Stocks open with a bang & close with a whimper (NCM)

WHAT MATTERED TODAY

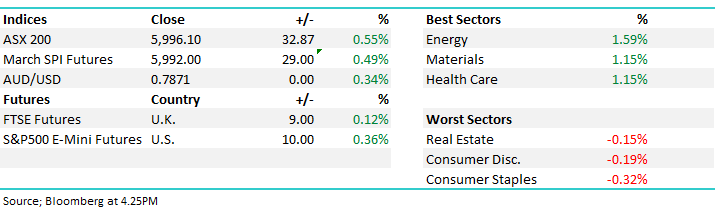

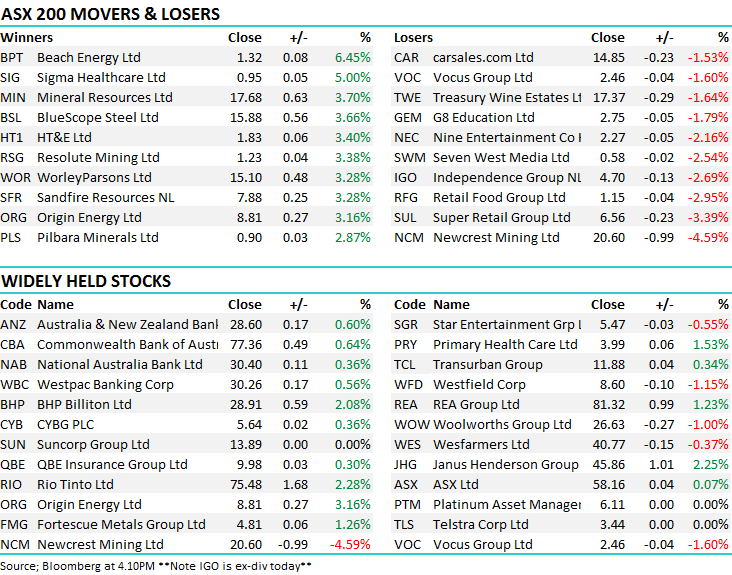

The start of the trading week promised so much with a very strong overseas lead and continued support throughout Asia + buying in US Futures (+0.36%) during our session, however the ASX failed to live up to expectations with what looked to be Futures led selling throughout the day ahead of a big portfolio unwind in the match – – most large caps gapping down post 4pm and there was big volume through the futures market as well. We saw this on Friday as well in particular stocks like Iluka, Western Areas and others with Colonial said to be the seller. As one trader this afternoon put it to us on Bloomberg chat – SPI led, everything drifted throughout the day – selling not focussed on one sector - a pathetic effort with US and Asia so strong!

Anyway, the best of trade was seen early with the mkt peaking at the 10.10am unwind - a high of 6026 before a slow grind lower to close at 5996. A rise of +33pts in aggregate or +0.55% which is nice but we were up +63pts at the best, clear underperformance in Australia after a recent period of outperformance…

ASX 200 Chart – stocks whacked on the match today

ASX 200 Chart

CATHCING OUR EYE

1. Employment Data - Wage Growth & the market vibe; A lot written already about the stat on Friday night and we covered it in the weekend report (click here) and briefly in the AM report this morning (click here) however as means of a quick summary and our interpretation of the market ‘vibe’ as a result, here’s the main takeaway.

On Friday night the US market received a very strong combination of economic data to send stocks roaring ahead and as expected the market has forgotten the ~12% plunge in February, for now i.e. the American economy continues to strengthen but importantly we’re not seeing a big uplift in wages which stokes fears around inflation and gives fuel to the concept that the US Central Bank is behind the curve:

1. The US created 313,00 new jobs in February with a jobless rate of 4.1% - a huge beat on analyst estimates of just over 200,000 new jobs.

2. Average hourly earnings only rallied +0.1% after last month’s +0.3% and importantly below analysts’ estimates of +0.2%, plus the icing on the cake was Januarys gains in pay that created havoc in stocks were revised down.

We are in goldilocks territory for stocks, a perfect scenario to create the blow-off top we are forecasting for March / April:

· The US economy is powering ahead without major signs of inflation (yet) – but inflation will rise at some point causing a rapid increase in bond yields / interest rates and that will likely be one of the reasons for a sharp market drop e.g. Think February when markets simply sniffed the potential.

Equities are following the path we have largely been anticipating since the major market correction in 2015-6 and hence until further notice our strong view remains intact:

1. US stocks will form an important top in March / April with the S&P500 likely to make an attempt on the psychological 3000 area i.e. 6-8% higher.

2. MM is still looking for a +20% correction to commence in 2018/9 – goldilocks scenarios do not / cannot last forever.

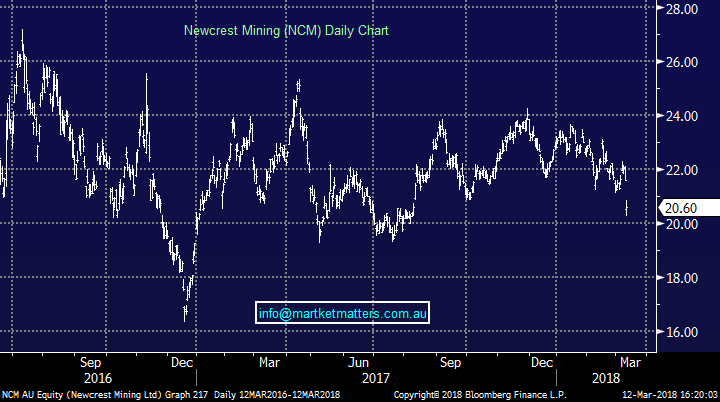

2. Newcrest Mining NCM) $20.60 / -4.59%; Hit hard today after the company announced a Tailings Dam Breach at their Cadia operation near Orange– 3 words we don’t want to hear particularly after what happened with Samarco in Brazil. In short, Cadia is the driver of NCM earnings and is now not producing + there are a huge amount of unknowns in terms of operational, social, community and financial risk. Expect NCM to be in the sin bin while production is halted and information is scarce. Below in the image released by the company which highlights the magnitude of the issue – not easily fixed by the look. We’re not fans of gold at this juncture given we think the next BIG move in the $US is up which is headwind for the precious metal however NCM does screen “cheapest” of the major Australian golds having lagged the recent offshore buying spree in the likes of EVN, NST, SBM, SAR, RRL etc.

Newcrest Tailings Dam partial failure

Image of the partial wall failure of the Northern Tailings Storage Facility at Cadia Valley Operations. Photo by Newcrest Mining

Newcrest Mining Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here