Stocks rebound however inflation print in the US on Wednesday remains key (TCL, CGF, COH)

WHAT MATTERED TODAY

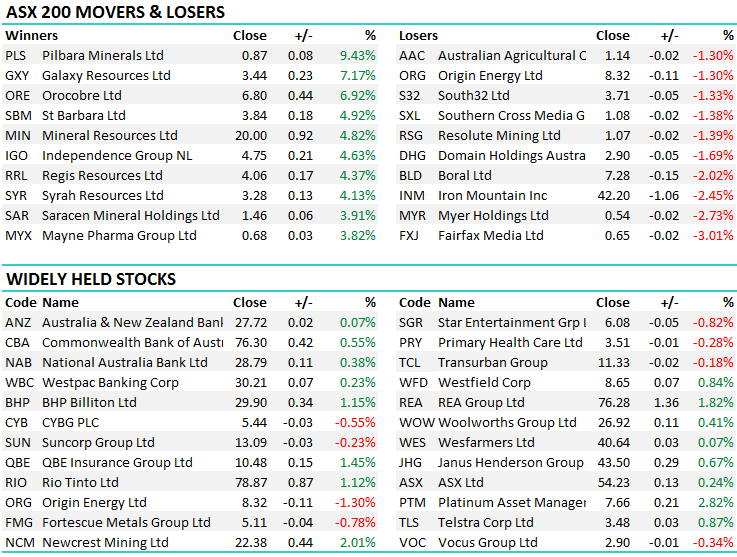

The market continued to recover today post last week’s savage selloff with some of the higher risk plays, particularly in the commodity space doing well – the Lithium Miners like Orocobre, Pilbara Minerals and Galaxy topping the leader board today (adding 6%+) while Kidman Resources (KDR) which we hold in the Growth Portfolio put on +3.06%. A number of key companies reported today and there was some reasonable volatility as a result. Challenger Group Financial (CGF) did okay in aggregate however it was a volatile session for the annuity provider – a 7.4% daily range, while Cochlear also had a wild ride, initially trading down before recovering to close flat, a ~5% daily range. More on these results later.

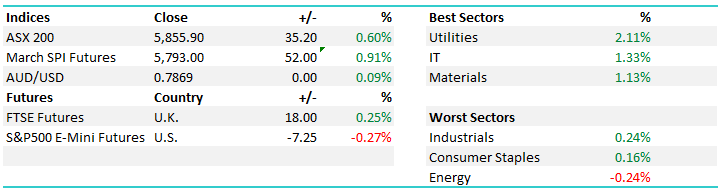

On the market today, the utilities sector was best on ground adding ~2%, the Energy stocks the worst while the broader ASX 200 put on +35pts or +0.60% to close at 5855 – the Friday morning low of 5786 last week now proving to be a reasonable buying opportunity, however the clear risk factor this week comes on Wednesday evening US time with the release of US inflation data. A strong print and the market should take another leg down, however on the flipside, a weaker result will allay a lot of the fears being played out in the mkt at the moment around an overheating US economy + a Fed Reserve that is thought to be behind the curve. Seems like a fairly binary outcome for our mkt on Thursday.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

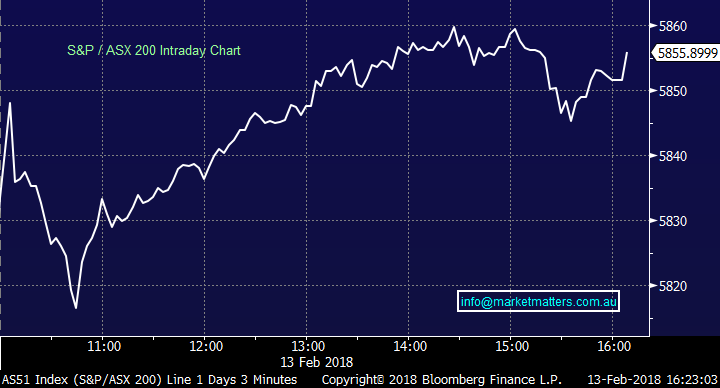

1. Challenger Group Financial (CGF) $12.82 / -0.16%: I had a discussion with the team this morning about buying CGF into the weakness around $12 after it reported numbers that looked OK in aggregate however their guidance was a tad light on (or mkt expectations too high). The stock was hit hard early, down to a $12.05 low only to bounce back strongly. We missed it, however wouldn’t be surprised to see it trade lower from here, into a downside technical target of ~$11.50. To recap, CGF is a stock we held last year, bought at $11.95 and sold at $13.80 in the Growth Portfolio and we’re keen to get back in here, however given cash levels, we stayed patient today.

In terms of the result all metrics were sound with a big uplift in total assets (+18% to $76.5bn) while annuity sales remained strong, with their distribution through platforms + international expansion working well. They re-affirmed FY profit guidance of $545m-$565m which was probably where the issue resided initially, given consensus was already looking for $564m, which implies top end of the range. A strong recovery from the lows to close almost flat on the session.

Challenger Daily Chart

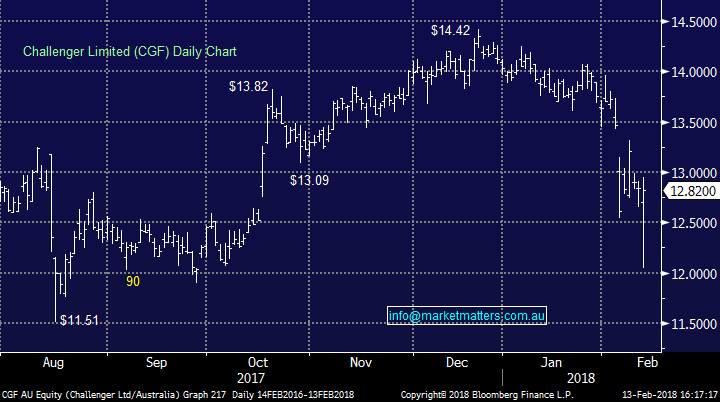

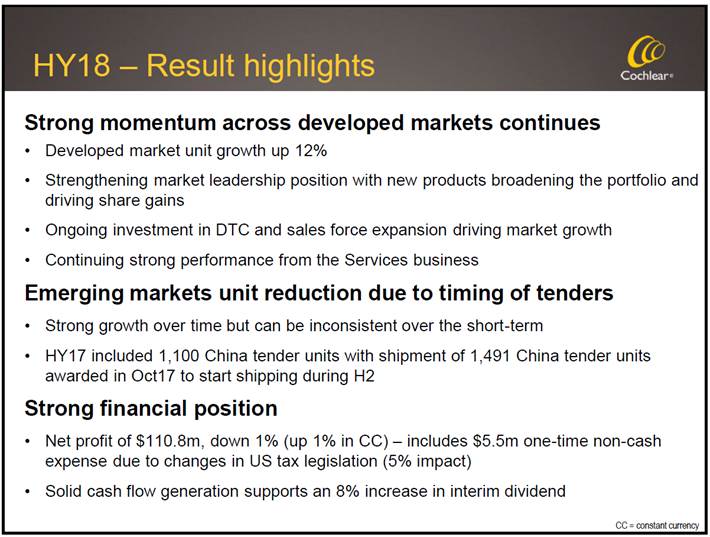

2. Cochlear (COH) $171.74 / -0.03%; Another that saw a big intra-day range today with the mkt reacting poorly to the initial result which was below in terms of the headline profit number of $110m versus the $120m consensus, however they did wear a 5.5% non-cash expense on the back of US tax changes. All up – a good result .

Cochlear Daily Chart

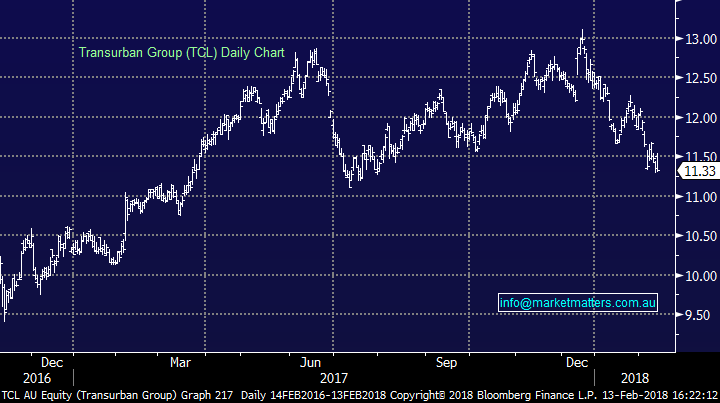

3. Transurban (TCL) $11.33 / -0.18%: Result was inline in terms of earnings however the dividend of 28cps was a tad below the 29cps expected by the market. TCL is obviously a premium infrastructure play on the ASX, an exceptionally strong business, good growth in earnings + dividends over the past 3 years of +12% with the expectation that dividends will continue to grow at a 10% clip in the years ahead – todays result supported that thesis, however the negative influence of rising US interest rates is simply too much of a headwind for us. There is a point that this looks interesting, but not yet.

Transurban Daily Chart

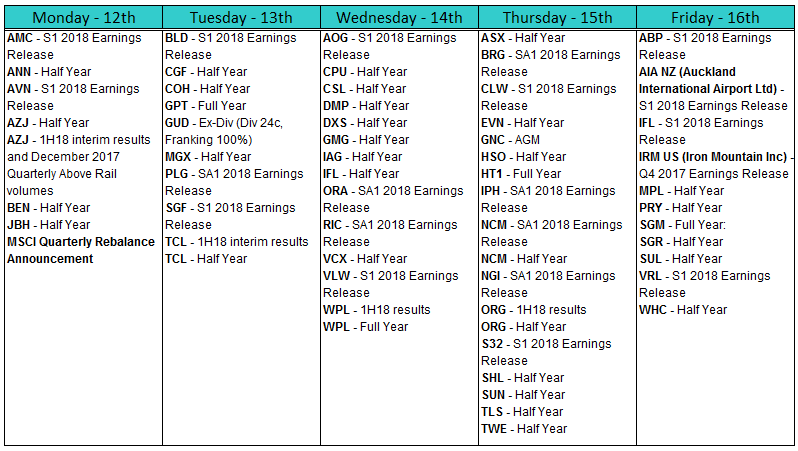

REPORTING THIS WEEK

OUR CALLS

No changes to the portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2018. 5.19PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here