Telstra dives on weak result…

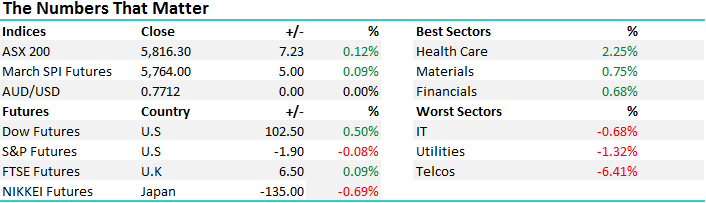

Index options expiry this morning and traders squeezed it up early to force a settlement of 5829 which was just 3 points off the high of the day before sellers came in to push the index down to a 11.30am low before grinding higher into the close. 7 of the last 8 trading days have been positive for the ASX and despite a very weak performance from Telstra which took 13 points off the index, we still managed to close in the black. That said, the mkt is clearly finding is more challenging when above 5800 and there was some obvious indecision today.

We saw a range of +/- 44 points, a high of 5833, a low of 5789 and a close of 5816, up +7pts or +0.12%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

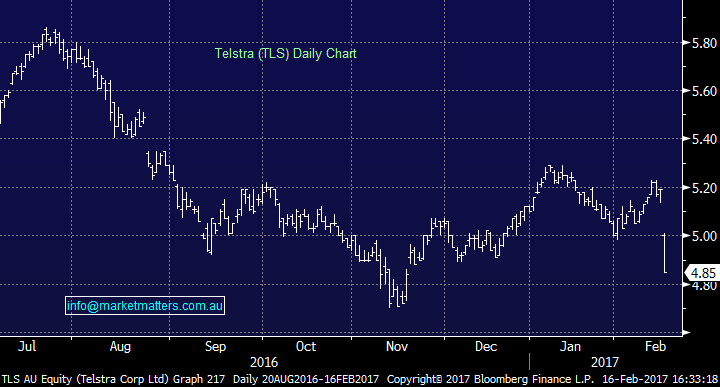

Another BIG day on the reporting front headlined by Telstra (TLS) which disappointed and was sold off by -6.55% to close at $4.85. They dropped sharply on open, tried to recover but another wave of selling hit the stock in the afternoon session and that dragged down the other Telco’s as well.

Telstra (TLS) Daily chart

The issue with TLS was in its top line trends, or in other words it has very sluggish growth due to weakness in data & mobiles which is obviously a poor read through for TPG & Vocus. Mobile service revenue declined by -9.8% with lower margins (40.9% versus 45.9%) as they cut prices to be more competitive while data & IP revenues were down by -4.2%. TLS a big cumbersome beast and they managed to do very well in reducing costs which meant that overall earnings were ok. They also maintained guidance saying income will be at the low end of the guidance range for the full year.

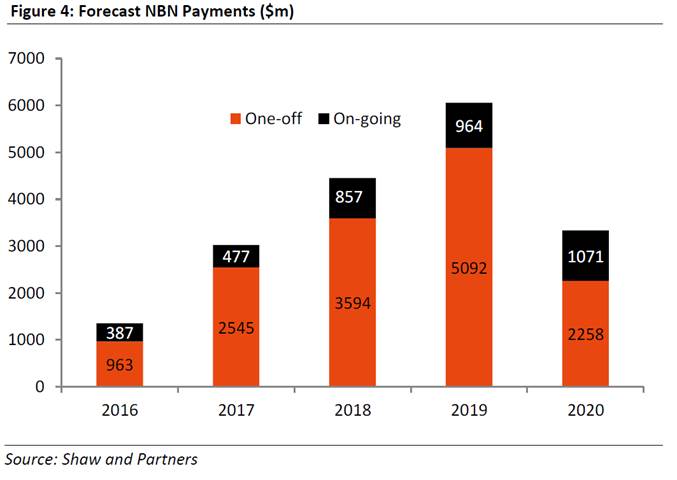

Earnings per share for TLS came in (on a normalised basis) at 14.8cps, while they paid a 15.5cps dividend, they’re borrowing to pay the dividend to the tune of about $1bn per year. They can afford to do it given the lumpy NBN payments totalling about $11bn being paid over the next few years however it obviously highlights the challenges currently faced by the Telco. The NBN payments inflate earnings but the bulk of them end in 2020. Telstra need to reinvest that capital elsewhere to drive future growth, and therein lies the risk (or the opportunity). The market is getting very negative Telstra, and we have been negative for a long time, but there will be a time to step up and BUY this stock…we’re starting to see some blood on the streets! We do not own Telstra (yet)

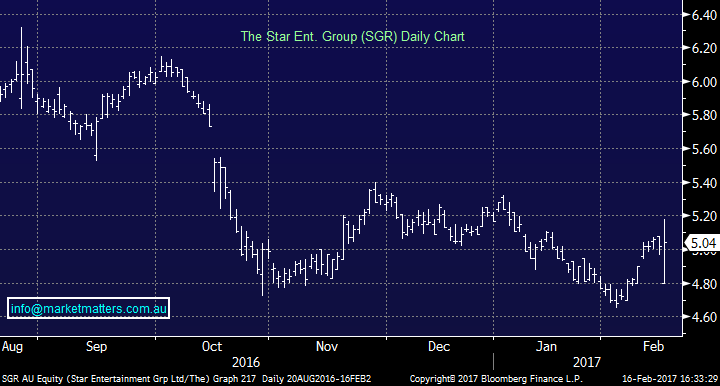

Star Entertainment (SGR); A decent result from Star and better overall than the market was positioned for in our opinion. All the things that were expected to hit earnings did, with the Crown debacle hurting VIP and the renovations to Star in Sydney also having a negative impact. That said, guidance was good and trends in the last few months have been positive. This is business that is worth buying into negativity - the clouds will pass and there is a very strong earnings stream underpinning this company. The stock closed up +0.4% to $5.04.

Star Entertainment (SGR) Daily Chart

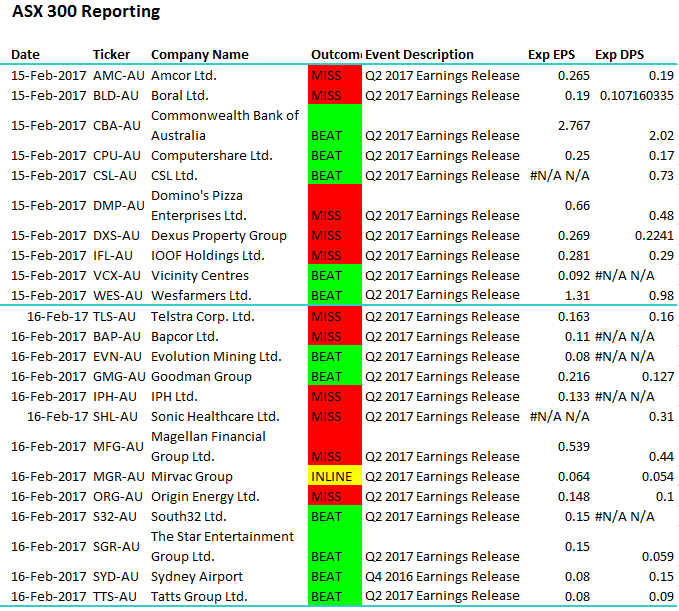

We’ve included yesterdays results (15th Feb) and today’s (Feb 16)

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here