Stocks trickle lower into the Easter long weekend (ORE)

***There will be no Weekend Report published this weekend - back on Tuesday – Happy Easter to all***

WHAT MATTERED TODAY

It seemed like the Aussie market started the Easter break early today with the index opening firmer before tracking lower throughout the session eventually closing on its lows – not surprising really given that the US market is open for 2 sessions (Friday and Monday) while we’re chewing the ears off a few chocolate bunnies. The family and I will be around Nelson Bay for the break – four days off is always a luxury and here’s hoping that a few fish are biting around the reefs off the coast of Hawkesnest. I’ll (hopefully) have some reasonable pics for the MM community come Tuesday!

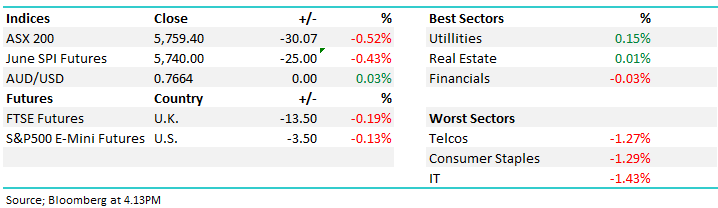

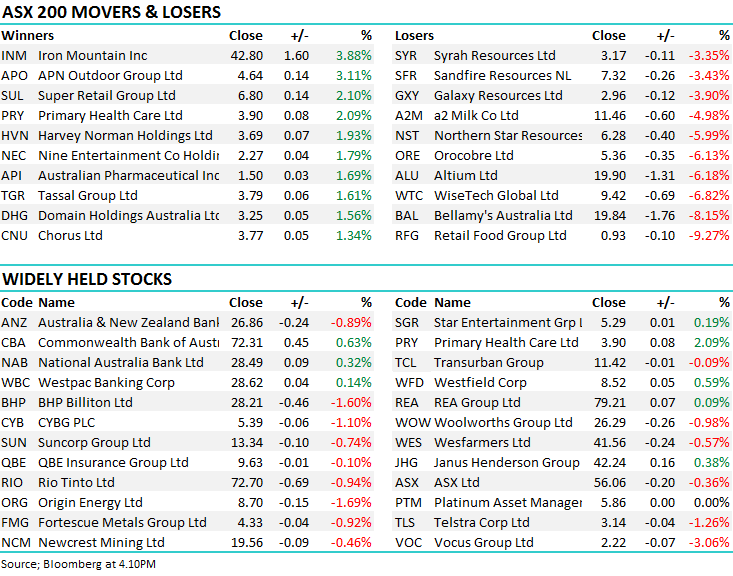

On the market today, the defensive Utilities and Real Estate stocks did best – while the financials outperformed on a relative basis which is a rarity in recent times. An overall decline for the market today of –30pts or -0.52% with the ASX 200 closing at 5759. US Futures are trading down -0.13% at time of writing.

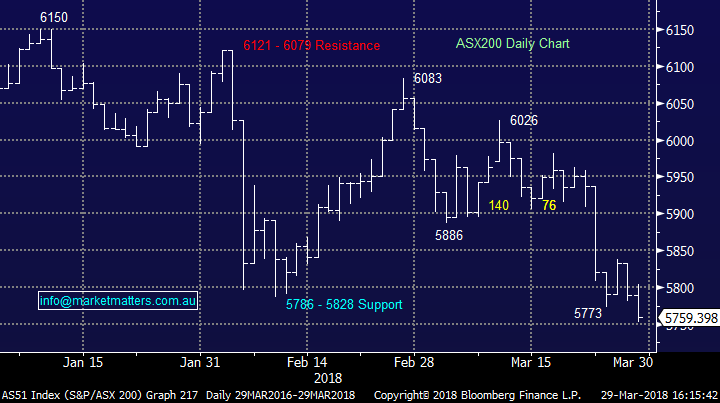

ASX 200 Chart

ASX 200 Chart

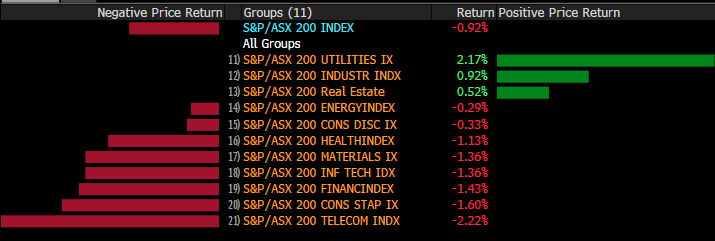

CATCHING OUR EYE – STOCKS & SECTORS OVER THE WEEK

Two extremes – the Defensive Utilities were well supported while the Telcos were weak.

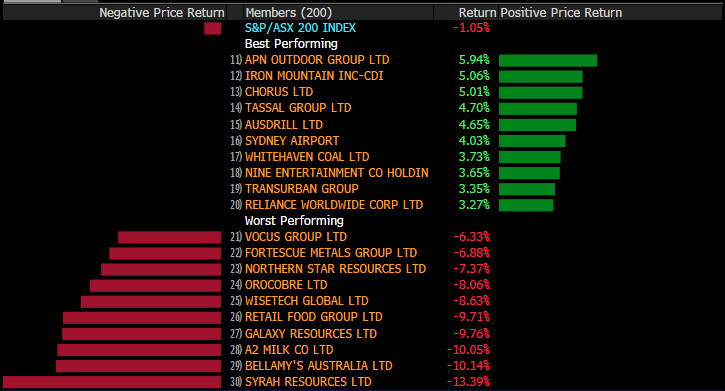

High PE stocks the targets of most pain this week – Syrah, Bellamy’s and A2 down more than 10% in the 4 days

Lithium; A very weak day for the sector highlighting the underlying volatility that is often evident in this more speculative are of the market at the moment….The AFR running with a story that highlights China’s influence on the electric vehicle market saying that China is the single most important driver of growth and profitability for the sector – this clearly rattled the cage of some given the simmering tensions on the trade front between the two global super powers (US & China). China is at the forefront of the adoption of technologies to slash greenhouse gases. Its socialist market economy, which includes centralised control over industrial production, has led to the fastest uptake of electric vehicles of any country in the world. China's shipments of electric vehicles in January were 38,470, up about 480 per cent from a year earlier, according to figures published last month by Japanese broker Nomura. In 2017 global shipments of electric vehicles hit 1.4 million, up 50 per cent on a year earlier. (source AFR).

This week we saw the Goldman Sachs Battery conference with the following companies presenting; Independence Group, Orocobre, Pilbara Minerals, Galaxy Resources, Syrah Resources, Western Areas, Clean TeQ Holdings, Altura Mining, Global Geoscience, Neometals, Talga Resources, First Cobalt, Lithium Power International, Lithium Australia and Blackstone Minerals.

The other concern is whether or not too much too soon has been priced into the sector and that’s a legitimate consideration, and the main reason why we’ll remain active in our positioning. We hold currently hold a position in ORE.

Orocobre (ORE) Chart

Blue Sky Alternative (BLA) $10.40 – Has remained in a trading halt today however the more I ponder the report written yesterday, the more this looks like a self-fulfilling thesis, and the stock is likely to get crunched when it comes back online. Opaque structures are always risky and the initial response from the company was a weak one. A more detailed response is being composed and I’d assume the company will come back online after this is released to the market next week.

OUR CALLS

No trades in the MM Portfolio’s today

Happy Easter to all

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/03/2018. 4.20PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here