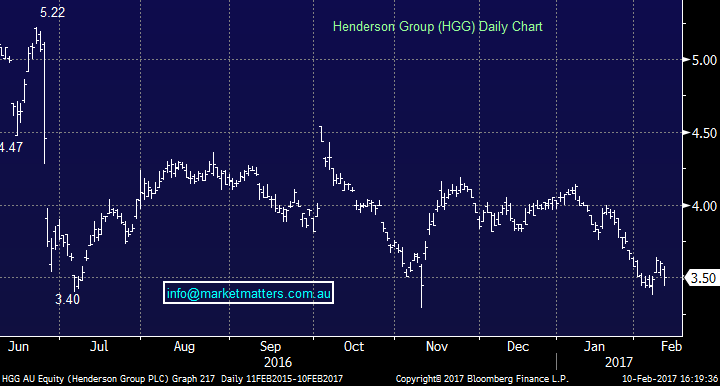

Strong week for stocks as reporting heats up…Review of HGG result

**Please note, our report templates are being amended with a further update next week. Revised templates will provide a PDF link making tables & charts larger / easier to read. As always, any feedback is appreciated**

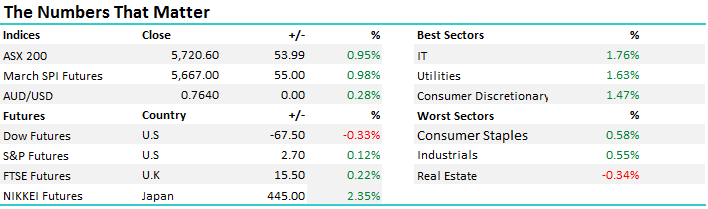

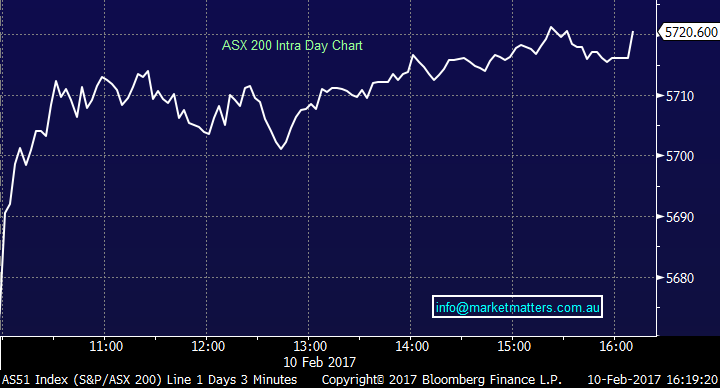

Another good session today with the market pushing up through 5700 on the ASX 200. Our expectation has been that the market would trade would between 5600 and 5725 however a clear break over 5735 will target at least the 5800 area in the short term. We haven’t yet broken that level with the index hitting a daily high of 5721 today, however we’re clearly within striking distant. 5600 provided a good level of support earlier in the week and we’ve subsequently bounced strongly from it.

We had a range today of +/- 48 points, a high of 5721, a low of 5673 and a close of 5720, up +pts or +0.99%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

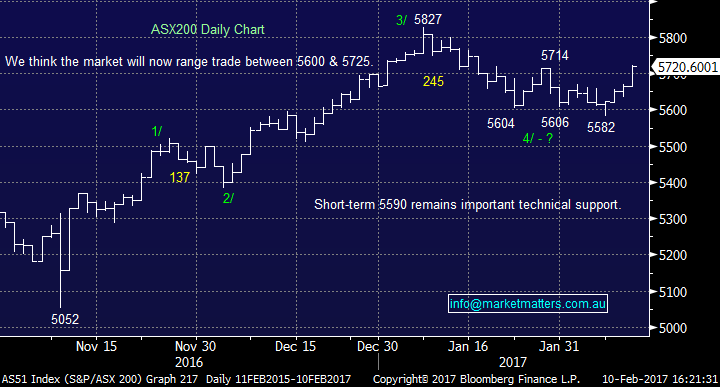

For the week, the ASX 200 was higher in aggregate adding +1.33% with the Real Estate & Healthcare Sectors adding more than 3% a piece as we continue to see some of the beaten down high PE / high yield type plays that have been on the nose in the last few months. Stocks that caught our attention this week included; Star Entertainment (SGR) which put on +6.81% to finish at $5.02, Transurban (TCL) bounced +6.52% after reporting very good numbers early in the week and upgrading guidance, Carsales.com (CAR) added +8.34% on the back of a good report in terms of growth, but as we said at the time, falling margins remain a concern while Henderson Group (HGG), who reported overnight was up +0.86% for the 5 days (more on HGG below).

On the flipside Genworth (GMA) reported inline/slightly better but the outlook to us remains a major concern – the stock was the worst performer for the week down -14.86%. Resources were also under some pressure despite a good result from RIO, which goes to show how much positivity is already baked into the resource cake; BHP (BHP) lost -4.29% for the week while, Fortescue (FMG) lost -4.14%.

(Source Bloomberg)

Reporting really kicks into gear next week with more than 60 companies in our universe delivering results.

Henderson Group (HGG); Reported overnight and the result was broadly in-line with consensus, however on the conference call, the CEO was downbeat about prospects for 2017. To recap, HGG has clearly had a tough FY 16 for a variety of reasons. The BREXIT earlier in the year prompted a huge amount of nervousness around European equities, HGG’s funds had a tough time performance wise which hit their performance fee revenue with both of these things leading to an outflow of funds, particularly from retail funds which are higher margin (more profitable for them).

The only really negative surprise in the results was around the uptick in outflows in Q4 – and that’s one of the elements that is a bit troubling for us at the moment. That said, when we distil it all down, and overlay the price action we saw on the market today despite a number of broker downgrades, it seems that a lot of this ‘bad news’ was already in the price. Clearly a higher risk play but we remain comfortable holding at current levels.

The stocks closed down -2.78% to $3.50 but is up slightly for the week

Henderson Group (HGG) Daily Chart

REA Group (REA); Reported 1st half numbers today which were below consensus, however given the backdrop of very low listings in Australia, the result was actually OK – and management are doing a good job in a tough environment. That said, trading on 30x with a lack of visibility around when listing volumes will pick up seems a risk to us…

Aconex (ACX) has had a cracking week up +21.58% - Myer (MYR) also looks interesting here as does Sims Metal (SGM).

Have a great Weekend & watch out for the Report on Sunday,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/02/2017. 5.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here