The ‘Sell in May’ call starts to play out

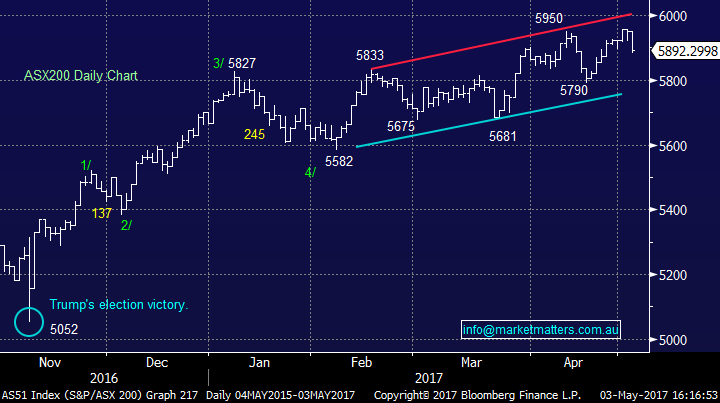

We made an interesting and in hindsight well timed comment in the AM report today suggesting that one day soon the afternoon rally which local stocks have regularly enjoyed in 2017 will not materialise and this is likely to be an ideal trigger to sell for the short term traders out there. We saw that play out today with the index soft on open however the selling intensified for most of the session with only a slight bullish whimper in the last 30mins of trade.

The ‘Sell in May’ thematic looks like it has now started and the main drivers of the selling today were the large cap stocks – which is typical at the start of a pullback. We’ve talked about seasonal significance for some time now and obviously nothing in markets has a 100% certainty however it makes sense to increase cash levels and position more defensively going into a weak period – which May/ June typically is.

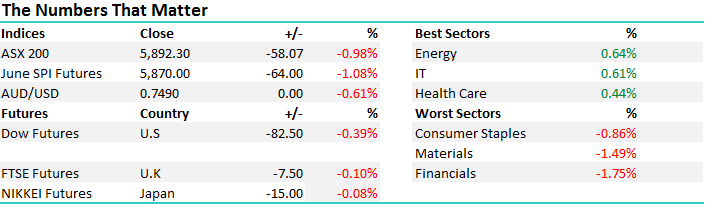

In terms of the market weights today, the big 4 banks were a clear drag while BHP was also soft courtesy of a 2% drop in Oil overnight. That said, Oil / Energy stocks are actually entering a period of seasonal strength courtesy of the US driving season which seems to support energy prices. Woolies was also weak today losing -2.71% and taking 3 index points from the 200.

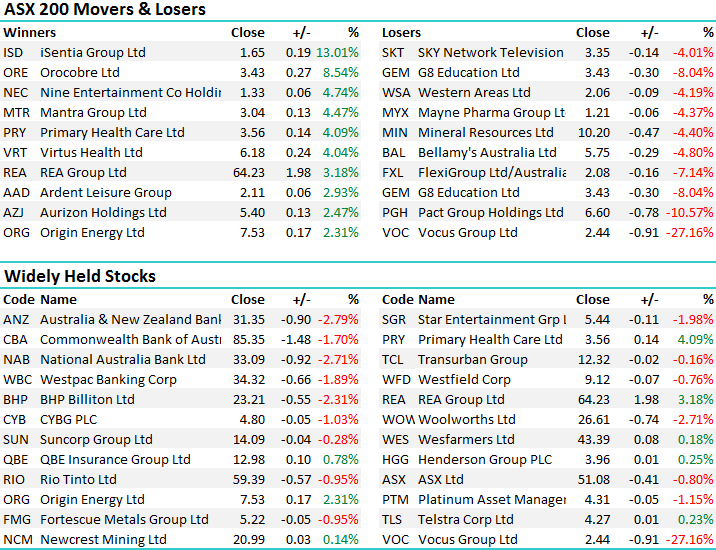

Big index movers today

More broadly, the index had a range today of +/- 66 points, a high of 5948, a low of 5882 and a close of 5892, off -58pts or -0.98%.

ASX 200 Intra-Day Chart

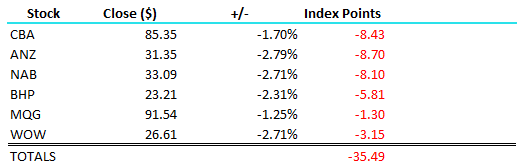

ASX 200 Daily Chart

The most recent major low on the market was back on the 28th June 2016 with the index closing that day at 5103. Since then it’s been a very strong market with the index putting on 15.46% up to today’s close. The financials have been the backbone of this strength adding an impressive 21% while materials have been biting at their heels. The May/June period is the weakest for the year for the banks and also the market generally, which goes some way to explain our ~30% cash levels in the MM Portfolio. We’re positioning for a 5% correction over May / June, similar to last year. If that prevails, and todays price action adds to that likelyhood, the will be keen buyers into this weakness targeting further gains later in 2017.

Source; Bloomberg

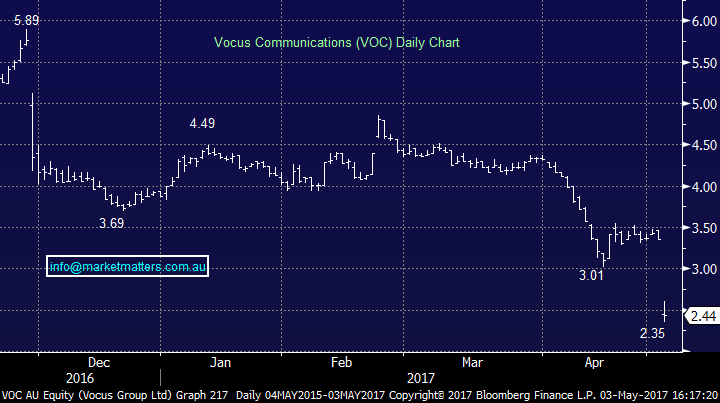

It was bitter sweet today (probably more bitter) after Vocus (VOC) came out with an earnings downgrade and the stock dropped by 27% to close at $2.44. VOC was a big disappointment for us this year and we cut the position nearer to $4 on the expectation that another hit to earnings was likely. After market yesterday that happened and the stock today was sold down sharply. In terms of guidance, they lowered FY17 guidance by ~22% to $160-$165m at the net profit line and $365-$375m at the EBITDA line. According to the company they reviewed their accounting policies and took a $40m impact at the revenue line and $33m impact at the EBITDA line in FY17!! Clearly management are struggling with this business and doing a poor job of integrating recently acquired assets.

The real issue now is around their balance sheet balance. This was one of the main topics on the conference call this morning. They have $1.05bn of debt on $365m of earnings- which is leverage of 2.9x. They have a debt covenant of 3.5x. and also market cap to debt parameters which after today’s fall may have bankers having a good look at it. If we see any further downgrades VOC will likely breach debt covenant levels and they would be forced to raise capital. The is not one to buy to dip.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here