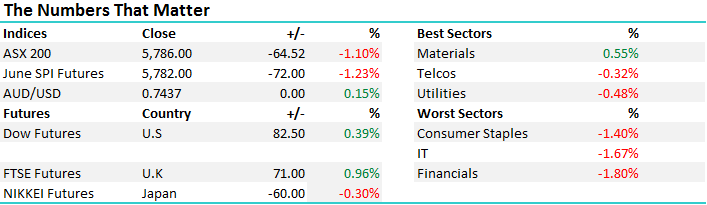

The sleeping giant awakes, index down -64pts

Good Afternoon everyone,

As you aware we have an upcomming seminar that we are hosting in Sydney and we are very pleased to announce that FNArena are helping promote the event. They have a good service which we think may complement your Market Matters subscription. Subsequently we are pleased to offer you a complementary 6-week trial to FNArena. Click here to access your 6-week complementary trial.

The sleeping giant rose from its slumber today with the market getting slapped by 64pts following focus on Trump early on this morning. News broke about his ‘Russian leaks’ which led to calls for impeachment! Only a matter of time really. As we’ve written numerous times of late, periods of low volatility – tight ranges – complacency don’t last forever and we see some sort of ‘straw that breaks the camel’s back and the market gets hit – which we’ve clearly seen today. This isn’t a new theme given seasonal weakness that often plays out during the May/June period, however the level of complacency that is obvious at the moment is likely to lead to some follow through selling over the next few days. The obvious Q is, are we concerned that this is something more sinister? In short, at the stage no and it’s playing to our script with banks weak and resources finding some love in the market today.

Our note this morning was timely suggesting ‘we simply believe the market will get its almost self-fulfilling “sell in May and go away” correction, especially considering the ASX200 is trading on its highest valuation, minus resources, in well over a decade. With local PE’s clearly on the rich side and investors very conscious of the seasonal influences the market just “feels” ready to crack back under the strong psychological 5800 support area, if only for a quick clear out of the weak longs’

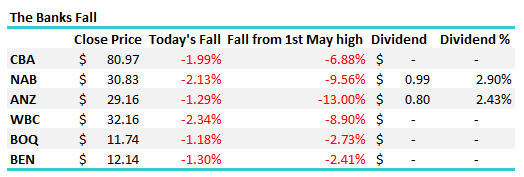

As subscribers know, we’re in high levels of cash, around the 30% mark looking to buy seasonal weakness. The sell in May call gets a lot of air time however it does have statistical relevance, particularly in the banks given 3 trade ex-dividend. The Banks were the weakest link today and that’s been the theme over the past few weeks with the sector clearly suffering some short term headwinds, some technical selling and of course the new bank tax.

Bank performance since 1st May high

As touched on above, seasonally this is the weakest period for the banks and this often lasts into June/July however this is often dependent upon the weakness we see in May. Very weak May’s often lead to better June’s while July is generally a very positive period for the sector overall. Given the big decline that has already played out (-6.69%) for the sector to date (and more in terms of the banks in isolation), we remain are on the buy side of the sector rather than the sell side, even though it looks a little scary today.

Financial index – May / June seasonally over past 10 years – July a very good month for sector

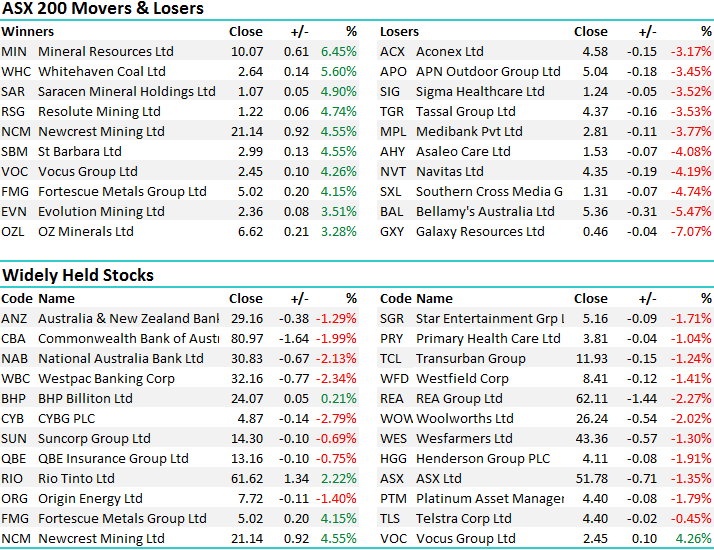

On the broader market, we opened lower while selling intensified throughout the session. US futures sold off throughout our day – but only by around 0.50% while Iron Ore futures in Asia put on +4.6%, which underwrote strength in the likes of RIO and Fortescue. The broader market had a range today of +/- 66points, a high of 5850, a low of 5784 and a close of 5786, off -64pts or -1.10%.

As mentioned above, money flowed out of the banks and into the resources today and given the composition of the index, the market struggles when that happens – the banks detracting 28pts from the ASX 200

ASX 200 Intra-Day Chart – selling and no afternoon strength today!!

ASX 200 Daily Chart – breaks support today and now 5600 comes into play

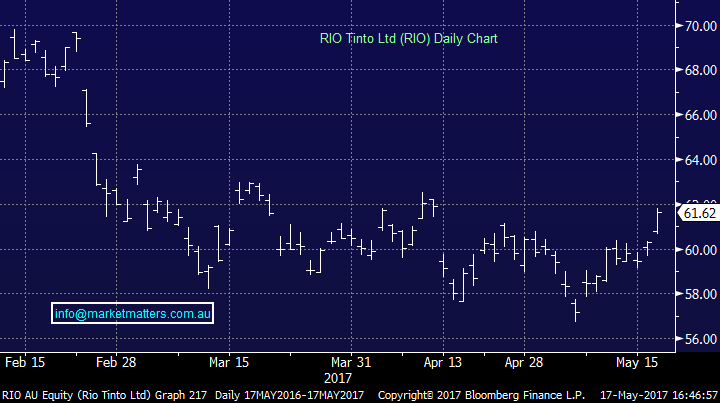

BHP traded up through $24 yesterday and was another outperformer today, however the real star was RIO which traded up by +2.22% today to close back up at $61.62 – we own RIO in the portfolio from the ~$59 region. This now looks very good for a run up the $68 region.

RIO Tinto (RIO) Daily Chart - bullish to $68

Overnight we saw CYBG deliver results which were messy and the numbers slightly weak overall, however the reason to own this stock remains it’s UK exposure, which is working in terms of both earnings and currency but probably more important is the cost out story over the next few years which should see a reasonable uptick in earnings. The stock was weaker today, more so in the morning and less so in the afternoon. We continue to like this story and will be sticking with our holding bought at lower levels.

CYBG (CYB) Daily Chart

Click here to access your 6-week complementary trial to FNArena.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here