Australian Investment Blog

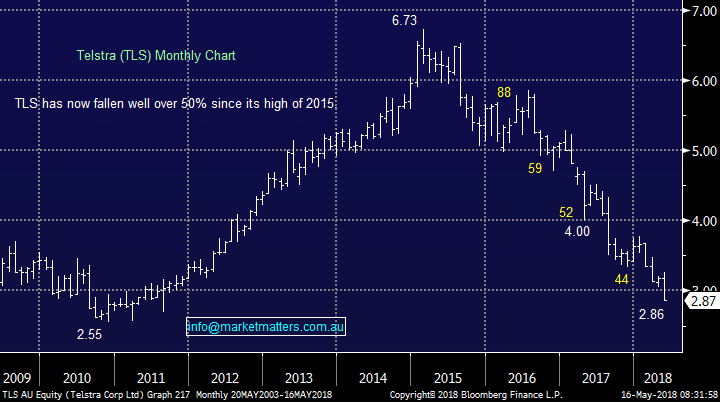

ASX:TLS 16/05/2018

Telstra, Phoenix or dodo?

Stock

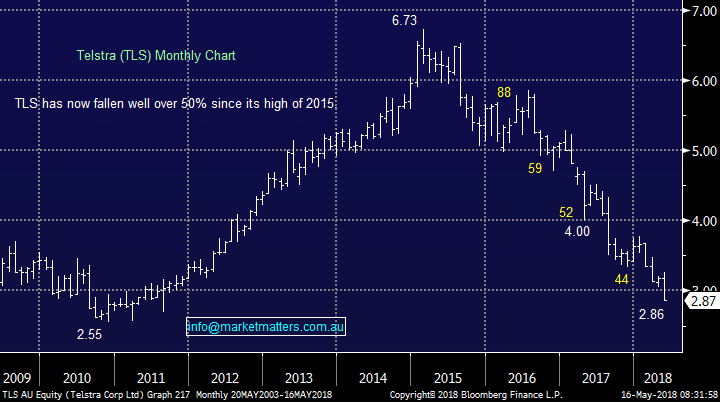

Telstra (TLS) $2.87 as at 16/05/2018

Event

Before we look at Telstra lets quickly consider 4 household names that have made phenomenal comebacks when many thought they were in the “non-investable basket” or worse potential going to fade into oblivion.

1 APPLE Inc (US) $186.44

Perhaps the biggest of all is APPLE which faced tough times due to poor sales and low market share during the 1990s of its personal computers. Steve Jobs, who had been ousted from the company in 1985, returned to Apple in 1996 after his company NeXT was bought by APPLE and most of us know the rest, give or take a few details.

- A few more wrong turns in the road and we may not have seen the iPhone as we know it today!

APPLE Inc (US) Chart

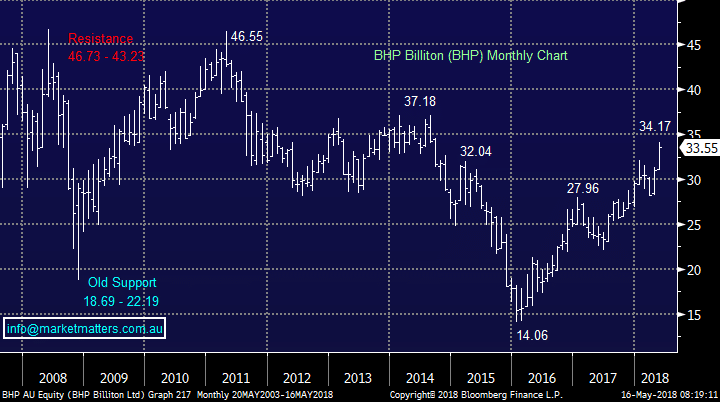

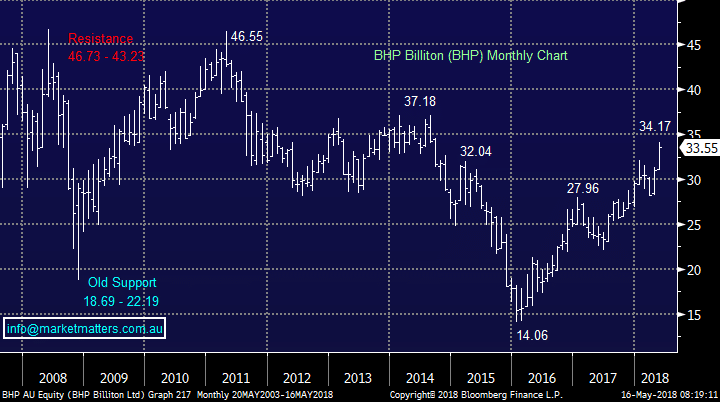

2 BHP Billiton (BHP) $35.55

BHP may be in favour now yet it remains more than 20% below its 2011 high while the ASX200 has advanced ~60%. I still remember when MM started “nibbling” at / buying BHP around $20, unsuccessfully the first time, we got many queries from subscribers who thought we were simply mad! Today everyone loves BHP and feels it can do no wrong.

However, BHP is a diversified resources business and hence very cyclical in nature – to us it’s simply a big “trading” stock, or more accurately one that we like in our portfolio every few years but not always.

BHP Billiton (BHP) Chart

2 BHP Billiton (BHP) $35.55

BHP may be in favour now yet it remains more than 20% below its 2011 high while the ASX200 has advanced ~60%. I still remember when MM started “nibbling” at / buying BHP around $20, unsuccessfully the first time, we got many queries from subscribers who thought we were simply mad! Today everyone loves BHP and feels it can do no wrong.

However, BHP is a diversified resources business and hence very cyclical in nature – to us it’s simply a big “trading” stock, or more accurately one that we like in our portfolio every few years but not always.

BHP Billiton (BHP) Chart

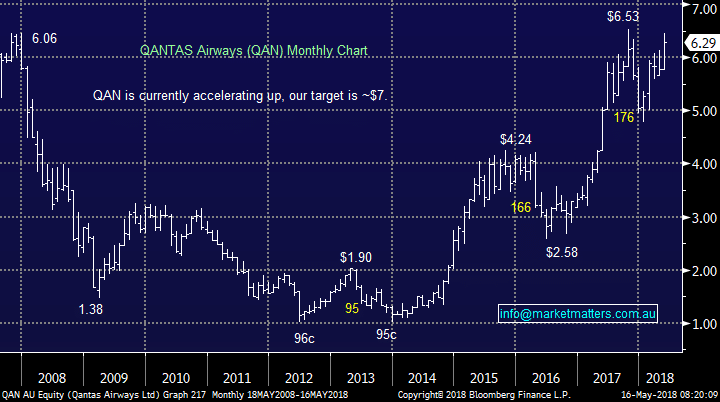

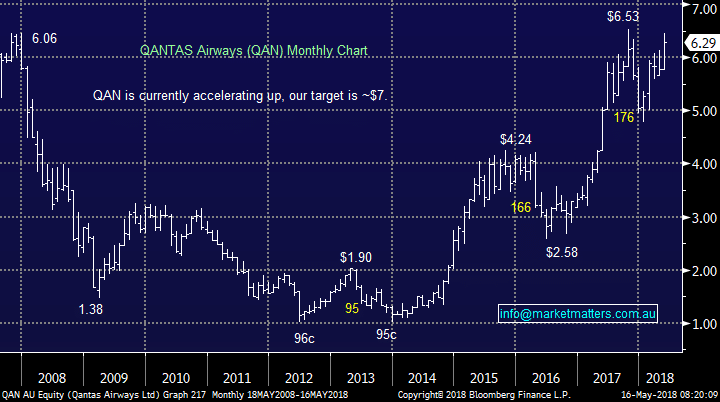

3 QANTAS (QAN) $6.29

Only 5/6 years ago investors simply hated QAN and questioned whether it could survive without government support. Yesterday I dropped by the Future Generation event with Qantas being discussed by fundies as a No 1 pick!

Alan Joyce has done a phenomenal job with the business and the significant correction in energy costs has obviously been a very supporting factor.

QANTAS (QAN) Chart

3 QANTAS (QAN) $6.29

Only 5/6 years ago investors simply hated QAN and questioned whether it could survive without government support. Yesterday I dropped by the Future Generation event with Qantas being discussed by fundies as a No 1 pick!

Alan Joyce has done a phenomenal job with the business and the significant correction in energy costs has obviously been a very supporting factor.

QANTAS (QAN) Chart

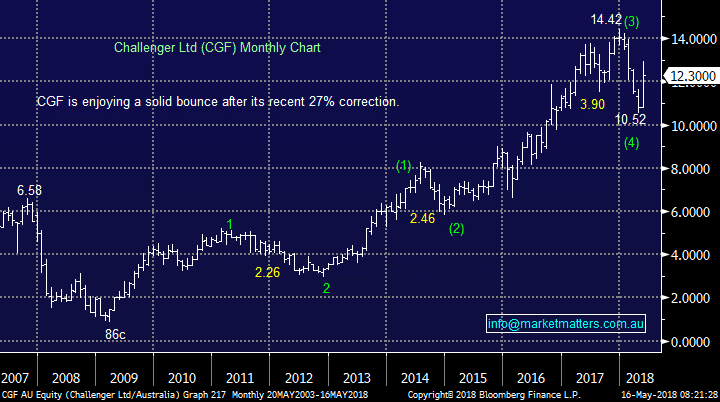

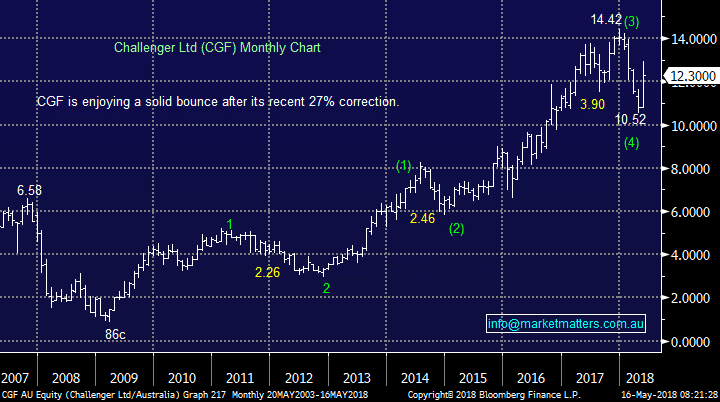

4 Challenger (CGF) $12.30

After the GFC Challenger (CGF) looked / felt awful as investors questioned whether it could survive paying out guaranteed annuities while the value of its investments crashed.

Today CGF has thrived as global share markets have recovered from those dark days! An 86c low in CGF!

Challenger (CGF) Chart

4 Challenger (CGF) $12.30

After the GFC Challenger (CGF) looked / felt awful as investors questioned whether it could survive paying out guaranteed annuities while the value of its investments crashed.

Today CGF has thrived as global share markets have recovered from those dark days! An 86c low in CGF!

Challenger (CGF) Chart

Market Matters Take/Outlook

Telstra (TLS) $2.87

Now considering Telstra which is clearly having a nightmare run, falling almost 11% over the last 5-days and making a fresh 7-year low yesterday. You will have to search extremely hard to find anybody that likes this stock, something that certainly pricks our ears up.

- We sold part of MM’s holding in TLS in January, now well over 20% higher, clearly we wish we had sold all of it!

- Our plan was to increase our holding ~$3.10, fortunately we have not pressed this buy button yet – it simply did not “feel right”.

This week’s fall has occurred following a market update where TLS which stated they would likely hit the “low end” of their earnings guidance. Most definitely not a major downgrade as we often see but the market already has the knives out for TLS and specifically for the struggling mobile business, in “challenging conditions”.

However, it wasn’t all bad news, free cash flow is expected at the top end of its guidance range of $4.2-4.7 billion as they aggressively cut costs plus management are now under intense pressure to deliver.

- TLS reaffirmed its full-year dividend will be 22 cents per share fully franked.

Analysts have largely declared the dividend is not sustainable earmarking 20c pa moving forward but this would still put TLS on a 7% fully franked yield.

- We like TLS as a speculative buy around $2.85.

We think TLS remains a dominant player in a growth market if we look far enough ahead into the future – come on Andy Penn, shows us some vision and prove the masses wrong!

- We also like that Telco’s usually perform well during stock market downturns which we believe is on the horizon.

Telstra (TLS) Chart

Relevant suggested news and content from the site

2 BHP Billiton (BHP) $35.55

BHP may be in favour now yet it remains more than 20% below its 2011 high while the ASX200 has advanced ~60%. I still remember when MM started “nibbling” at / buying BHP around $20, unsuccessfully the first time, we got many queries from subscribers who thought we were simply mad! Today everyone loves BHP and feels it can do no wrong.

However, BHP is a diversified resources business and hence very cyclical in nature – to us it’s simply a big “trading” stock, or more accurately one that we like in our portfolio every few years but not always.

BHP Billiton (BHP) Chart

2 BHP Billiton (BHP) $35.55

BHP may be in favour now yet it remains more than 20% below its 2011 high while the ASX200 has advanced ~60%. I still remember when MM started “nibbling” at / buying BHP around $20, unsuccessfully the first time, we got many queries from subscribers who thought we were simply mad! Today everyone loves BHP and feels it can do no wrong.

However, BHP is a diversified resources business and hence very cyclical in nature – to us it’s simply a big “trading” stock, or more accurately one that we like in our portfolio every few years but not always.

BHP Billiton (BHP) Chart

3 QANTAS (QAN) $6.29

Only 5/6 years ago investors simply hated QAN and questioned whether it could survive without government support. Yesterday I dropped by the Future Generation event with Qantas being discussed by fundies as a No 1 pick!

Alan Joyce has done a phenomenal job with the business and the significant correction in energy costs has obviously been a very supporting factor.

QANTAS (QAN) Chart

3 QANTAS (QAN) $6.29

Only 5/6 years ago investors simply hated QAN and questioned whether it could survive without government support. Yesterday I dropped by the Future Generation event with Qantas being discussed by fundies as a No 1 pick!

Alan Joyce has done a phenomenal job with the business and the significant correction in energy costs has obviously been a very supporting factor.

QANTAS (QAN) Chart

4 Challenger (CGF) $12.30

After the GFC Challenger (CGF) looked / felt awful as investors questioned whether it could survive paying out guaranteed annuities while the value of its investments crashed.

Today CGF has thrived as global share markets have recovered from those dark days! An 86c low in CGF!

Challenger (CGF) Chart

4 Challenger (CGF) $12.30

After the GFC Challenger (CGF) looked / felt awful as investors questioned whether it could survive paying out guaranteed annuities while the value of its investments crashed.

Today CGF has thrived as global share markets have recovered from those dark days! An 86c low in CGF!

Challenger (CGF) Chart