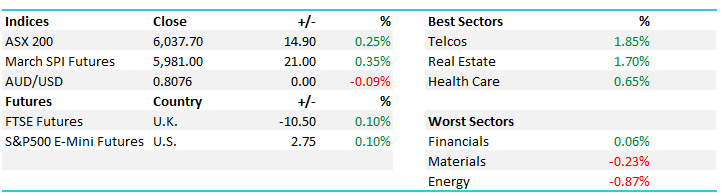

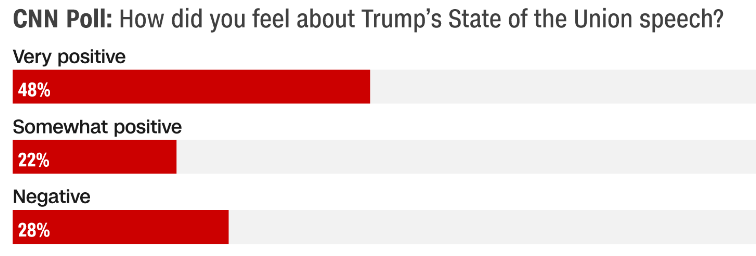

Aussie stocks bucked the overnight selloff in the US helped somewhat by Trumps State of the Union address which was long on patriotism, shorter on protectionism than some feared and full of classic Trump one liners…”Over the last year, the world has seen what we always knew: that no people on Earth are so fearless, or daring, or determined as Americans. If there is a mountain, we climb it. If there is a frontier, we cross it. If there is a challenge, we tame it. If there is an opportunity, we seize it…”

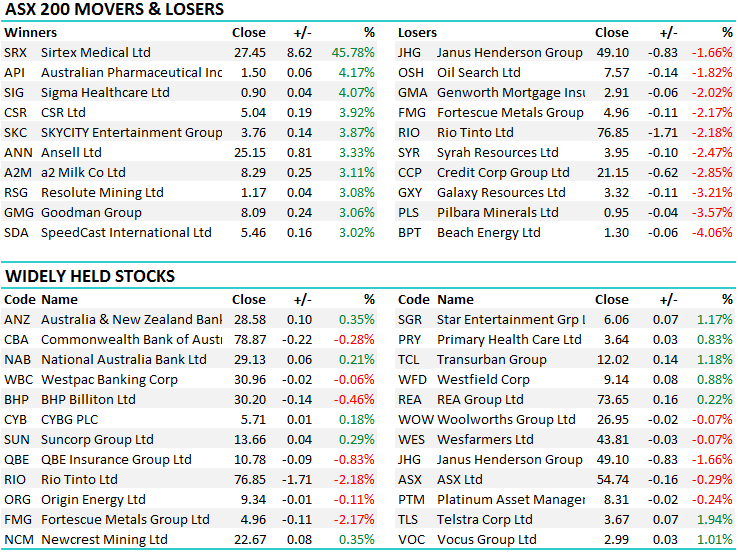

The market particularly liked talk on infrastructure spend and US Futures ticked higher helping to support our market, however the bulk of the local buying from the daily lows below 6000 happened before Trump took stage – clearly there was a buy the dips mentality, supported by a weaker than expected inflation print which reduces the chance for local interest rate hikes. On the mkt, the $US earnings were well bid, as was some of the defensive sectors like the Telco’s – Telstra put on +1.94% to close at $3.67, a good effort and we expect TLS to trade higher into their Feb/Mar Dividend with Bloomberg consensus sitting at 11cps FF – which puts it on a yield of 3% for the half. We own in both portfolios from around current levels.

Elsewhere, banks remained pretty well supported today while resources were lower, but nothing big. All up, it seemed like Aussie investors saw last night’s US led sell off as a US centric thematic, probably due to pension redemptions at the end of the month. As we wrote in the income portfolio, end of month pension redemptions are happening in the US, and given the massive strength/outperformance of equities this month, it makes sense the sell equities to fund redemptions over and above selling bonds given the recent correction. That theme could again play out tonight however Futures are trading fairly flat as I tap away.

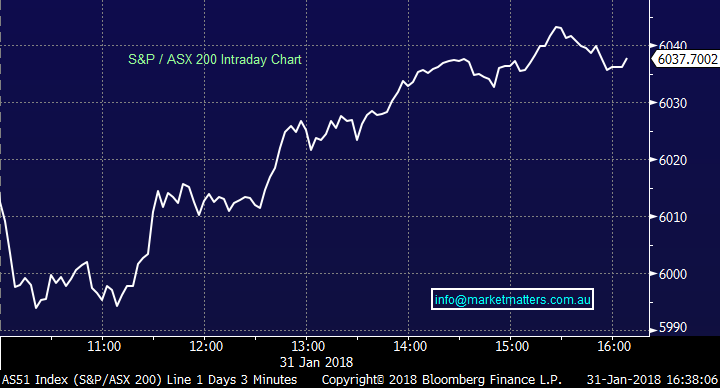

Whatever the case, it was a good effort by Aussie stocks today ending a downbeat month on a positive note. The S&P/ASX 200 index rose 14 points, or 0.3 per cent, to 6037, while the broader All Ordinaries climbed 11 points, or 0.2 per cent, to 6146. For the month, the market has lost 0.5% - the biggest drags being the interest rate sensitive areas like the real estate firms which fell 4.9 per cent and utilities which lost 4.5 per cent. In terms of the currency, the Aussie has had a cracking month adding 3.4 per cent, even though it was softer today courtesy of the inflation data.

On another note, I sort of feel like we’re doing our subscribers / clients a disservice by not having some sort of Crypto news, some section of our note which has a catchy heading that talks in very certain terms about what the market is like is Crypto Currencies. Not sure I’ll join the party just yet, I’m a total cynic on things I don’t understand, or importantly, have no sort of ‘edge in’ so maybe we title the sector – Crypto Cynic – not sure what I’d write about but I did find one interesting story that could make the cut today… South Korea has uncovered cryptocurrency crimes worth 637.5 billion won ($594.35 million), which includes illegal foreign exchange trading, a statement released by the country's customs service said on Wednesday. The statement said domestic investors bought 1.7 billion won worth of cryptocurrencies, which they sent to overseas partner companies through virtual wallets. The transfers were then converted back into fiat currencies, which amount to unrecorded capital outflows. I reckon we’ll see more of that sort of thing! Anyway, Bitcoin has had a tough start to the year, down from $19,000 in Dec 17 to $10,000 now.

Anyway, back to more serious topics, a strong bounce from today’s low was obviously a good sign.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

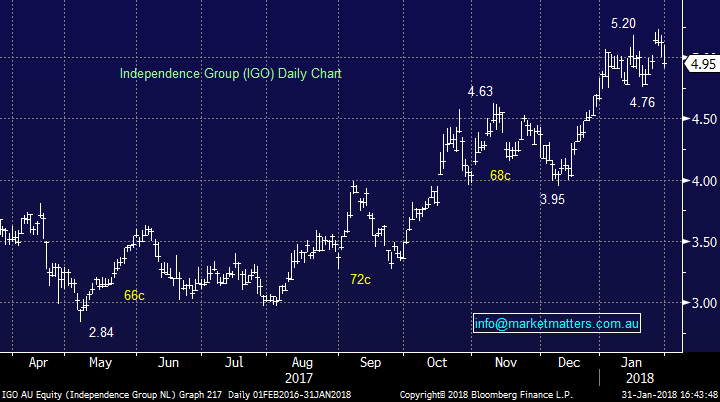

1. Indepdence Group (IGO) $5.03 / -0.79%; A decent set of production numbers today with their Nova nickel and Tropicana gold doing well in the QTR and the company is well set up to meet all FY18 guidance metrics. On 25 October 2017 (SQ report), the CEO commented, “IGO has turned a corner, underpinned by first commercial production at company flagship project Nova nickel. Moreover, with continuing ramp up to reach full potential and a blend of higher grade ore in 2H18” … IGO could do a lot better in the second half of 18 however the market is positioned for that with 1H EBITDA of $135m versus full year expectations for $350m. Anyway, we still view this as a trading stock, and it continues to be on our radar for pullbacks to buy….

Independence Group Daily Chart

2. Sirtex Medical (SRX) $27.45 / +45.78%; The best on ground today after a bid was lobbed by US listed Varian Medical Systems last night at a huge 49% premium to last trade and the share price responded accordingly. The $28/share all cash offer, which was unanimously backed by the board, was one of a number of offers the board was considering and takes SRX back to levels not seen since they reduced FY17 guidance back in December of 2016. Given the significant premium, the offer is expected to be accepted by shareholders and barring any operational issues / better bids the deal will be completed in May of this year.

Sirtex Medical Daily Chart

OUR CALLS

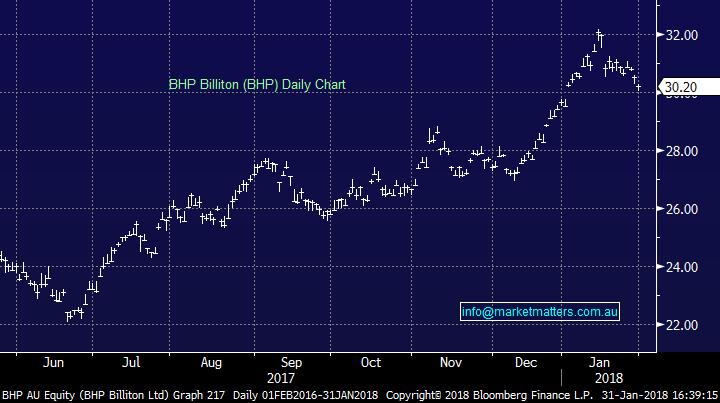

We added to our position in BHP today near $30, taking our total holding to 6% in the Growth Portfolio

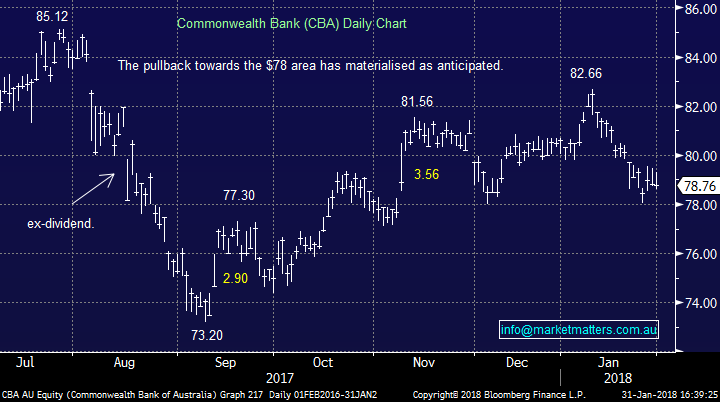

No luck in adding to our CBA position today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/01/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here