The market heads lower on light volumes, Oil spikes to 2014 levels (PLS)

WHAT MATTERED TODAY

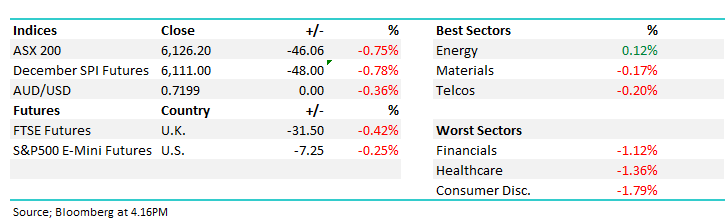

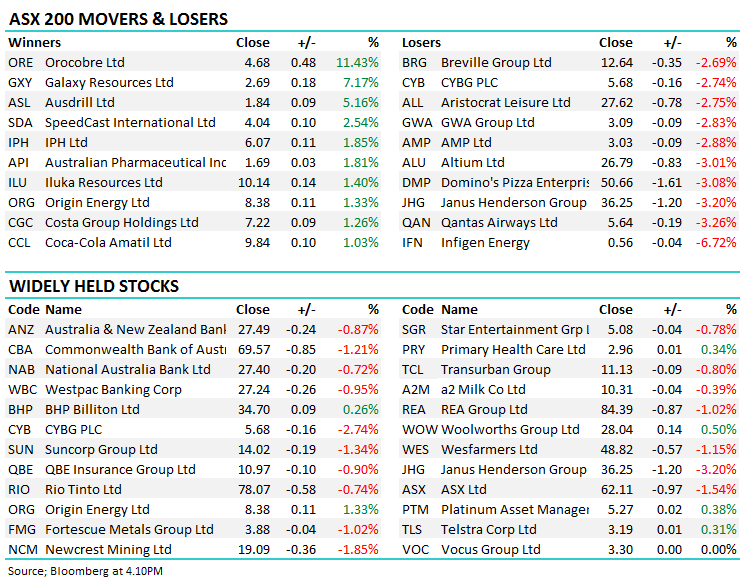

Early optimism quickly faded today as the market was taken to the cleaners on light volume and a lack of buyers to soak up the broad selling. With many in the market on school holidays there was not much resistance to the selling that happened throughout the morning similar to the sustained weakness seen in yesterday’s trading. The banks took a beating with more commentary coming from the interim Royal Commission report suggesting the final outcomes will be much harsher than what Commissioner Hayne has suggested in his initial submission.

The RBA rate decision threw up no surprises with another month of no change, and commentary was similar to the September decision, still looking for an uptick in inflation through 2019 and 2020 which may finally prompt a move from Australia’s central bank.

Australian Dollar (AUD) Chart

Energy moved higher with supply concerns out of the middle east as well as a falling rig counts in the US shale market. Oil is currently trading at levels not seen since 2014. Lithium names were also strong with Orocobre leading the charge up +11.43%. Surprisingly Pilbara fell despite their announcement that their first shipment was seaborne as expected. The consumer discretionary sector was the weakest today and CSL broke the $200 resistance level we have been quoting recently to close at $199.33 down -1.96%, dragging Healthcare down and contributing the most to the index’s weakness with -5.8 index points.

Overall, the index closed down -46 points or -0.75% today to 6126. Dow Futures are currently trading down -0.2%, Hang Seng (Hong Kong Futures) are down -2.6%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

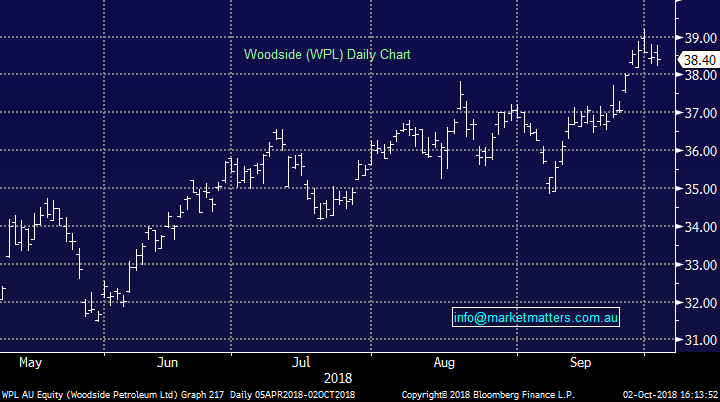

Broker Moves; News flow from the brokers was light thanks to the public holiday yesterday – just the one downgrade with Citi citing LNG demand as their reason for staying cautious on Woodside. A move we agree with in the short term given how energy prices have run in recent weeks however a sector we are watching closely.

Woodside (WPL) Chart

RATINGS CHANGES:

· Woodside (WPL AU): Downgraded to Sell at Citi

Pilbara Minerals (PLS) $0.90 / -1.64%; The WA based lithium name announced today that their first shipment of Lithium concentrate had hit the seas as expected. This news had been flagged for weeks leading up to it but it is key for the company in terms of how the market will now treat the stock. Companies pre-production are much more volatile as they are unable to lock in current prices which many believe are elevated due to a lack of supply. Commentary from the analysts show that lithium is expected to go into oversupply early in the next decade with companies in asset development or even assessment stages, more prone to fluctuations in the lithium price and any increase funding costs. Despite the good news, Pilbara edged lower today.

Pilbara (PLS) Chart

OUR CALLS

We sold A2 Milk in the Growth Portfolio today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.