The commodities pullback with more to come

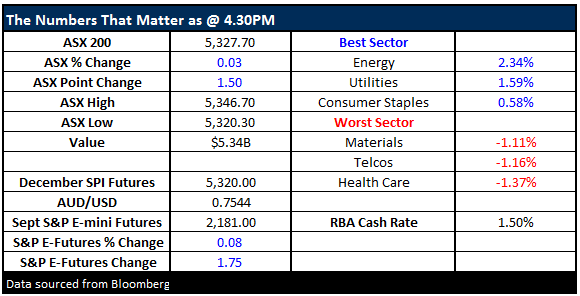

What Mattered Today

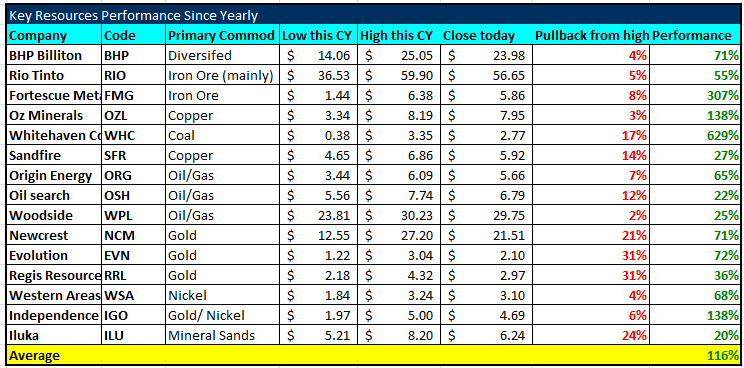

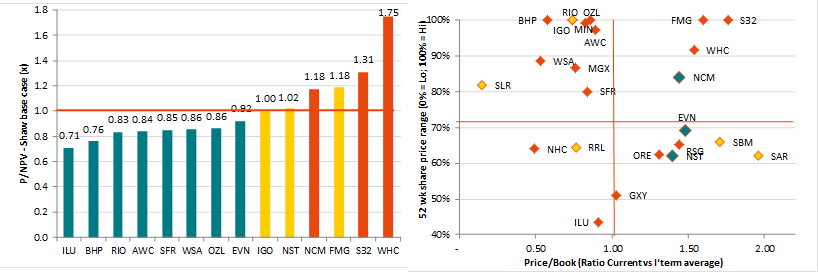

We wrote yesterday that commodities look overheated and are due for a correction and the first signs of that played out today following a barrage of selling in the Iron Ore market overnight and follow through in Asian trade today. It shouldn’t really come as a surprise as we now see a lot of the miners trade at a premium to their assets versus a steep discount earlier in the year. The rallies have been massive – with the basket of commodities we track up an average of 116% from their CY16 lows….Whitehaven Coal (WHC) as we wrote yesterday led the rally and could well lead the sell-off that we’re anticipating in the short term. Simply put, the global economy was not as bad as commodity producers were pricing early in the year but it’s not as good as they’re implying now…

As we wrote this morning, our bullish outlook for the $US is a clear headwind to commodity prices.

Since the US election, equity markets have focused on the positives, specifically to the banking and resources sectors. However, the increased risks of a trade war, especially with China, should not be ignored under a Donald Trump presidency. A trade war with China would potentially slow both economies, negatively impacting resource prices. Also as we have mentioned before, his plans for massive infrastructure spending will take time, assuming he can pass them through the senate. Simply, we feel resource stocks have priced in much of the good news while ignoring the risks.

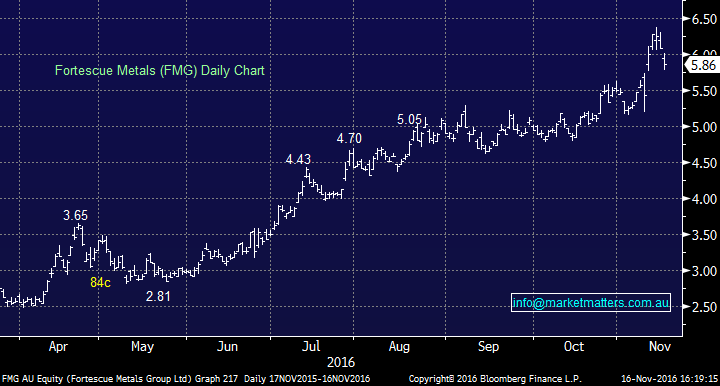

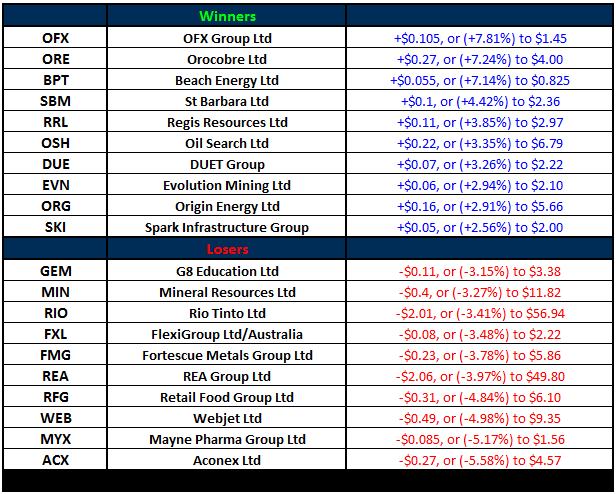

Today we saw Iron Ore Futures in Asia down 8.75% - close to being limit down - Fortescue Metals (FMG) was the weakest stock in the sector, ending -3.78% lower to $5.86…which is hardly surprising given the +307% gain from the lows set early in the year!!

Fortescue Metals (FMG) Daily Chart

There’s a lot of commentary out there spruiking the commodity story, which in time probably makes sense however from a short term tactical sense we continue to think they’ve run too hard, too fast and better entries will be had in coming weeks.

Here’s another way to look at it…Price to Net Present Value (NPV) & Price to Book P/B. The bulk of these commodity places were in the bottom left hand quadrant of the P/B matrix early in the year, while in terms of P/NPV all of them were under 1.

We’re not super bearish the commodity space, in fact, we think the broader commodity trade has more legs over time but buying here seems risky…

The other thing that seems risky to us is ordering a Pizza and getting it delivered by one of these bad boys…. Domino's claims it has completed the world's first pizza delivery by drone. Domino's says it shipped two pizzas - one peri-peri chicken and one chicken and cranberry - to a customer in Whangaparaoa, 25km north of Auckland, shortly before Wednesday lunchtime. The company said the successful use of the unmanned aerial vehicle represented the first commercial delivery of food by drone to a customer anywhere in the world. "We believe drone delivery will be an essential component of our pizza deliveries, so even more customers can receive the freshest, hottest pizza we can offer," Domino's chief executive Don Meij said in a statement. Domino's is looking conduct drone delivery trials in Australia, Belgium, France, the Netherlands, Japan and Germany. Source AAP

Source; Internet

Share in Domino’s (DMP) closed the day down -1.85% to $66.40 – we have no interest in Domino’s at current levels….

Domino’s (DMP) Daily Chart

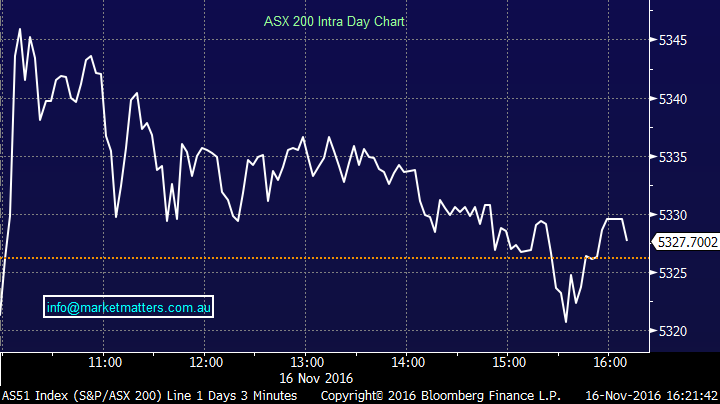

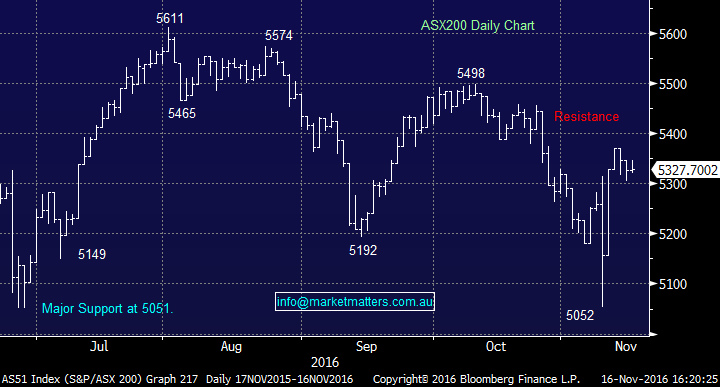

Overall we had a range today of +/- 26 points, a high of 5346, a low of 5320 and a close of 5327, up +1pt or +0.03%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

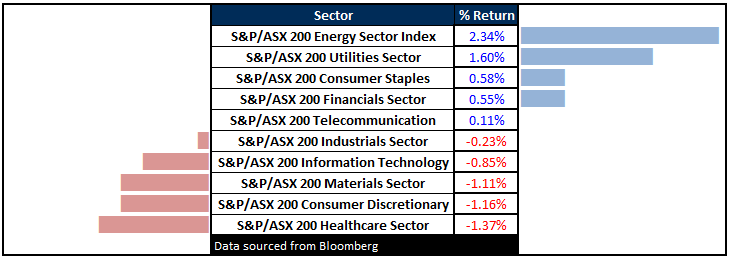

Sectors – Energy stocks in play today and we’ve not seen Crude rally by more than 8% in 2 sessions. Origin owns 50% of an asset called Kupe which New Zealand Oil and Gas just sold a 15% stake in for NZ$168m, implying a 100% value for Kupe of ~A$1,050m – which is reasonably big price + shows ORG has some options around asset sales – We own oil stocks in the portfolio .

ASX 200 Movers - OFX bounced back from a BIG drop yesterday

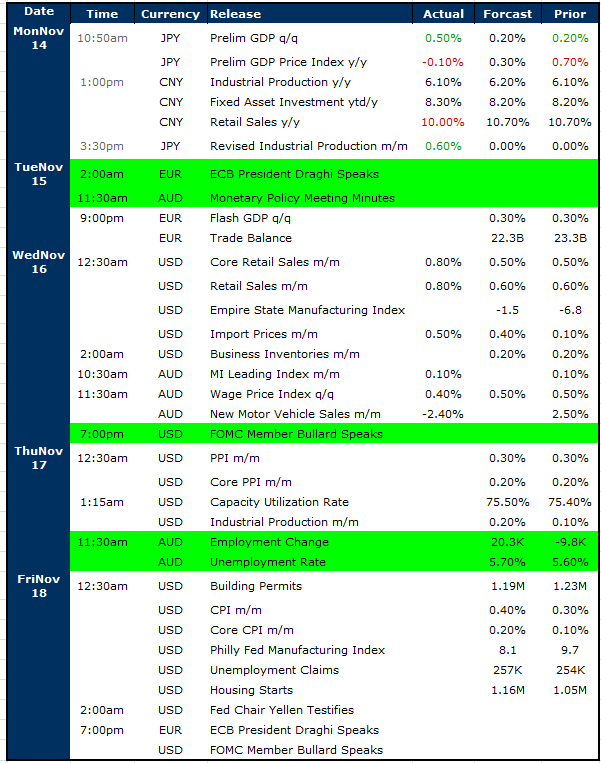

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

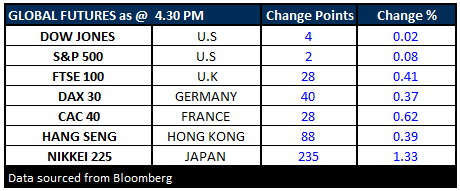

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here