The Aussie market rebounds on energy, ore (Z1P, MYO)

WHAT MATTERED TODAY

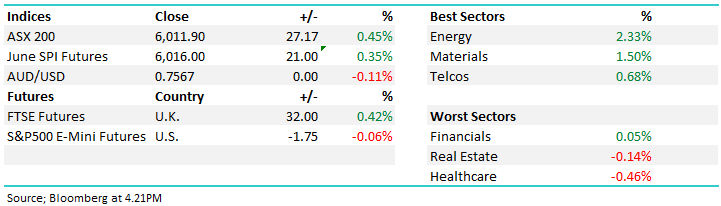

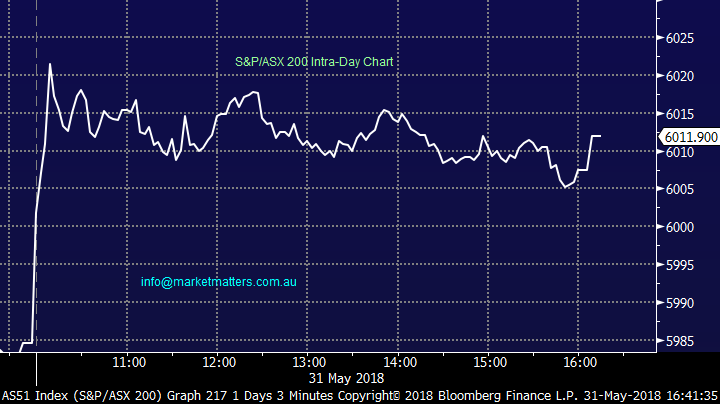

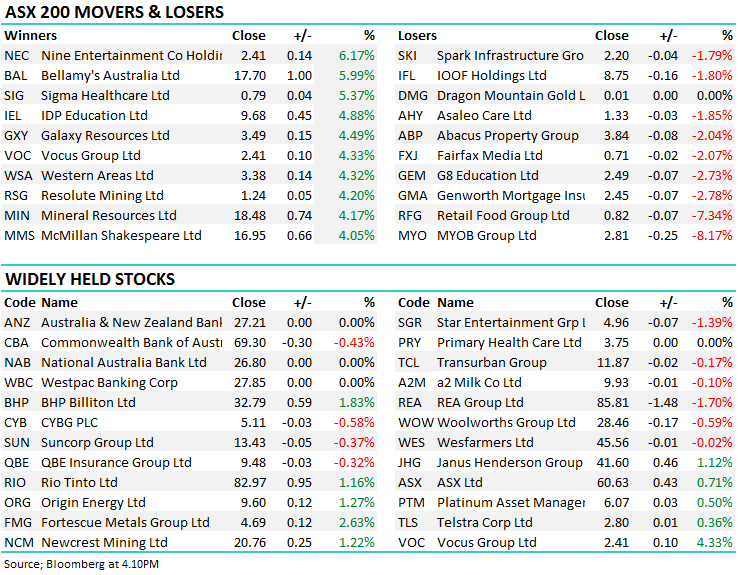

Aussie stocks rebounded in line with overseas markets as the threat of an Italian implosion subsided leaving Bond King Bill Gross licking his wounds! On our market today, banks were left out of the optimism with three of the big four ending unchanged while it was the iron ore names that benefitted most courtesy of strong Chinese data which showed signs of steel inventories falling. Oil names also benefitted today following easing concerns of supply ramping up in the Middle East. Retail Food Group gave back some of the gains we discussed in yesterday’s note, while MYOB was punished on the announcement the Reckon acquisition (they were buying some parts of it) will no longer go ahead after regulatory delays – it fell -8.17% and is down 22% year to date!

Overall the market added 27 points or +0.45% to 6011.

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker moves; Goldman’s new retail analyst was busy today, reinstating the big three supermarkets to ratings, not fazed by the recent rally’s by Wesfarmers & Metcash, preferring them over Woolworths. We have no interest in WES and WOW at current levels, however MTS looks interesting into recent weakness / relative valuation.

· Lovisa (LOV AU): Downgraded to Hold at Bell Potter; PT A$12.80

· Metcash (MTS AU): Reinstated at Goldman With Buy; PT A$3.30

· Orocobre (ORE AU): Upgraded to Buy at Cormark

· SmartGroup (SIQ AU): Downgraded to Hold at Morgans Financial; PT A$11.60

· Wesfarmers (WES AU): Reinstated at Goldman With Buy; PT A$50

· Woolworths Group (WOW AU): Reinstated at Goldman With Neutral; PT A$27

Zip Co (Z1P) $0.85 / +3.03%; Zip announced the signing of Super Retail Group today in a massive addition to the money lender’s reach. Super Retail turnover over $2.5bil annually across over 600 stores through brands such as BCF, Super Cheap Auto and Rebel. After shooting to a high of $1.34 in February, Zip fell over 40% in about 2 months following scrutiny by regulators of their competitor After Pay (APT, $7.82). The industry is young, and regulation has been slow to catch up, however Zip appears to have strong checks and balances in place, and are adding large retailers to the list of partnerships monthly. We like ZIP, we have previously looked to buy but have been picky with the price due to concern that greater regulation may be around the corner.

Z1P Co (Z1P) Chart

MYOB Group (MY0) $2.81 / -8.17%; MYOB’s business is getting creamed by the more aggressive competitor Xero (XRO) with the proposed deal to buy some of the Reckon Business seen as a way to claw back some lost ground, however regulators delayed the move and today MYO have walked – unable to come to terms on an extended time table. MYO dropped sharply today, clearly broke through support on big volume. We have no interest in MYO

MYOB (MYO) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry / James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here