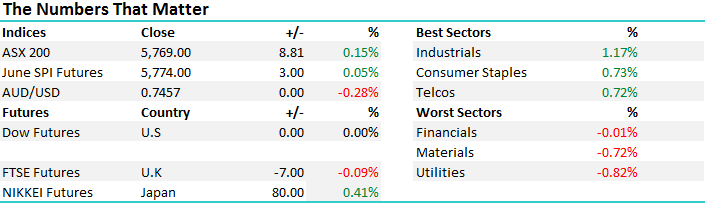

Stocks end choppy session up slightly

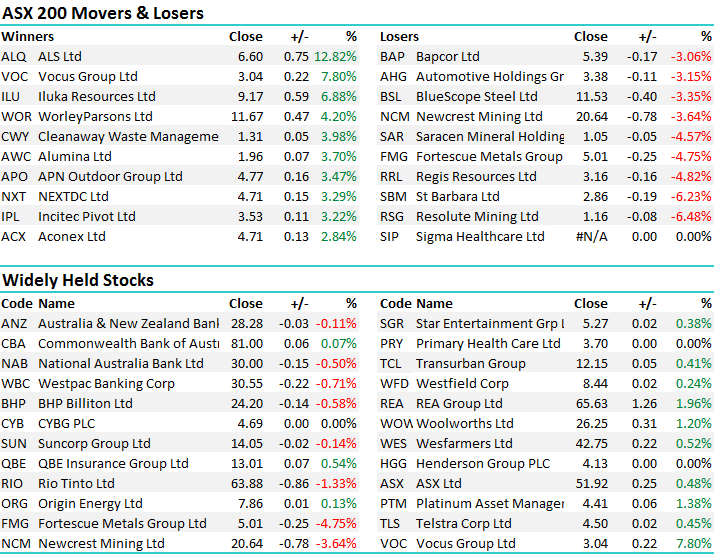

A choppy session for the market today with the index opening reasonably firm before an exchange issue in the options market saw the mkt drop off a cliff from around 1pm. It recovered from the lows just enough to pop back into positive territory. The Industrials saw strength while Utilities, Materials and Financials were the weakest links - a tight range today of +/- 21 points, a high of 5776, a low of 5754 and a close of 5769, up +8pts or +0.15%.

We were just talking in the office a little earlier and discussing the lack of activity in the last few days – indeed, a lot of guys have been quiet for the last month which is not surprising. We did some selling early on in May, have picked up CBA under $80 but have done very little since. We often find ourselves in a bit of holding pattern at the back end the end of May / June with the weak seasonals forcing us to keep some powder dry while enough weakness has already prevailed for us to hold back on any further sales. Patience is one of the underestimated virtues as an investment manager and sometimes it’s simply best to sit on ones hands and do nothing.

The Market Matters event is shaping up as a good one – a very strong turnout with a good line up of speakers; Our own Nick Forsyth will be hosting, while we have presentations by Martin Crabb, the Chief Investment Officer at Shaw and Partners who have ~$12bn under advice, Charlie Aitken, the well-known broker turned fund manager from AIM, Jason Huljich who runs very large property business and of course James Gerrish, a very well regarded adviser at Shaw and Partners, an owner and the Primary Contributor to Market Matters. For those who are yet to register, a few tickets still available by visiting the www.marketmatterslive.com.au

ASX 200 Intra-Day Chart

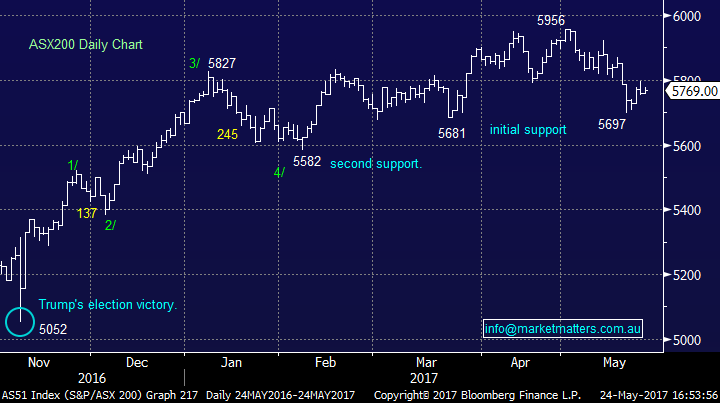

ASX 200 Daily Chart

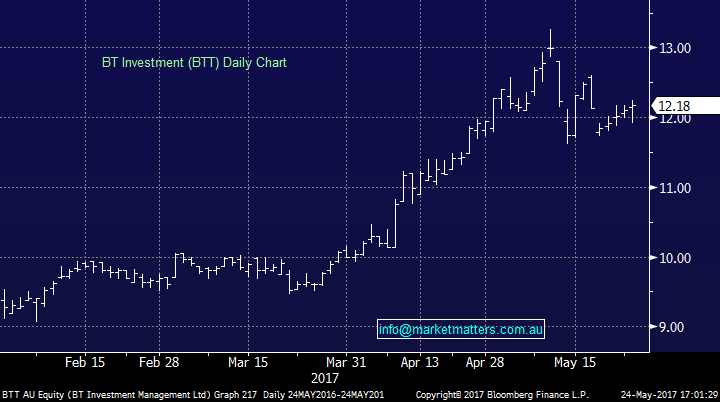

News just out with reports that MQG are seeking buyers for Westpac’s 19.2% stake in fund manager BT – 60m shares at somewhere between $10.25 to $10.75 versus $12.18 close today – however the stock does go ex-divi tomorrow for 30cps – still it’s a decent discount and we’ll likely see some of the other funds managers sold off tomorrow to fund the purchase of the discounted stock

BT Investment Management (BTT) Daily Chart

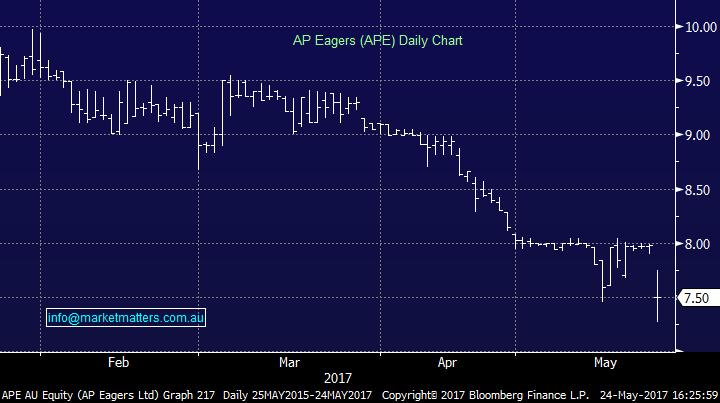

A couple of interesting stock moves today, mostly on the downside with the car dealer AP Eagers (APE) suffering a downgrade with the company now seeing first half profit down by 7-9%, on the back of modest drop in national sales of 2.8% between Jan & April. The drop in profit of 7-9% from a decline in sales of less than 3% shows how susceptible they are to changes of trends. New car sales were strong for a period but have fallen back in recent times and clearly this is hitting the car industry. QLD has been the main issue for them with a drop of 5.9% in the same period which goes some way to highlight the softness happening in the north of the country.

We had a subscriber question on APE this week and we made the following comments which still hold true; In terms of APE specifically, this is a company that looks good on paper. Uninterrupted profit growth, reliable dividends and a reasonable multiple (14.3x) , however it is a stock that will be hit hard if the economy starts to struggle and interest rates tick higher given the likely drop in new vehicle sales.

The other points to make here is that price action was highlighting a problem long before a problem emerged. Each slight rally in the share price was met with selling and we see the stock consistently trending lower.

AP Eagers (APE) Daily Chart

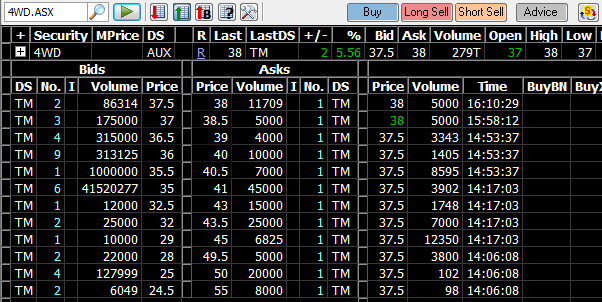

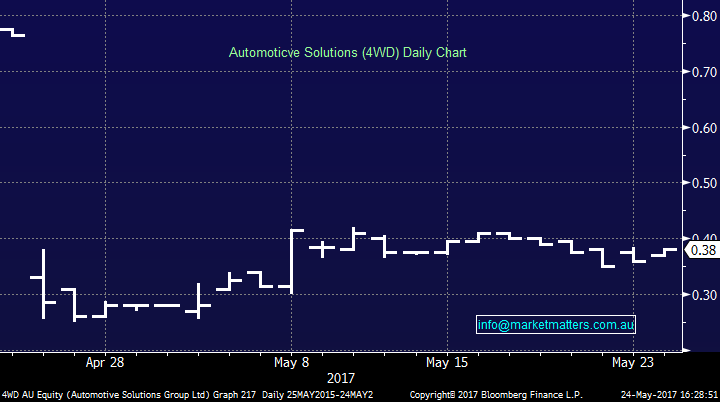

Staying within the car industry, a stock that has had a short but very difficult time on the market is Automotive Solutions (4WD). A small cap company looking to ‘roll up’ 4wd accessory businesses into a listed entity, grow through better systems, cross selling, wider distribution and of course through ‘intelligent’ acquisitions. One of these ‘intelligent’ acquisitions called Umhauers in regional Victoria has failed to live up to expectations – which is an understatement really, and the company was forced to downgrade earnings pretty substantially. Since then, the CEO has been sacked, the non-exec (now exec) Chair has stepped into run the business and more recently AMA Group which is another listed operator bought ~18% of the company at around 28cps.

AMA Group has now launched a takeover, but it’s an ‘on market’ deal at 35cps – which is offering no premium. From what we can see, since the takeover has been launched they’ve managed to buy a total of ‘Zero Shares’ with the 4WD board coming out and recommending that shareholders take no action. We tend to agree and it feels like the business is worth a lot more than this current offer depending on the updated earnings guidance which is expected to be released shortly.

Automotive Solutions (4WD) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here