Sustained selling see’s the ASX close on the lows ahead of RBA decision tomorrow (ECX, BLD)

WHAT MATTERED TODAY

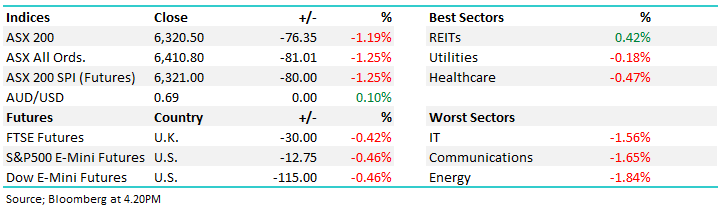

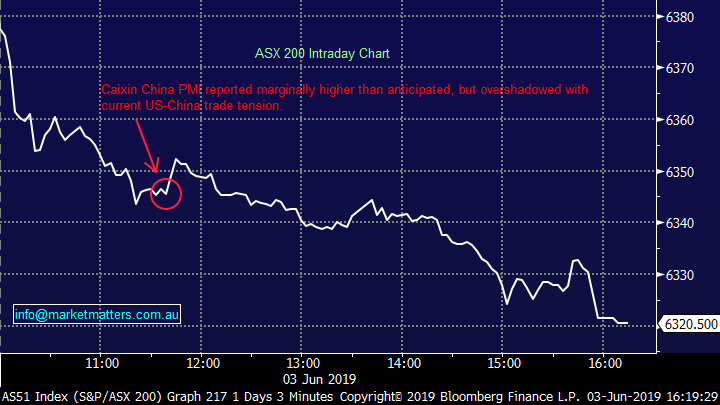

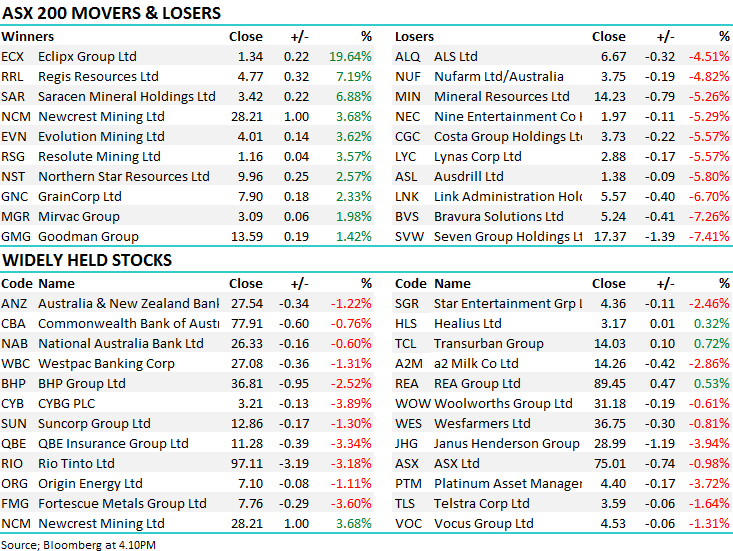

The weakness across the market persisted again today with the ASX 200 testing and breaking through support and closing on the lows of the session – hard to find a bright spot across the market, and the MM portfolios for that matter. The only stock we hold that managed to breakeven was Healius (HLS) which has some corporate appeal at the moment. While US futures were lower during our time zone, they did tick marginally higher into our close however that seemed to correspond with further selling of aussie stocks. During May, the ASX outperformed strongly v other global markets and it seemed like futures traders were starting to unwind that bet today. That outperformance was largely on the back of expectations around lower interest rates, with the first test of that thesis coming when the RBA meet tomorrow. The front page of the AFR this afternoon running with the headline 3 Reasons Why the RBA may not Cut! That certainly didn’t help the cause today.

Around Asia, markets were mixed however they didn’t experience the selling we did – Hong Kong down -0.10%, China off by -0.41% at time of writing after the Caixin PMI Data (manufacturing) came in slightly ahead of expectations.

At a sector level, the property stocks performed well as did the gold sector while energy was again the biggest laggard.

Overall today, the ASX 200 fell -76 points or -1.19% to 6320. Dow Futures are trading down -139pts / -0.56%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

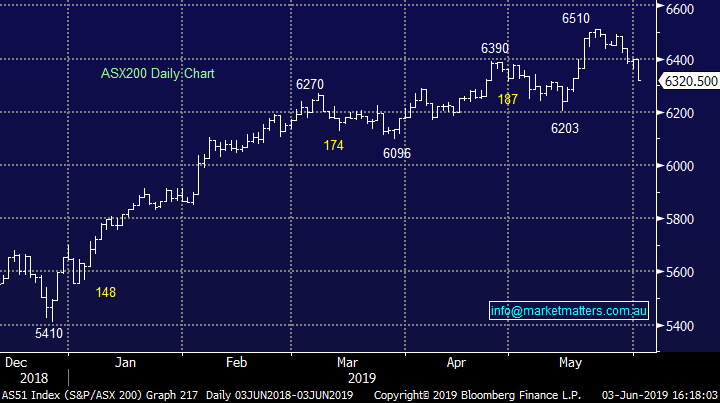

Eclipx (ECX) 19.64%; the leasing business topped the boards for the second straight session, with today’s move taking the two day rally to a total of 55%. The company which provides fleet management and asset finance announced their first half results on Friday morning which has sent investors into a frenzy despite posting an EBITDA loss of nearly $10m. Eclipx has put a number of its non-core businesses up for sale, or simply dissolve them following downgrading guidance and calling off a merger with McMillan Shakespeare (MMS) back in March. This includes online marketplace GraysOnline, car loan business Right2Drive and its commercial equipment leasing company, all three of which contributed negatively to EBITDA in the half with the proceeds set to be used to pay down debts

The market clearly liked the approach and rewarded the stock with the underlying business performing reasonably well. Eclipx expect the asset review and any subsequent sales to be completed within 4 months. Hard to fight the tape at the moment with the strong momentum, but not one for us at this stage preferring to review on a pullback towards $1.10

Eclipx (ECX) Chart

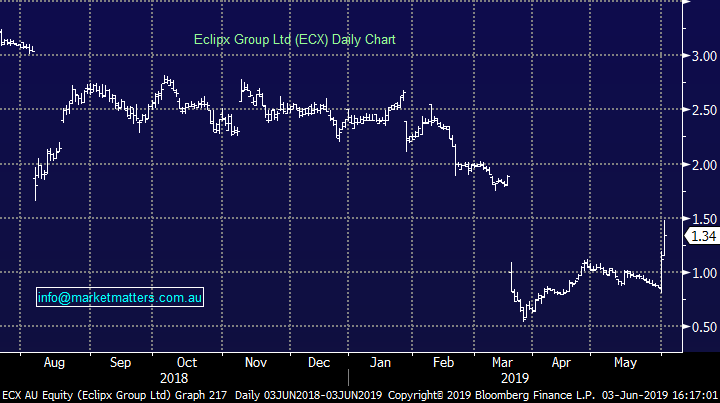

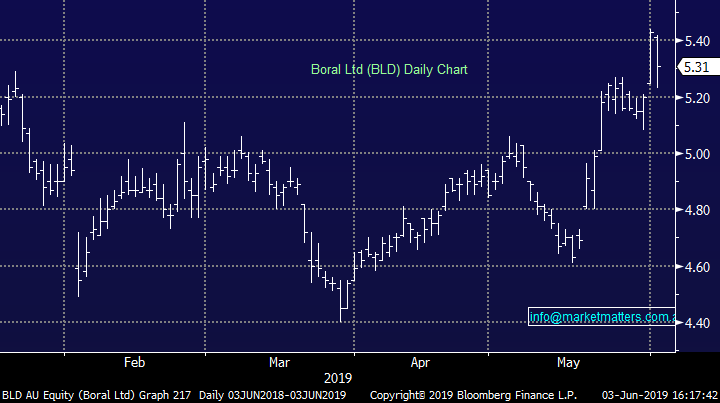

Boral (BLD) -2.21%; construction materials name struggled today, giving back a portion of Friday’s rally as investors grapple with the company’s investor presentation. Shares initially moved higher, but are struggling today with market commentators stuck on one key aspect of the presentation. The company that the second half is “broadly in range of our expectations …. as always we need a strong June to finish the year.” The company also noted that infrastructure activity growth had begun to slow while residential work remained weak.

So despite maintaining guidance, the FY19 result will come down to the wire, and only stumble over the line if June is strong. We see this as unlikely to hit the target, with a lack of construction activity around Australia Boral is unlikely to see the strong month it needs to meet or beat at the full year result. We see construction growth as nearing the bottom of the cycle, and Boral should benefit from an improving macro outlook when it does.

Boral (BLD) Chart

Broker moves:

· Iluka Downgraded to Hold at Morningstar

· Eclipx Upgraded to Outperform at Credit Suisse; PT A$1.40

· AGL Energy Downgraded to Neutral at Goldman; PT A$22.20

· Boral Downgraded to Underperform at Credit Suisse; PT A$4.40

· St Barbara Upgraded to Neutral at Credit Suisse; PT A$2.72

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.