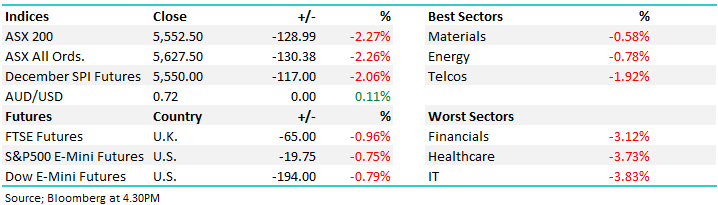

The ASX suffers it’s fourth biggest fall of 2018

WHAT MATTERED TODAY

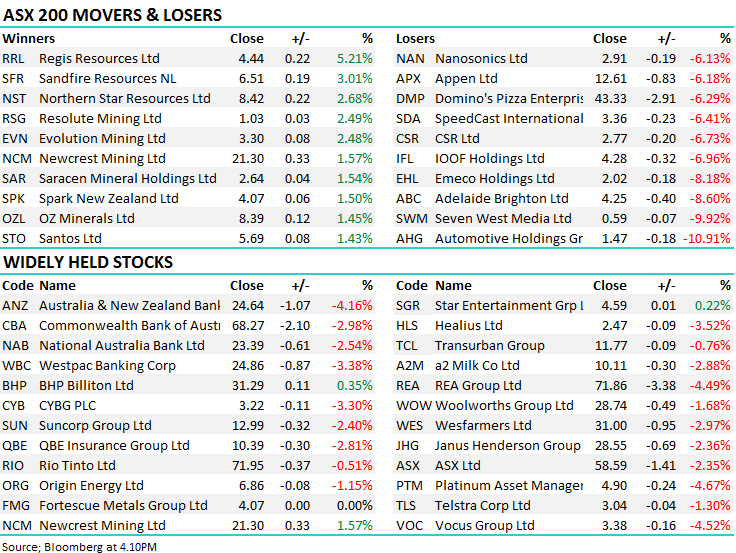

The market opened reasonably well this morning considering the soft leads overseas plus net negative news flow out over the weekend – a drop of 40pts early felt optimistic and that proved correct as stocks were sold down hard throughout the day, led lower by weakness across Asia along with US Futures which opened lower and stayed that way through our time zone. Banks have been relative ‘outperformers’ in recent times however today they copped one on the chin, the big four accounting for 37points of the ASX 200’s decline – ANZ the worst down -4.16% while NAB was the best of a bad bunch down ‘just’ 2.54%. CSL was also weak down ~4% and that took another 11points from the index. There were very few places to hide today with Golds the only obvious exception, Regis Resources (ASX: RRL) the standout adding +5.21% while Newcrest (ASX:NCM) put on +1.57%.

From a portfolio positioning perspective, we’re now fully invested in the Growth Portfolio taking that more aggressive stance into the October weakness, however clearly that view seems to be premature. Keeping with our mantra to ‘remain open minded’ we now must stand back and question whether or not the 2018 trends around seasonality, which have proven elusive this year will stay true to recent form and the Christmas rally with fail to eventuate. Today we felt more like being on the sell side than the buy side and looking at the grind lower throughout the day, we weren’t alone. We’ll re-visit our thinking around portfolio positioning in the AM report tomorrow.

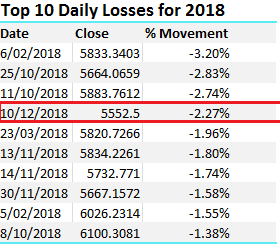

Overall, the ASX 200 closed down -129 points or -2.27% to 5552. Dow Futures are currently trading down -194 points or -0.79%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

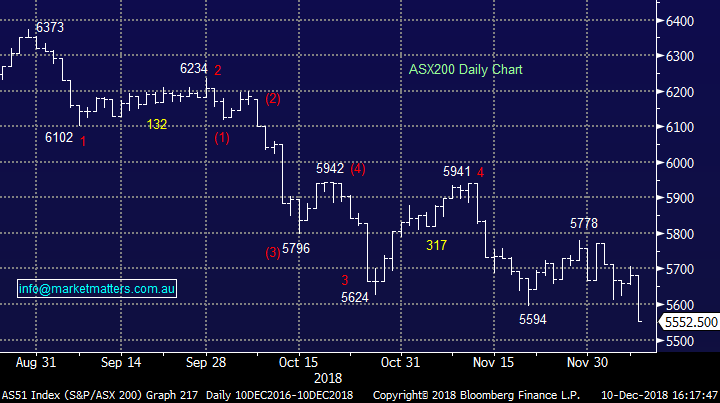

Broker Moves; Brokers moved on the embattled IOOF (ASX: IFL) today – according to the analysts neither of the O’s in the name stands for Opportunity… yet. The analysts took the cautious route, with a number of downgrades factoring the risk of the ANZ deal falling over among other potential issues. Today it was announced both the Chairman and the CEO would be stepping down immediately as a result of APRA’s pursuit of the executive team announced on Friday, although the company plans to fight the allegations. The stock took another tumble today, falling -6.96% to $4.28, taking the losses in 2018 to -60%.

IOOF Holdings (ASX: IFL) Chart

ELSEWHERE:

- IOOF Holdings Downgraded to Neutral at Citi; PT A$4.50

- IOOF Holdings Downgraded to Neutral at Macquarie; PT A$5.10

- IOOF Holdings Cut to Equal-weight at Morgan Stanley; PT A$5

- IOOF Holdings Downgraded to Neutral at Credit Suisse; PT A$4.60

- Meridian Energy Cut to Underperform at Forsyth Barr; PT NZ$3.09

- Mercury NZ Downgraded to Neutral at Forsyth Barr; PT NZ$3.56

- AMP Upgraded to Buy at Morningstar

- Charter Hall Downgraded to Sell at Morningstar

- Newcrest Reinstated at BMO With Market Perform; PT A$23

- Event Hospitality Rated New Overweight at JPMorgan; PT A$15.41

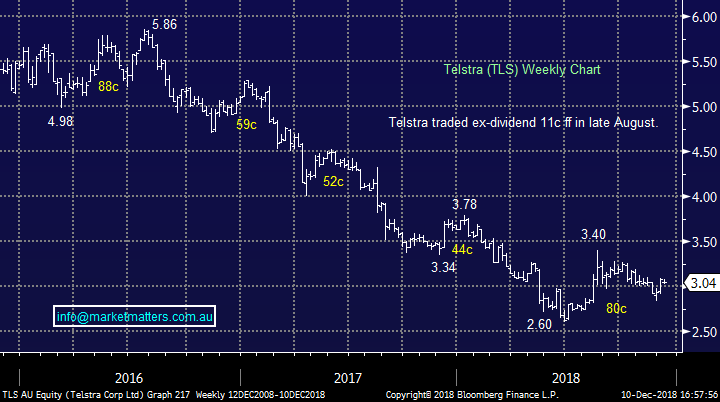

Telcos; The teclos were mixed today following the 5G spectrum auction which was held over the weekend. Much has been made of the new network availability that will see mobile speeds rival that of the NBN. The auction saw Telstra (ASX: TLS) buy the most of any competitor, spending $386m across 143 of the 350 available ‘lots.’ Somewhat of a surprise was Vodafone & TPG (ASX: TPM) teaming up to buy 131 lots ahead of the merger, spending a total of $263m. This highlights the desire of the combined group to become a major player in the Australian telecommunications market, gaining almost 3x the amount of spectrum to rival Optus. Still though, Telstra remains the top telco in the country, and the new 5G network will give it yet another chance to stay at the helm. We own Telstra in the Growth Portfolio – it fell -1.3% today to $3.04.

Telstra (ASX: TLS) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.