The hunter becomes the hunted! (CNI, PLG, RRL, Seasonality)

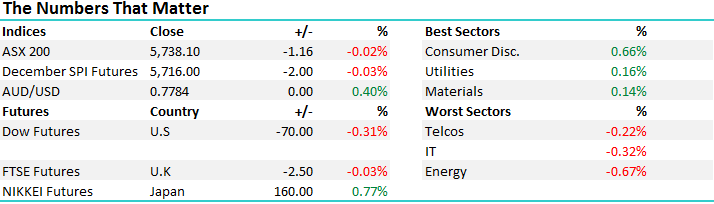

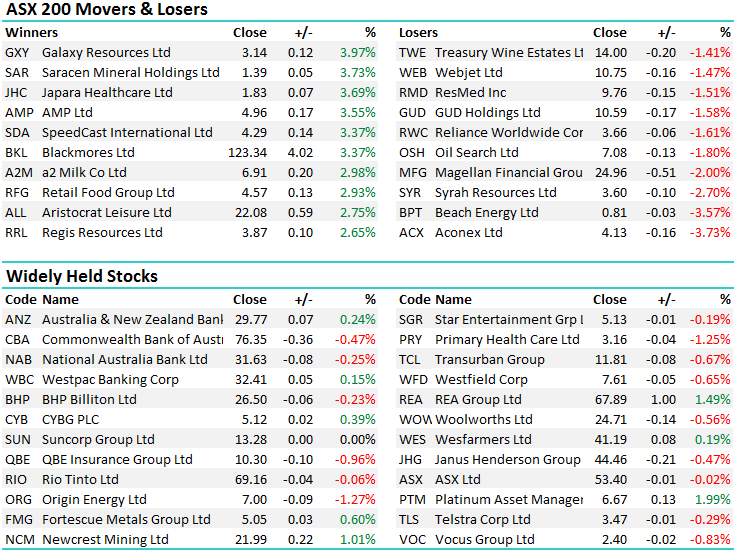

Another session where we saw the best of it in the morning before some sellers came into play around midday pushing the index to a 3pm low – before a slight whimper into the close. An overall range of +/- 30 points, a high of 5750, a low of 5720 and a close of 5738, off 1pt or -0.02%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

More Corporate Activity…

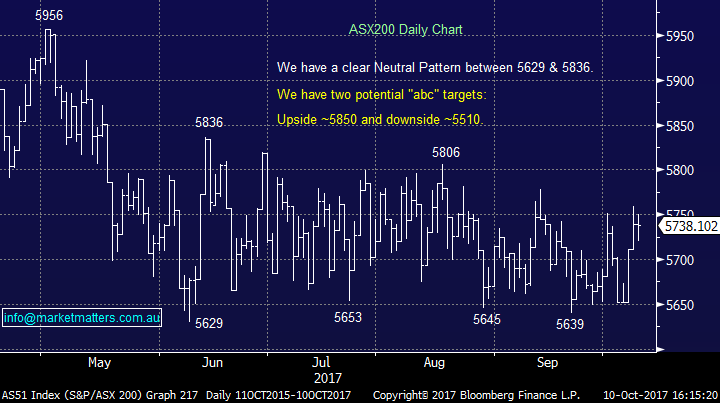

Some more corporate activity at play today, this time in a stock we own in the MM Income Portfolio, with Centuria (CNI) finding itself the target of a share raid by Credit Suisse on behalf of the Warburg Pincus entity, e-Shang Redwood Group. The private equity backed entity bought 14.9% of CNI overnight at $1.48 versus yesterdays close of $1.30 and this obviously had a very positive influence on the CNI share price today – with the stock closing up +7.69% at $1.40. The MM Income Portfolio has a 7% weighting to the stock from $1.20, however we continue to like the stock here. We’ll cover more of it tomorrow in the Income Report, however clearly this a strategic move with the same entity also acquiring 20% of Propertylink (PLG) – which CNI owns 17% of + CNI recently made a full takeover tilt for PLG which was rejected. To complicate matters further, CNI is also raising capital in a 1 for 4.9 entitlement offer to existing shareholders (after an institutional placement) with both being done at $1.28 per share – so we’ll increase our weighting further into CNI through this raise. Clearly a lot going on here which we’ll discuss tomorrow, however the stock is doing well for us.

Centuria (CNI) Daily Chart

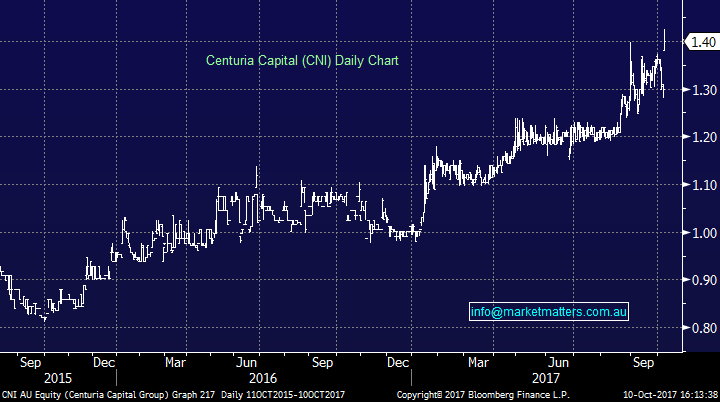

Good news also for the Gold miners today with the muted increase in GOLD MINERS royalty blocked by the WA liberals… Rewinding for a second, the WA government (Labor) recently announced plans to raise royalty rates on gold miners to 3.75% from 2.5% when the gold price stays above A$1200/oz. In addition, they were also aiming to remove the 2,500oz annual royalty-free threshold. In terms of stocks that would have been hit hardest, the pure play WA gold miners were clearly the ones, primarily NST, SBM, SAR and RRL with the lower margin producers (SAR) the most impacted. Obviously the fact it is not going through is a positive for those names first and foremost with SAR seeing most relief buying today adding +3.73% while Regis Resources (RRL), which we bought recently for $3.66 in the Growth Portfolio also did well adding 2.65% to $3.87. We’re targeting a move over $4 for this one…

Regis Resources (RRL) Daily Chart

And to finish off, I was thinking about tomorrow’s MM Webinar at 1pm (reply to this email to reserve your spot) given the title of - Stocks to buy into the Christmas Rally. Firstly, is the actual Christmas rally legitimate? In short, yes. October through to April is typically a very good period for stocks and right now we’re cashed up, looking for opportunities ahead of this seasonally strong period. November sees some weakness however that’s all about the banks (3 or the big 4) going ex-dividend – so inclusive of the dividends it actually does OK.

ASX 200 Seasonality post GFC

We’ll cover more of this in tomorrow’s presentation, however drilling down into the banks we continue to see that being long banks here, with the view of collecting dividends and depending on the run they have, selling into December, or holding some for the first quarter of the calendar year makes sense.

Banking Sector Seasonality post GFC

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here