Swings and roundabouts with FMG production (NCM, CCP, EVN, FMG, SFR, IFL)

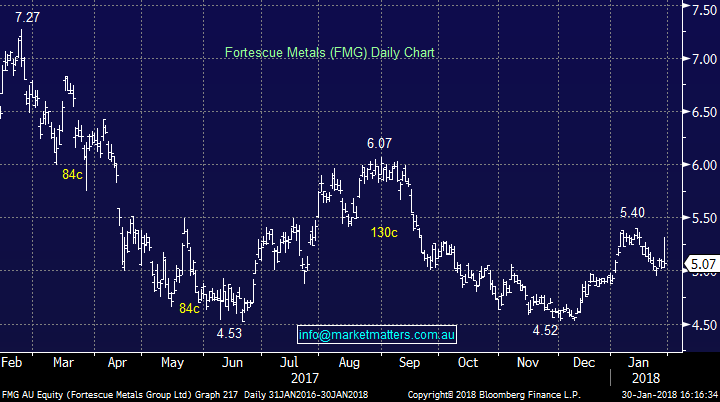

WHAT MATTERED TODAY

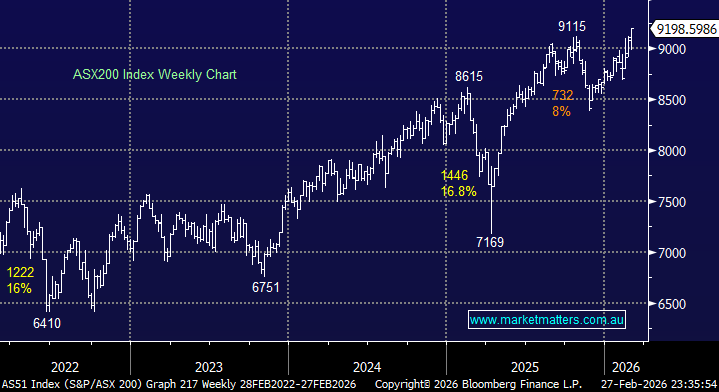

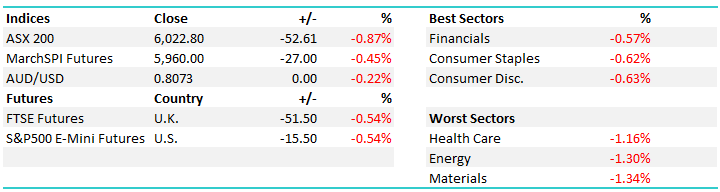

Local stocks hit the skids today courtesy of a weak lead from the US mkt overnight however we saw more selling in US Futures throughout our session today – at our close S&P Futures are trading down another -0.57% pricing a drop of ~170pts on the Dow when trading kicks off this evening. We’re starting to see an uptick in selling across global bond markets (yields higher) with the 10 year in the US printing 2.72% overnight – a big move and enough to spook equity investors as well.

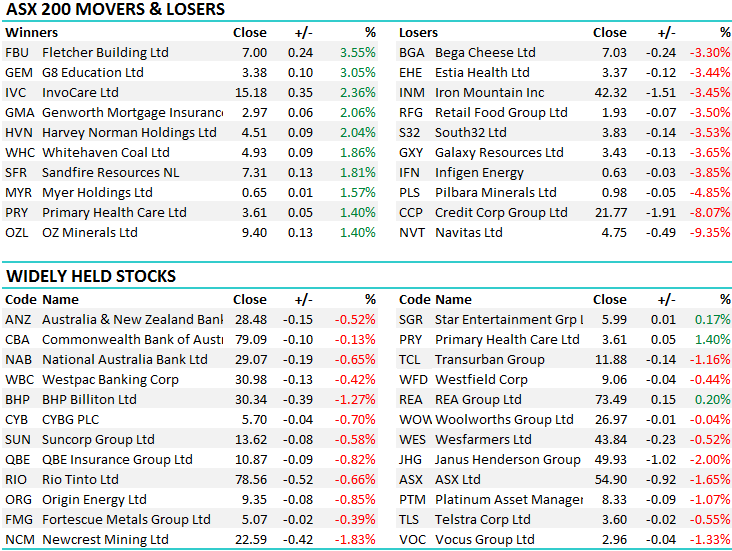

In strong markets cash feels like a drag and in weak markets it never feels enough – today was weak with the mkt heading back down to test the 6000 region again with a 6016 low. Lots to get ones head around today in terms of quarterly production numbers with some big volatility in some of the names reporting, while we also had an interim result from Credit Corp (CCP) – the stock offered hard as a result ending down ~8%. More on these themes below.

For the day the S&P/ASX 200 index lost -52 points, or -0.87 per cent, to 6022 while the All Ordinaries fell 52 points, or 0.85 per cent, to 6135.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

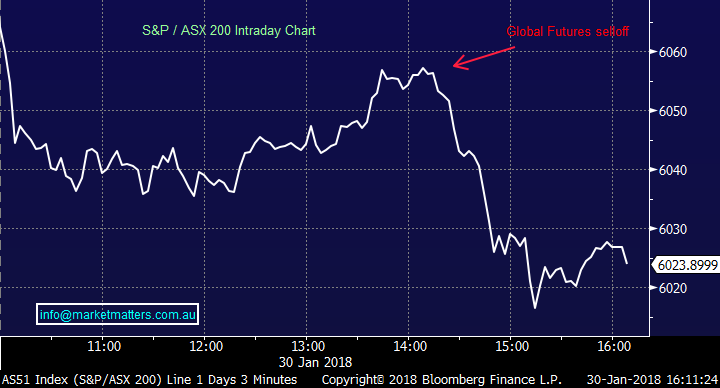

1.Foretscue Metals (FMG) $5.07 / -0.39%; Big volatility in FMG today with some curly parts to their Dec QTR production numbers offset by some reasonable commentary in terms Iron Ore demand and trends in terms of price realization. In short, the scorecard was OK on prodn/sales, costs & guidance although a slight miss on price realization offset to a degree of optimism around a potential ‘inflexion point’ mid Jan. In simple terms, FMG mine Iron Ore, it’s lower quality than others so a discount is applied versus the benchmark. A combination of some softer demand, environmental curbs in China which reduced the appetite for lower quality inputs and the discount that FMG usually gets blew out. In the Dec QTR that discount was bigger than the mkt thought it would, coming in at 34% versus the 1H18 discount of 32%.

However, similar to what we saw recently from White Haven Coal (WHC) who produce lower quality Met Coal (goes into Steel making) they saw a change in buying demand from mid Jan as well. So what does this all mean? In short, the discount should ease in 2H18 and is likely to land in their guidance range – 70-75% realisation or a 25-30% discount.

Elsewhere, costs still on the down low and getting better hitting a record qtrly low at US$12.08, a tad lower than $12.15 in SQ17. Guidance also maintained at US11-12/t which is a lot better than RIO and BHP. Net debt ticked up a bit but we / the mkt expected that given a few one offs that I won’t go into. Despite that, balance sheet still strong and free cash running at the rate of ~12% annualised yield. C1 cost guidance for the full year is maintained at $11-12/wmt: FY18 full year price realisation guidance is maintained at 70-75% of the Platts 62 CFR.

Overall – we like it here, we bought it ‘controversially’ for our Income Portfolio at $4.99 but would add to into further weakness if it played out.

Fortescue Metals Daily Chart - 6+% range in FMG today which is BIG

2. IOOF (IFL) $10.78 / -0.65%; IFL announced their December Funds Under Management, Advice and Supervision (FUMAS) numbers today, printing +4.7% growth in the figure over the quarter to $154.6bil total – big number and a record for IFL, now regaining all FUMAS lost to JHG in 2015 after selling the Perennial business at the time. IOOF has been a big winner in the advice space with a mass outflow from the big banks and life insurers – seems that Financial Planners now want to distance themselves from the big banks, I would too if I operated in that space (which I don’t). Anyway, much of the uplift can be attributed to the addition of 43 advisers over the quarter, and IFL will soon sit one notch behind AMP as the largest advice business in Australia. The leverage here is around the lower cost base post the ANZ Wealth acquisition (courtesy of synergies) with these benefits coming into the fray later in the year.

The stock drifted slightly today but the mkt was weak and it did outperform - the result was in line / slightly better in our view. We own IFL in the Growth Portfolio and remain comfortable for now

IOOF (IFL) Daily Chart

3. Newcrest Mining (NCM) $22.59/ -1.83%; Gold was weak overnight and down another $6 during Asian trade today which didn’t help, however NCM didn’t help themselves either with a 2Q scorecard that was on the lower end of the expected range – they printed 613k/oz versus consensus of 643k/oz while they did maintain full year production guidance of 2.4-2.7m/oz which is a positive.

Never the less, our main concern for gold at the moment and this is obviously relevant for EVN below, is a short term low in the US currency as we wrote about yesterday / and again this morning seems likely which should put the kibosh on Gold in the short term. We own NCM (reluctantly), think it’s a self-help story, is cheap v global and local peers and will print better numbers over time – it’s just the timing that’s the issue. Our trigger finger is getting itchy on this holding.

Newcrest Daily Chart

4. Evolution Mining $2.77 / +0.36%; another solid quarter for Evolution, “on track to comfortably deliver FY18” guidance with production expected at the higher end of guidance alongside reporting a record low cost of $784/oz. An effort was also made to lower debt, falling 32% in the quarter to reduce gearing to 9.5% - net debt around $230m when the mkt was expecting around $250m. A really good result here, better than its bigger rival above.

Evolution Daily Chart

5. Sandfire Resources (SFR) $7.31 / +1.81%; maintained guidance across gold and copper but said it would be at the upper end which was a good result. Dec QTR Copper production was inline at 16k/tonnes while they provided good colour in terms of their development projects saying progress has been made in Doolgunna (WA – copper/gold) and Black Butte (USA - copper) sites. A good result overall

Sandfire Daily Chart

6. Credit Corp (CCP) $21.77 / -8.07%; Morgan’s upgraded yesterday moving their PT up +5.8% to $23.80 while other brokers that cover this stock are reasonably keen on it, however the interim result today from CCP was a clear miss – mainly around the volume of purchased debt ledgers (PDLs). In short, they buy distressed debt from banks and others at a percentage in the dollar then back themselves to collect that and more. PDL’s are like their inventory and it seems the mkt has become more competitive here, pushing up the costs of that ‘inventory’. They’ve pulled back on their buying as a result which is sensible in the long term, however in the short term we see likely earnings downgrades as a result. It trades on a reasonable PE of 20 current and around 17 forward so not cheap, but not expensive, my concern lies around the mkts positioning which is clearly on the long side of the trade here – $19 downside target.

Credit Corp Daily Chart

OUR CALLS

No trades today across the portfolios

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/01/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here