The buybacks keep coming for Rio (RIO)

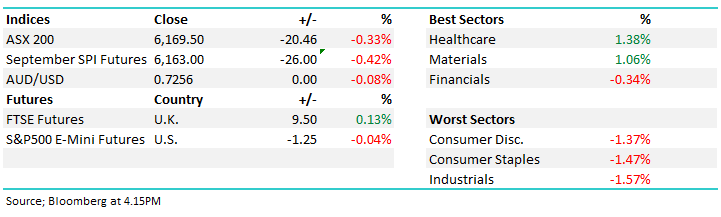

WHAT MATTERED TODAY

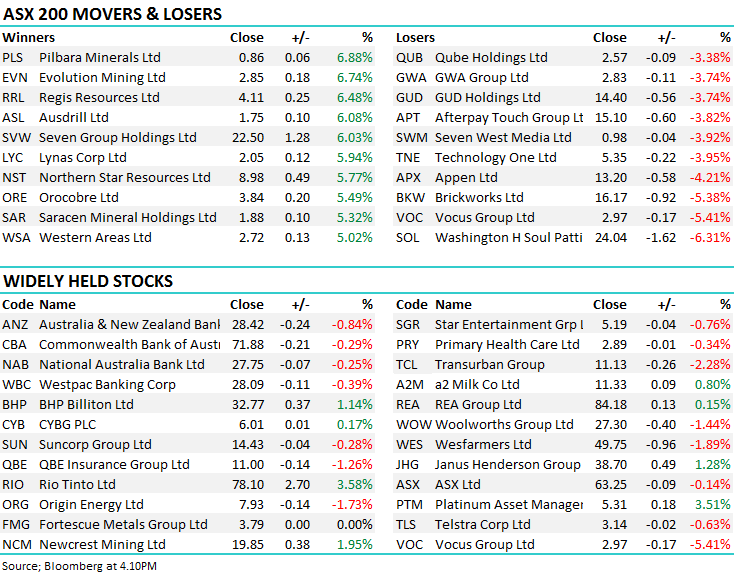

A mostly subdued day on the market today which lacked the volatility many were expecting following the September futures contracts expiring. The index spent most of the day in a tight ~22 point range between 6163 & 6185. Materials caught a bid again although the buying wasn’t across the board – mostly focussed on gold stocks and the big end of town which is poised to return capital to shareholders. Rio Tinto announced a big share buyback today which helped shares climb over 3.5% - more on that later. Healthcare was also strong following CSL, which we discussed in yesterday’s report, bouncing off the $200 support it reached early in the trading day. On the other end of the spectrum, anything tied to interest rates were sold off as US Treasury yields hovered around year to date highs of 3% – industrials, consumer facing & REITs all finished lower.

Overall, the index closed down -20 points or 0.33% today to 6169. Dow Futures are currently trading flat.

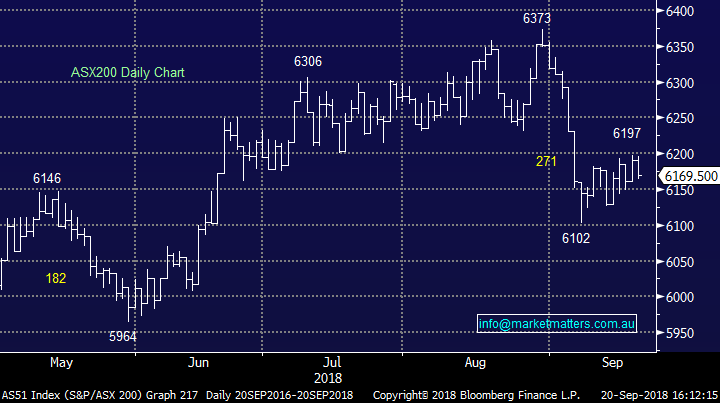

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; No broker moves today however there was an interesting note out from Citi late yesterday pondering the market impacts on banks from the interim Royal Commission report which is due out over the next week or so. The bank suggested that the report would focus on responsible lending and advice failures suggesting that the market positioning on the big 4 may not be negative enough. There’s no doubt it will be an important step in identifying the long term impacts of the commission, however it could also be the beginning of a recovery for the banks as a lot of negativity / uncertainty has been priced in.

Rio Tinto (RIO) $78.10 / +3.58%; The wait is finally over for Rio shareholders as the company announced how they plan to return capital from the coal asset sales back to its investors. Rio had for a long time signalled that the proceeds would make it to the pockets of shareholders, and today launched a $US 3.2b ($AUS 4.4b) buy back, comprising of on and off market components. Up to $US 1.9b worth of the Australian listed shares will be bought back, which will largely be paid for through a fully franked dividend as the miner looks to reduce its franking balance.

We always knew this announcement was coming – whether it was a buy-back or special dividend – however the market still liked the confirmation and the stock has rallied over 3.5% today outpacing most peers. We expect similar news out of BHP in November thanks to their sales of US shales that topped $US 11m.

Rio Tinto (RIO) Chart

OUR CALLS

No changes to either portfolio today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.