The ASX adds 0.70% for the week with Resources leading the charge (SWM, GEM)

WHAT MATTERED TODAY

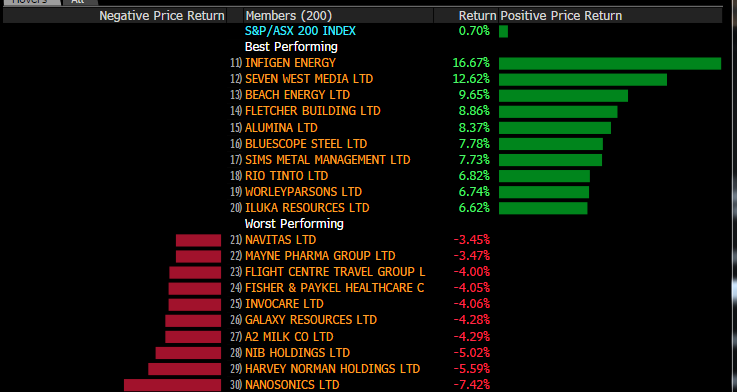

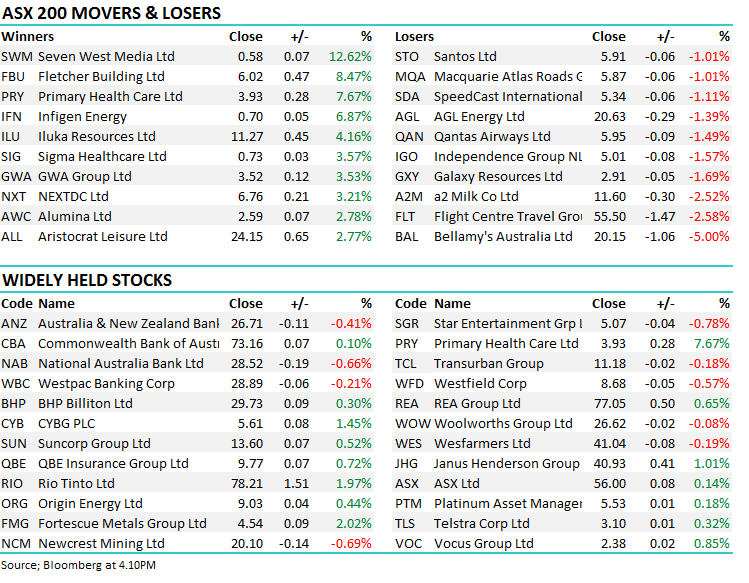

Another choppy session with the market soft on open, rallying throughout the morning then selling off into the close – fairly typical of late. The index closed slightly higher with some buying coming back into recently weak IT stocks, Seek (SEK) looks particularly interesting after trading down from the $21 region to near $18. Elsewhere, Seven West was strong after winning (a term used loosely given they spent +$1bn) the cricket rights with the stock up +12.62% today while the bulls are tussling hard with the bears on payment provider Afterpay (APT) – the stock adding +4.49% today, however ended down for the week.

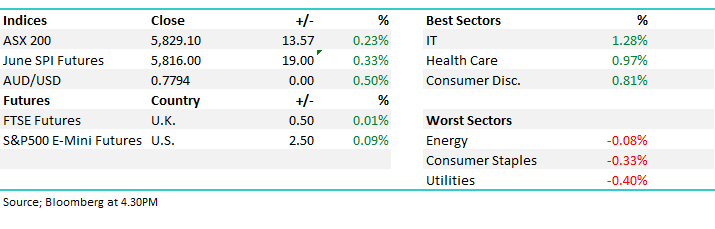

The ASX 200 added +13pts or +0.23% today to close at 5829

ASX 200 Chart

ASX 200 Chart

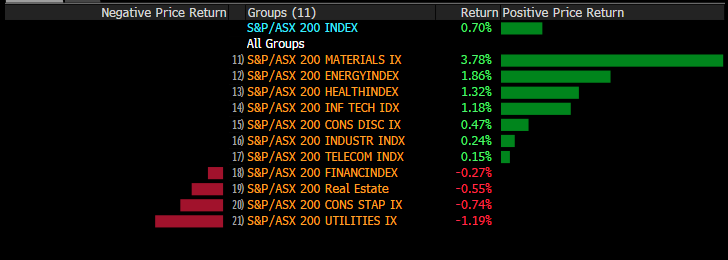

A strong move by the Material Stocks this week as the US Dollar continued to decline. Looking at the sectors on the week, a mix of growth and defence did well highlighting some confusion, although the yield sectors were weak overall. The ASX adding +0.70% on the week

For stocks, IFN (corporate activity), and Seven West (Cricket ticket) were strong, while it seemed that those stocks that have been well loved in recent years are starting suffer some loss of momentum. Harvey Norman (HVN) also interesting trading sub $3.40 during the week, before decent bounce today.

CATCHING OUR EYE

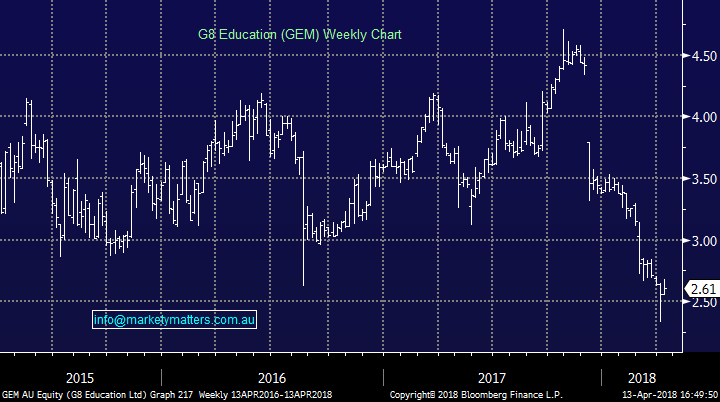

Broker Moves; Never a lot going through on a Friday and two of the stocks mentioned below are subject to corporate activity – Infigen and Atlas Iron. G8 is interesting and a stocks that was once loved, now no so much as it trades near enough to 5 year lows. We continue to ponder whether this one is an Income Opportunity or an ugly duckling left avoided. We’re avoiding it for now given the weakness in the weekly bar chart this week, after a good reversal last week. Another lower low seems likely here below $2.33

· Infigen Upgraded to Outperform at Macquarie; PT A$0.78

· G8 Education Rated New Sector Perform at RBC; PT A$3

· Primary Health Upgraded to Overweight at JPMorgan; PT A$4.30

· Atlas Iron Downgraded to Neutral at Hartleys Ltd; PT A$0.03

G8 Education (GEM) Chart

Seven West Media (SWM) 0.58c/+$12.62; After 40 years with Nine, Cricket coverage will now be shared between Seven and Foxtel in a $1Bil deal announced last night. While there is still more detail to emerge from the deal, it appears that all international games will be aired simultaneously by Seven and Foxtel, while BigBash will be split between the two. It was a rare day in the sun for Seven, which has been on a significant long-term downtrend for over 10 years following most of the media sector lower. No news yet on whether the commentary teams will follow.

Seven West (SWM) Chart

OUR CALLS

No changes to the MM Portfolio today, however Woodside as a sell is firmly on the radar. Alumina was again strong at stages today and we would now be sellers above $2.60 if we still held.

Have a great Weekend

James & the MM Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here