Thanks Bill! More Super uncertainty.

WHAT MATTERED TODAY

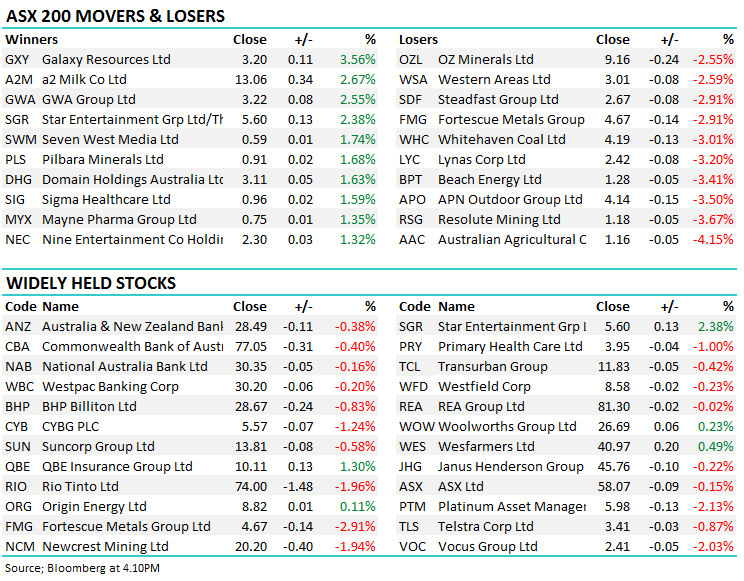

It looked like a combination of factors conspired against the Aussie market today with Bill Shorten’ s grab on cash franking credits announced this morning, the start of the Banking Royal Commission with NAB under the spotlight first up and another day that saw some big lines go through on the match which impacted some key heavy weight stocks on the index. The ASX 200 ticked down on an intra-day basis below the 5960 region we have in mind for our bullish bias to remain intact however a late rally saw it close +25pts from the session lows – and above that handle.

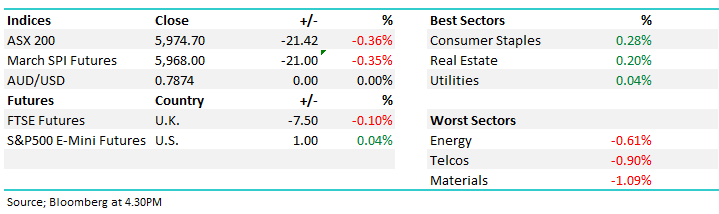

An overall move today of -21pts or -0.36% with the index settling at 5974 – Materials providing the biggest weight on the mkt.

In terms of the Labor Policy for cash franking credits, we’ll have more on it in tomorrow’s Market Matters Income Report, however briefly, the policy centres on restricting the cash payment / refund of accrued franking credits to those superannuants, and investors that receive them back in cash over and above offsetting tax payable. The announcement has a number of factors that we’ll delve into in more detail tomorrow with the help of a superannuation specialist, however suffice to say, we think the flagged move (assuming Labor win the next election) would impact a larger number of Australians than is initially being touted + it will also have unintended implications for particular assets.

For example, hybrids that are franked seem to be an asset that will be impacted negatively, while Tier 2 Subordinated Debt / Bonds etc. that are unfranked become naturally more appealing for some investors. Unfranked property trusts would also presumably become relatively better and that could put upward pressure on property prices.

Another obvious aspect that we can see from initial interpretations is that the ‘wealthy’ typically pay tax each year while those that are earning a considered more ‘middle income’ can often be supported by cash rebates derived from franking credits, and it seems they would feel most pain.

On the flipside, it’s very clear that our current taxation system makes the domestic share market less appealing to overseas investors, simply because our imputation rules create distortions around the value of the same stream of earnings from an ASX-listed company. In short, franked dividends are more valuable to an Australian investor than to foreign investors and with about 30% of the ASX owned by foreigners, a change to the structure could feed a bigger appetite for 1. Offshore investors to focus more on Australia & 2. Australians to invest offshore.

Clearly, there are many things to think about when considering this potential change and suffice to say there will be many unintended consequences to such a change that Shorten, Keating and co simply have not envisaged – we’ll attempt to simplify it tomorrow.

ASX 200 Chart

ASX 200 Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here