Stocks hit as Trump and Biden go toe to toe… (CTD)

WHAT MATTERED TODAY

Well, well, well, the market certainly didn’t like the sound of todays debate as Trump decided to bring his chaotic and confrontational style directly to the stage in what many are reporting as one of the low points in US Presidential debate history. Insults, interruptions, personal attacks, unrelenting cracks on Bidens family and policies, Biden calling Trump a “clown,” a “racist” and “the worst president America’s ever had.” I actually didn’t get to see much of it - others did around the office – with the consensus being that Biden took the gong, although it was a bit of a crash.

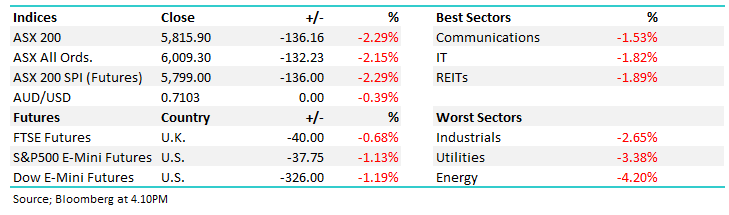

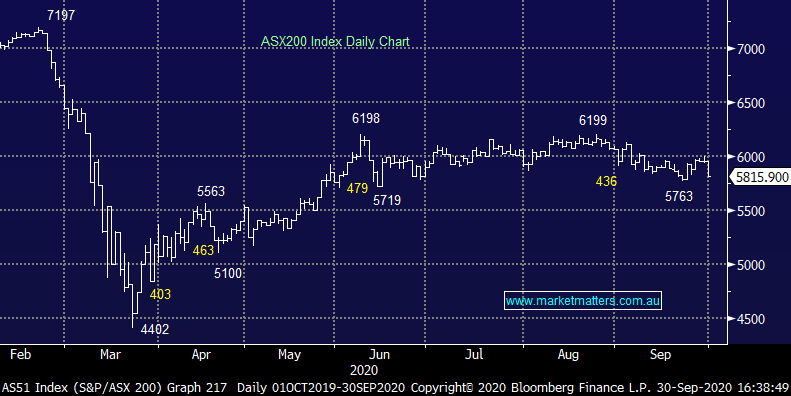

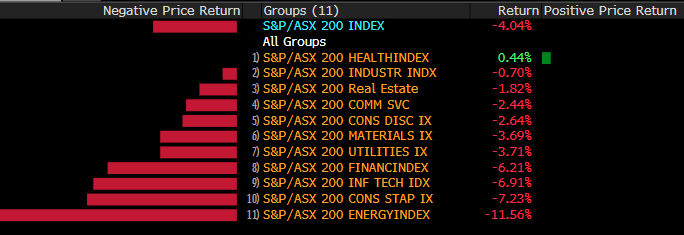

US Futures certainly played that tune with early gains of +0.3% giving way to a -1% decline by the time our market closed. The ASX initially opened on the back foot and despite an attempt at rallying mid-morning, it was all one way traffic from midday onwards, with sellers really feeling kicking up into the close. A poor way to end the month & quarter with the ASX down -4.04% and -1.39% respectively

Asian markets were a mixed bag today, Japan down 1.5% however Hong Kong & China were mostly higher while US Futures were down 1% by our close.

By the close, the ASX 200 was off by -136pts / 2.29%. Dow Futures are trading down -263pts/-0.96%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Month & Quarter Returns: A poor way to end the month & quarter…

Month – September

Quarter – Q1 FY21

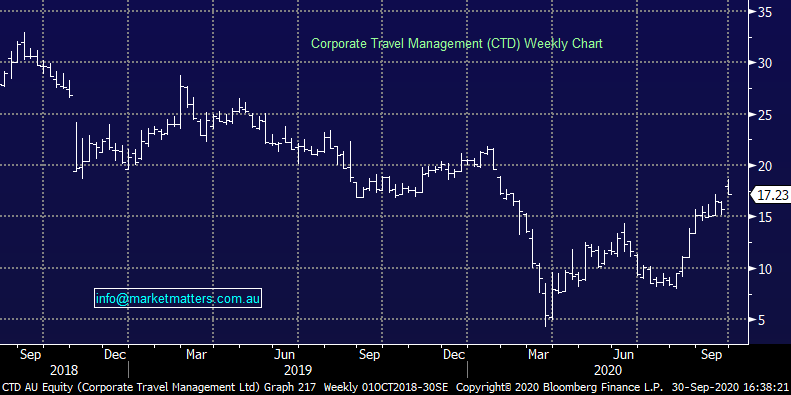

Corporate Travel (CTD) +9.74%: came out of halt today after successfully raising $262m under an institutional entitlement offer and launching a fully underwritten retail offer for an additional $113m all priced at $13.85/share. The funds are being put towards the acquisition of US based Travel & Transport, a similar business which had TTV of $US2.8b in 2019. The deal has been cut at $US200.4m which prices T&T on 7x EV to CY19 EBITDA which compares to CTD’s multiple of c. 11.3x. The discount becomes even more dramatic when taking into account the $25m EBITDA synergies that are expected to come out of the combined business, being ~30% EPS accretive post synergies.

It’s an aggressive call from Corporate Travel, going on the offensive when the travel market looks its worst. Clearly the market took the plan well with the raise not an issue – CTD raised an additional ~$100m more than required for the acquisition just to have some balance sheet flexibility with operations currently running at a loss given the down turn in travel. While CTM already operate a North American business, T&T have a greater footprint on the east coast while CTM tend to operate more west coast of the US. Pretty handy result for CTD today following a decent raise.

Corporate Travel (CTD) Chart

BROKER MOVES

- Pilbara Minerals Raised to Buy at Canaccord

- Downer EDI Raised to Buy at UBS; PT A$5

- Corporate Travel Raised to Outperform at Macquarie; PT A$16.40

- Atlas Arteria Raised to Outperform at Macquarie; PT A$6.99

OUR CALLS

No changes today

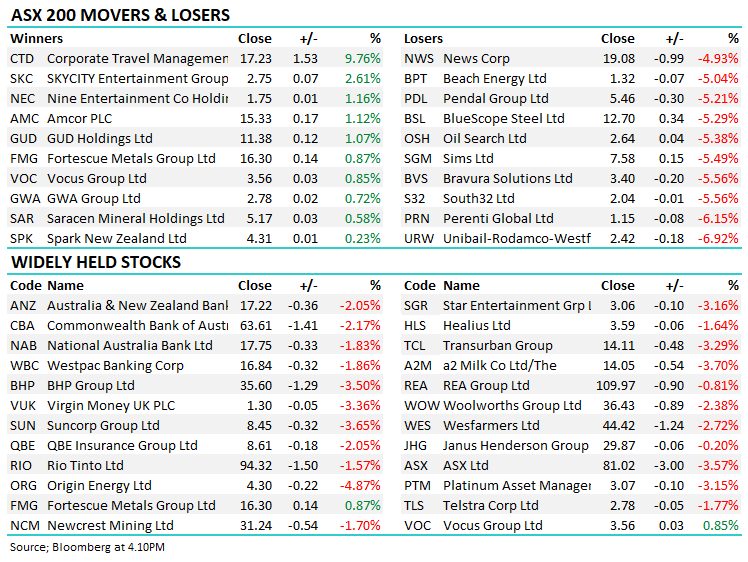

Major Movers Today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.