Tech stocks give back some recent gains (WHC)

WHAT MATTERED TODAY

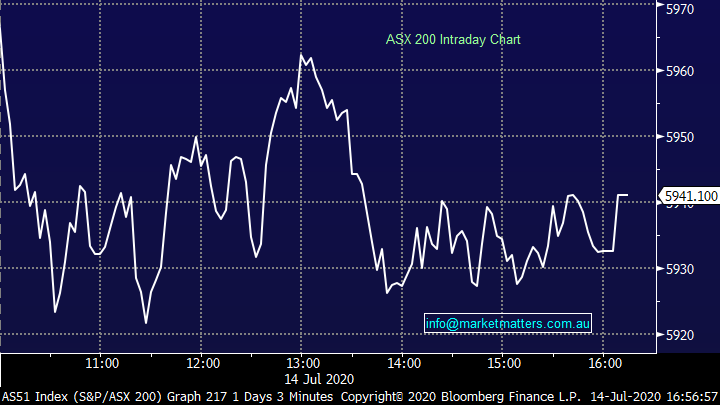

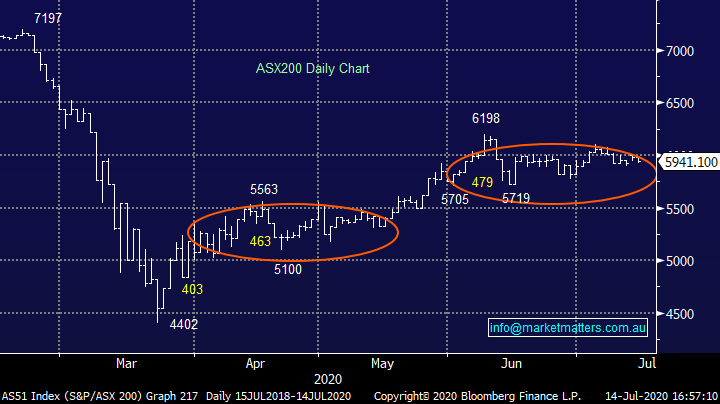

Another day that saw the market chop around in a tight range, weakness bought, strength sold, and we remain around the midpoint of the 6200/5700 trading range that has held stocks at bay for over a month now. My gut feel is that we’re close to a breakout and given the market’s resilience in the face of bad news we favour the upside however things are neutral at the index level for now.

There’s some big moves playing out at the stock level though, Openpay (OPY) continues to see big flows on a daily basis, today it traded 27m shares valued at $120m, there’s only 81m shares on issue! Clearly there’s hot money here, and the stock could do anything, for now it’s showing resilience. Closed up +8.64% today at $4.40.

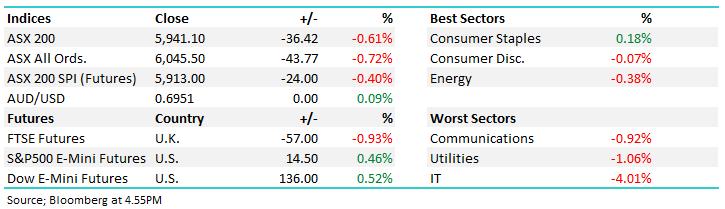

At a sector level today, IT was sold off following weakness in the tech stocks overnight - growing lockdowns in California, the home of many tech companies to blame. That flowed through to weakness locally with the sector down 4% on the session to be the biggest drag.

Asian markets were all lower today, even China fell back from recent highs while US Futures remained resilient during our time zone, trading marginally higher.

Overall, the ASX 200 fell -36pts / -0.61% to close at 5941. Dow Futures are trading up +136pts / 0.52%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Portfolio Moves: We made some amendments to the MM Growth Portfolio today and I’ve discussed these in a quick podcast below.

Whitehaven Coal (WHC) +4.11%: finally saw some love today after being one of the serial underperformers as the market rallied, Whitehaven was bid strongly on the back of an impressive quarterly that saw production hit guidance for the full year. The final quarter of the year saw the Maules Creek mine hit a record and Narrabri finishing the year fast as it sets up for an even better FY21.

It’s been a messy 12 months for the coal miner, after some management changes at the back end of last year, and poor production rates in the March quarter the market was rightfully concerned that the June quarter would also disappoint. Concerns still remain around sales with a number of clients refusing shipments as the COVID shutdown hit demand for coal – stocks jumped 20% on last year. If the rebound in demand for other commodities is anything to go by, thermal coal will soon be back in favour and Whitehaven should start to move higher. Operationally they look in good shape which hasn’t been said of Whitehaven in some time. For those interested, I was also on Ausbiz this morning before market ope, and talked about Whitehaven – click here

Whitehaven Coal (WHC) Chart

BROKER MOVES:

· Webcentral Grp Ltd Raised to Hold at Bell Potter

· Technology One Raised to Buy at Bell Potter; PT A$9.50

· Breville Rated New Overweight at Morgan Stanley; PT A$28

OUR CALLS

We made some amendments to the MM Growth portfolio today, selling Ramsay Healthcare (RHC) given the rising case count in Victoria and threat of wider lockdowns (and subsequent reduction in elective surgery), we also trimmed Xero (XRO), added to Alumina (AWC) and bought a small position in Z1P

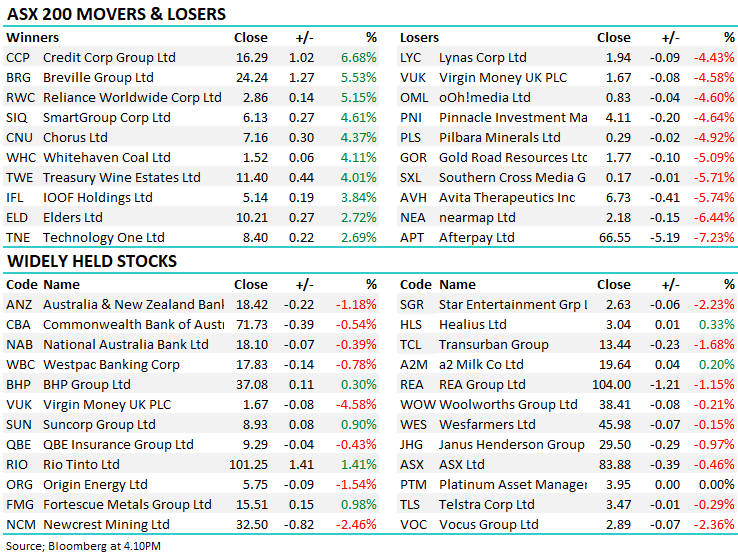

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.