The dogs are starting to bark…!

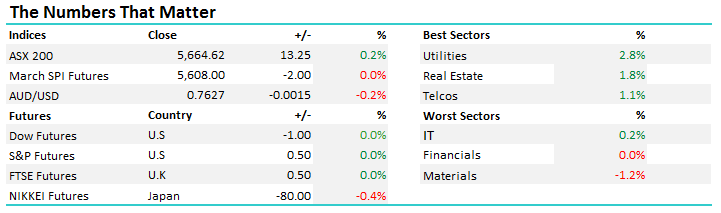

Further upside today from Aussie stocks however most of the love was towards those stocks / sectors that have been sold down in recent times. The defensive ‘yield play’ that the market is now extremely negative on led today’s buying while RIO, which reported a very strong set of numbers yesterday ended lower (RIO -0.44% / $65.25). The material stocks were the weakest link and we’re targeting sub $25 for BHP and around $63 for RIO. It’s all about market positioning / sentiment and as we said yesterday, what has already been baked into the cake . Contrasting RIO report which was very strong yet the stock finished lower today with AMP which was a weak result but the market dislikes the stock, and it’s very under owned and therefore rallies on the announcement of the buy back. AMP +3.98% / $5.23

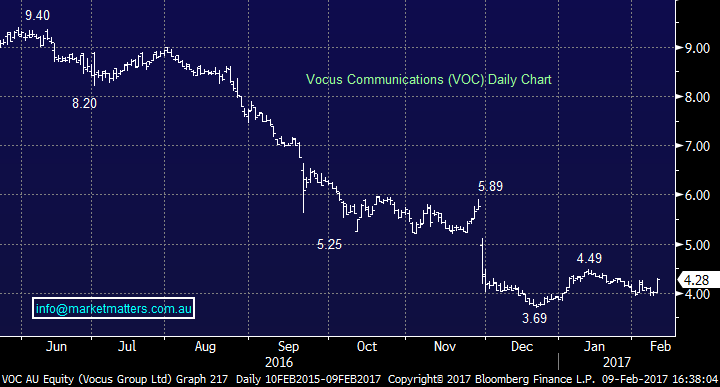

Along the same line, the market is still very negative the Telco space after a tough 8 months for the sector, and specifically the likes of TPG Telecom (TPM) and Vocus Communications (VOC) – both rallied well today with VOC up +6.73% and TPM up +4.09%- on decent volume. We bought TPG today as a short term trade targeting ~$7.80…We already own Vocus (VOC)

Vocus Communications (VOC) Daily Chart

We’ve written numerous times recently about looking at stocks that are cheap or stocks that have been sold down too aggressively as a particular theme has unwound – and vice versa on the upside. It’s typical of markets where investors get too optimistic and too pessimistic particular themes. 2017 will be a very choppy year in our view and investors will need to be more active around positioning. Our recent BUYs have been in Star Entertainment (SGR) this week, Henderson Group (HGG) which reports tonight, and TPG as a short term trade today. These are all ‘unloved stocks’ that we think the market has become too negative on .

Suncorp (SUN) released results today and they were messy, but all up more on the positive side than not. Another example of a relatively cheap stock in our portfolio, that has tailwinds from internal business improvement / better management plus will benefit from an improved external environment – interest rates + insurance rates.

In terms of their result, they announced a 1H17 cash profit of $584m, EPS of 44.6cps and an interim dividend of 33cps – they also said they’re looking to sell their Life Insurance business. On the positive side, they’re starting to see reasonable top line growth with OK rate increases for general insurance while costs are staying prettyflat. There’s no doubt that the last few years has been tough for SUN but they’ve got a good balance sheet and excess capital. If they can sell their life book that will improve their return on equity which is a positive. Ex the upcoming dividend the stock is on 12.9x and 6% yield fully franked. Happy holders for now.

Suncorp (SUN) Daily Chart

Elsewhere, AGL had a good result and the stock rallied +4% to $24.00. The divi of 41c versus 33c expected with 80% franking the main driver.

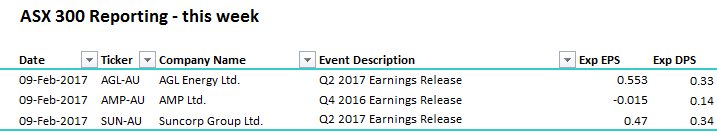

Reporting really kicks into gear next week with around 60 companies in our universe reporting numbers…

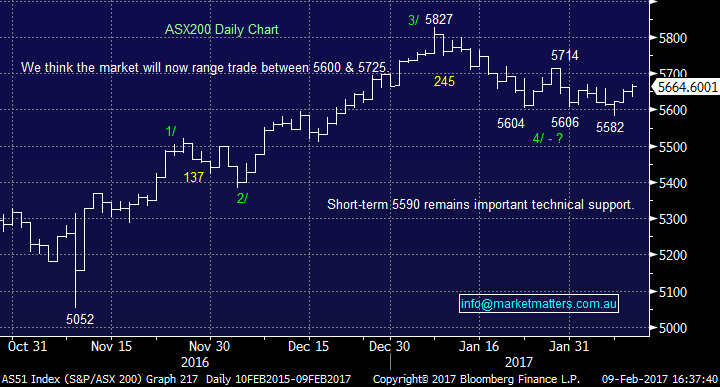

On the market today, we had a range +/- 36 points, a high of 5671, a low of 5635 and a close of 5664, up +13pts or +0.23%. A good rally into the close again another sign that we’re headed higher from here.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The DOGS of recent times starting to see some buying – insentia + Vocus + Aconex + TPG + AMP have all been under a lot of pressure in recent times

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here