Tech rally encourages equities higher (KGN, SEK, CCP)

WHAT MATTERED TODAY

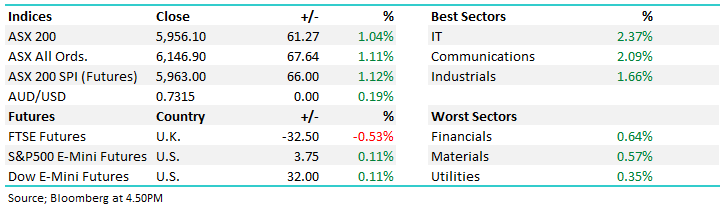

After yesterday’s tight trading range the market opened up its shoulders today and rallied for much of the session. A few standouts from a stock perspective with Seek (SEK) rallying ~10% on some rumours of Alibaba interest in their Chinese division while Kogan (KGN) regained form following a recent pullback. The IT sector was best on ground today with some interest flowing back into the BNPL space led by Zip Co (Z1P) which put on 6.1% while Afterpay (APT) put on +4.03% - certainly a volatile space of late.

Still in the tech space, lots of talk tonight about the Snowflake IPO in the US which is set to list under code SNOW US (yet to be confirmed by the exchange), however it’s the biggest IPO of the year after they raised $US3.36b at $US120 valuing the company at US$33b. They were originally guiding to a range of $79-$85 then that was bumped up to $100-$110 before they printed it at $120. Buffet is investing in his first ever IPO weighing in with $250m. SNOW provide data warehouse technology and is a rare competitor to Amazon Web Services (AWS). In any case, this is the hottest IPO, a bit bigger than the ones being working on at Shaw at the moment!

Asian markets were a mixed bag today while US Futures ticked higher during our time zone.

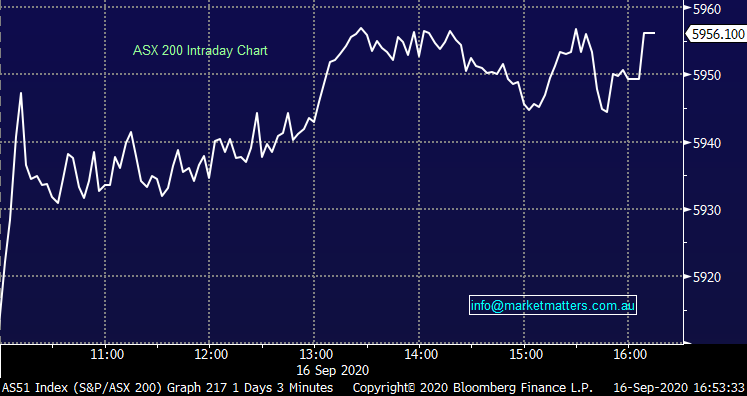

By the close, the ASX 200 added +61pts / 1.04% to 5956. Dow Futures are trading up +51pts

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

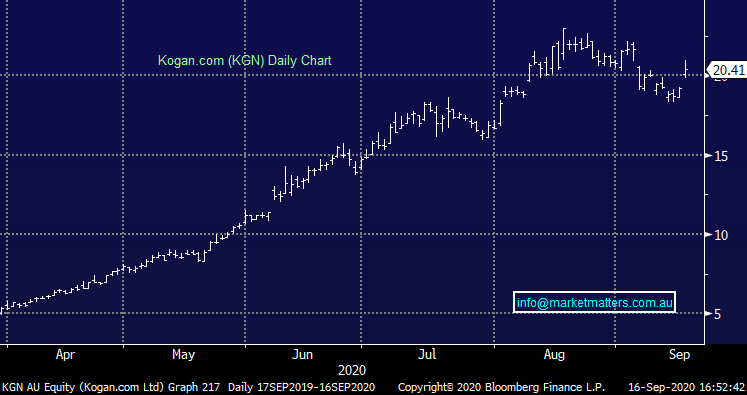

Kogan.com (KGN) +6.14%: Popped back above $20 again today after their September business update showed continued momentum while an increase in marketing spend was taken well by the market. Active customers grew to 2.45m by the end of August, sales ran 117% better year on year and gross profit was up 165% yoy. The company noted that it had spent a record amount on marketing in the month which bodes well for additional customers and sales. Shares in peer Temple & Webster (TPW) also jumped on the news, adding 8.1% in the session. Both names are hard to fight at this stage though they will likely see some slowdown in sales as shops reopen. KGN now trading on a multiple of 3.2x sales while TPW is on around 4x the same measure.

Kogan.com (KGN) Chart

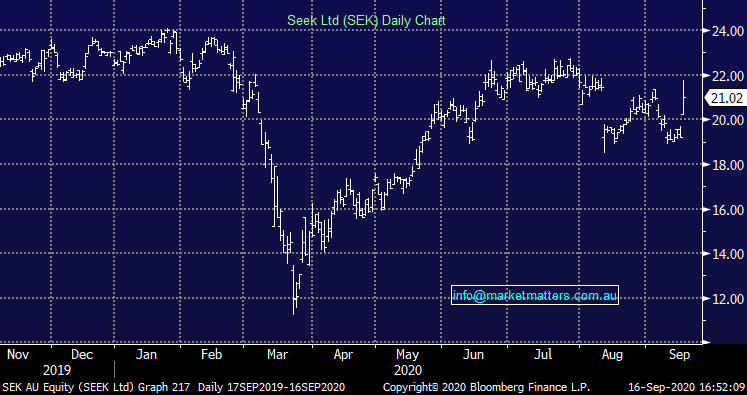

Seek (SEK) +9.42%: we mentioned briefly in the Income report, shares were higher today on media speculation surrounding the Chinese Zhaopin platform, of which Seek had a 61% stake in at the end of the financial year alongside Hillhouse Capital and FountainVest Partners. Alibaba was rumoured to be looking at investing in the online recruitment platform through a $500m placement to take a minority stake in Zhaopin which posted around $55m in profit last year. The interest increases the reach Zhaopin would have in China, while the global economic recovery is positive for job ads – a tailwind for Seek.

Seek (SEK) Chart

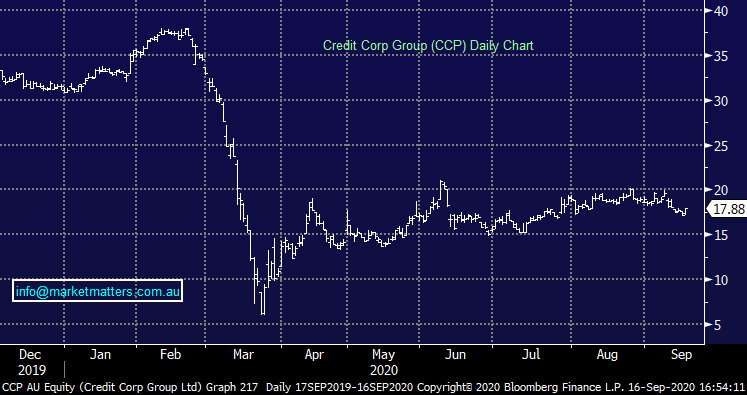

Credit Corp (CCP) +4.07%: We had a zoom with the CEO and CFO today and there were a few interesting takeaways, more so in terms of insight around their collection activities and the availability and market pricing of debt ledgers. Their ability to collect on debts speaks to the health or otherwise of the markets they operate in and even after US stimulus ended their debt collection ability has held up well – according to the company, which is a positive indication. The other takeaway being that the cost to acquire debt ledgers is still too high in their opinion with their competitors willing to pay more for them than CCP. For now, they’re being patient and will wait to see more pain play out (which they believe will happen) although they concede that they’re not seeing it across their book now nor are they seeing it in the pricing of debt. If things deteriorate sharply from an economic sense, CCP are in a good position to take advantage with available liquidity.

Credit Corp (CCP) Chart

BROKER MOVES

- BHP Raised to Buy at Jefferies; PT A$45

- JB Hi-Fi Raised to Outperform at Macquarie; PT A$53.70

- Lendlease Resumed Equal-Weight at Morgan Stanley; PT A$13.55

- Challenger Raised to Outperform at Credit Suisse

- BHP Group PLC PT Raised to 2,260 pence at JPMorgan

OUR CALLS

No changes to the portfolios today.

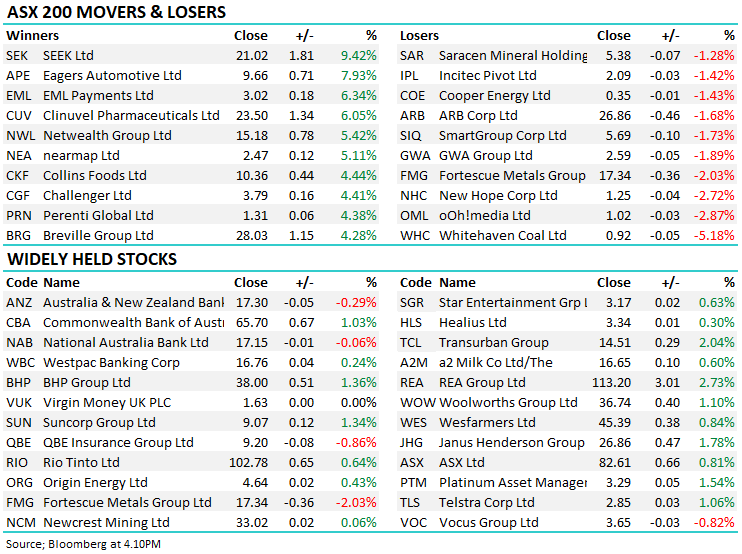

Major Movers Today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.