Syrah miss production, more reason for shorts to cheer

Stock

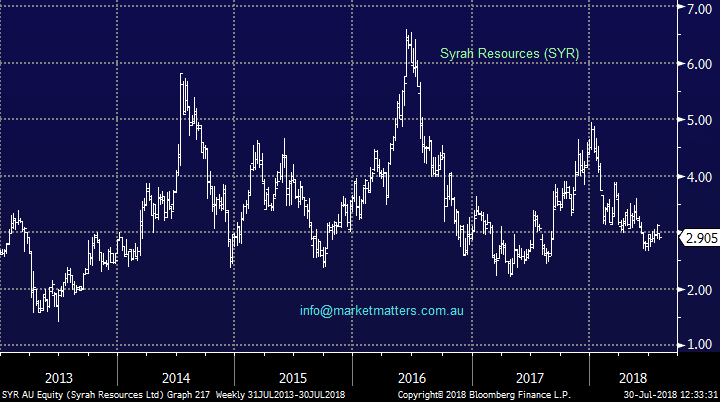

Syrah (SYR) $2.90 as at 30/07/2018

Event

The graphite miner disappointed the market this morning with their June quarter production report that saw a poor start to life at their Balama mine. Now six months in to production, the mine has struggled to hit the expected run rate, and production guidance has been lowered over 15% - they now expect 135,000 to 145,0000 tonnes of graphite for 2018. Investors are also concerned about pricing for Syrah’s product. It’s Balama mine is regarded as one of the highest grade and largest graphite deposits, however Syrah has seen output sold at a discount to the market benchmark blamed on “product mix, prioritized shipments to key customers.”

As of last week Syrah was the second highest shorted company on the ASX, and the shorts may be looking for more blood as Syrah’s cash balance continues to fall – the cash balance has already halved this year to $US 57mil, another $US 17mil is expected to go out the door during the September quarter while the company also expects to spend a further $US 40 mil on a Battery Anode Material (BAM) plant in Louisiana. This now looks to be cum-raise!

Syrah Resources (SYR) Chart

Market Matters Take/Outlook

All in all a very disappointing quarterly from Syrah, and while we often like a highly shorted company - a sign the market is too bearish and can rally hard on non-negative news – there seems to be more pain in sight for investors. It is one to keep an eye on however, as it plays into the battery theme we like and if the company can avoid a capital raise, there is potentially a lot of upside in the stock

Market Matters Take/Outlook

All in all a very disappointing quarterly from Syrah, and while we often like a highly shorted company - a sign the market is too bearish and can rally hard on non-negative news – there seems to be more pain in sight for investors. It is one to keep an eye on however, as it plays into the battery theme we like and if the company can avoid a capital raise, there is potentially a lot of upside in the stock