Suncorp smashes expectations – rallies 11% (SUN, ING)

WHAT MATTERED TODAY

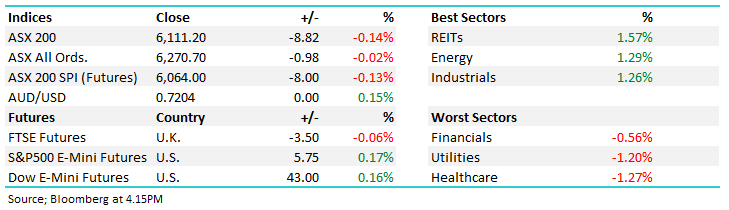

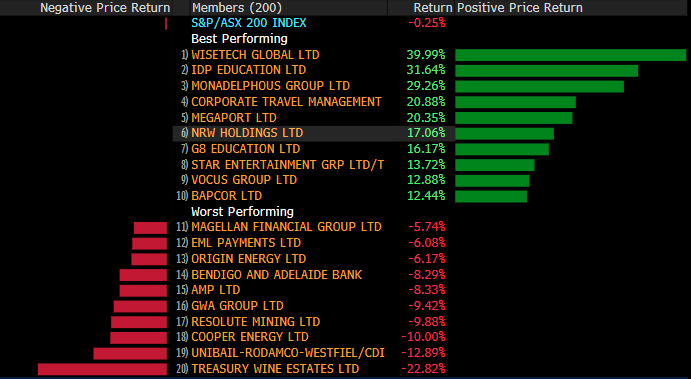

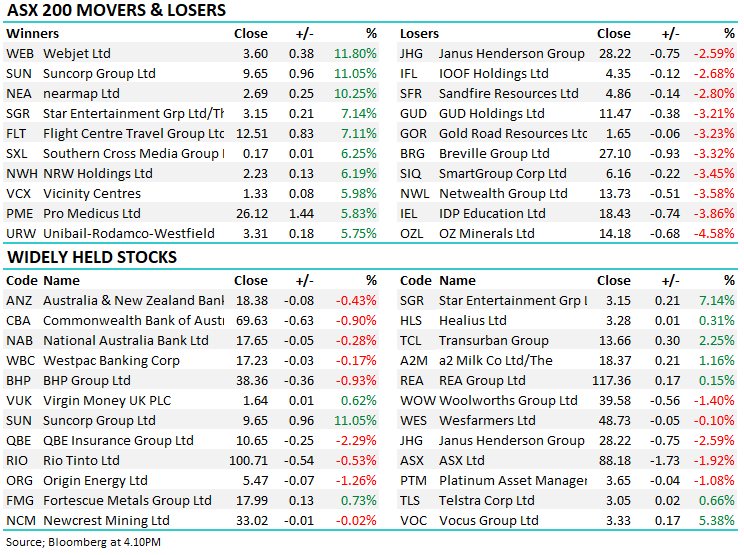

A strong open this morning with the market hitting an early high of 6166 only to see sellers hit the boards and push the index lower into the close. Gainers to losers were split pretty much down the middle today, however again there were some very strong performances from individual stocks that reported numbers headlined by Suncorp (SUN) – more on that below. Looking at the leader board today, the likes of Flight Centre (FLT), Webjet (WEB) and Star Entertainment (SGR) all rallied well highlighting the ‘re-opening trade’ is gaining momentum.

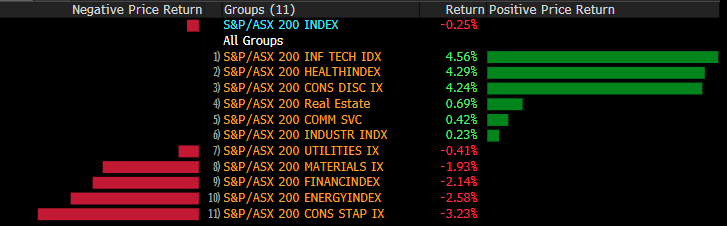

At a sector level today, property stocks regained some form to top the leader board while the pullback in CSL continued weighing on Healthcare.

Asian markets were higher across the board today while US Futures are fairly muted.

Overall, the ASX 200 lost -8pts / -0.14% to close at 6111. Dow Futures are trading down +43pts / +0.16%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

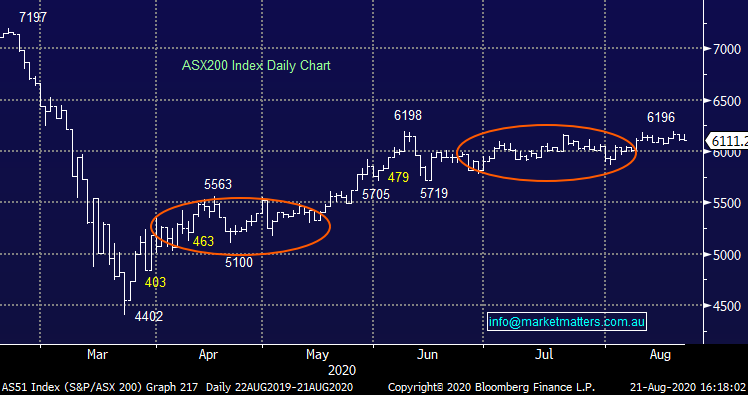

Suncorp (SUN) +11.05%: SUN reported a FY20 profit of $913M and a fully franked final dividend of 10 cps. The profit was a big beat to market expectations ($817m) with the result driven by strength in their general insurance business which saw a big expansion in margins. The bank delivered a profit of $77M for 2H20 which compares with $171M for 1H20, the large decline in profit was the increase in the bad debt charge from $1M in 1H20 to $171M in 2H20, as expected. There was 3% income growth from 1H20 to 2H20 and expenses fell by 5% over the period. A strong performance in very difficult circumstances.

Suncorp (SUN) Chart

Inghams (ING) +3.04%: underlying earnings were off 24% for the full year as COVID restrictions slowed meat processing volumes in the 2nd half, though volumes were higher year on year. The dividend was cut to a similar proportion to earnings, but the outcome was largely in line with expectations. The market liked the outlook with the company noting the resilience in poultry and the company’s work on costs despite the headwinds being faced.

Inghams (ING) Chart

TPG +2.74%: the new and improved TPG reported first half today with the market more concerned with the update on the merger with Vodafone which completed late in the half. The result showed a decline in revenue on the Vodafone business in the first half but a strong start to life for the combined group as they combine the network offering. The announcement noted her customer demand on fixed and mobile services while the group “achieved the highest market share of net NBN growth” in the June quarter. Scale is the key here, and TPG are now working to migrate customers to cut costs.

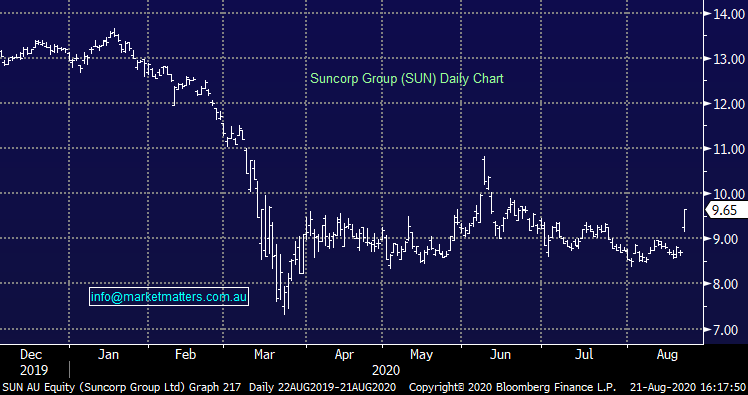

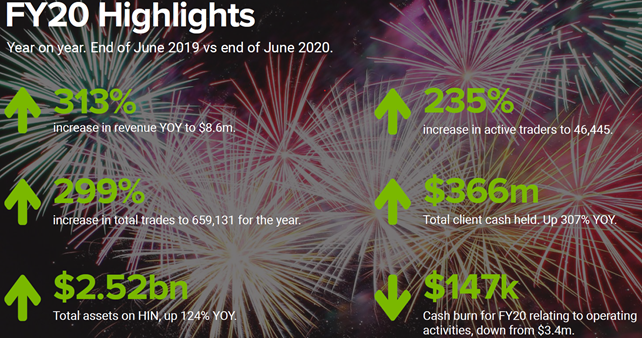

SelfWealth (SWF) +10.48%: This is a really interesting business and one I’ve started to look at over recent months. They’re a cheap online broker (they’re not an ASX participant, they clear through OpenMarkets) however they use a social platform as their point of difference. It’s a small cap stock, growing strongly and the share price has risen as a consequence. With more work from home, they’re seeing more new accounts than ever before, and that’s highlighted in the stats below. I’ve also heard that CMC markets are opening around 1000 new accounts per day, while Commsec is apparently opening around 2000 a day.

They reported FY20 results today and rallied as a consequence – the fireworks on the slide behind the numbers (below) is pretty cliché, but the growth is good from a low base.

Sectors This Week

Stocks This Week

BROKER MOVES

· IDP Education Cut to Hold at Morgans Financial Limited

· Origin Energy Cut to Neutral at Macquarie; PT A$6.01

· Pro Medicus Raised to Buy at UBS; PT A$29.65

· Charter Hall Group Cut to Neutral at UBS; PT A$12.25

· Domain Holdings Cut to Neutral at UBS; PT A$3.60

· Michael Hill Raised to Outperform at Forsyth Barr

· Charter Hall Group Cut to Neutral at Credit Suisse; PT A$12.21

· Codan Cut to Hold at Canaccord; PT A$10.25

· Nine Entertainment Cut to Hold at Morningstar

· Star Entertainment Raised to Outperform at Credit Suisse

· Coca-Cola Amatil Raised to Outperform at Credit Suisse

· HT&E Raised to Outperform at Credit Suisse; PT A$1.60

· Growthpoint Cut to Neutral at JPMorgan; PT A$3.40

· Domain Holdings Cut to Neutral at JPMorgan; PT A$3.50

· Orora Raised to Buy at Jefferies; PT A$2.65

· IDP Education Cut to Hold at Blue Ocean; PT A$20

· ASX Raised to Neutral at Evans & Partners Pty Ltd; PT A$75.51

· Star Entertainment Raised to Overweight at JPMorgan; PT A$3.25

· Coca-Cola Amatil Raised to Add at Morgans Financial Limited

· IDP Education Cut to Negative at Evans & Partners Pty Ltd

· Pro Medicus Raised to Buy at Bell Potter; PT A$28.50

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.