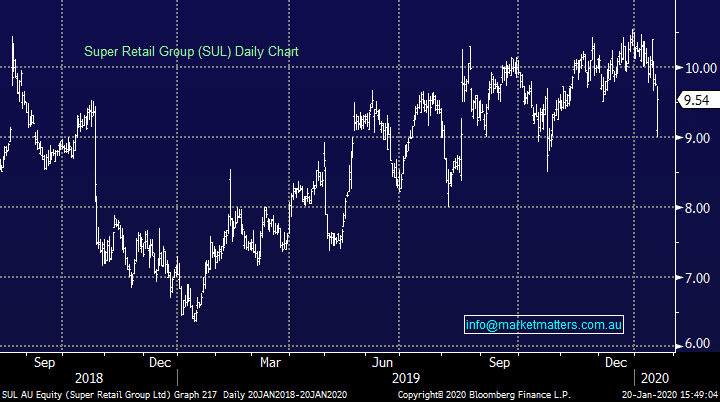

Super Retail (SUL) margins squeezed, Macpac suffers

Stock

Super Retail Group (SUL) $9.52 as at 20/01/2020

Event

Group sales across the Super Retail brands saw total sales growth of nearly 3% to 28 December despite the impact of drought and fires late in the second half, however it has not been enough to please the market with shares trading lower throughout the session. The BCF and Macpac brands, Super Retail’s two smallest contributors, were most heavily impacted “due to their higher exposure to the outdoor category” with like-for-like sales falling 0.5% and 7% respectively.

Macpac was the only brand to see total sales fall, down 1% in the first half with BCF store openings delivering some growth. Supercheap Auto and Rebel both recorded more than 3.5% total sales, however it was Rebel who won out on a life-for-like basis hitting 3.3%.

The company now expects first half EBIT between $113-115m, around flat on the first half of 2019. The company blamed higher labour costs and a delay in price increases in Macpac ahead of the winter period for tighter margins although they expect this to normalize somewhat in the second half. The market is looking for low single digit EBIT growth over the year, so Super Retail have some work to do in the second half.

Super Retail (SUL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook