Stocks down, Westpac in Austrac crosshairs (WBC, ALL, SAR, WEB)

WHAT MATTERED TODAY

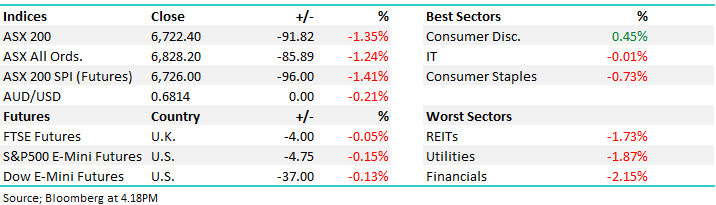

A tough day at the office with the market hit hard, pretty much all day. The banks in the firing line thanks to a new Austrac law suit filed against Westpac refocussed attention on regulatory risk – the sector the worst performing on the board today with the BIG 4 banks accounting for 30% of today’s decline, although in fairness the sell-off was broad based with only the consumer discretionary stocks managing to eke out a small gain. While the banks were clearly weak, the defensive areas also proved to be anything but, Property and Utilities were also down 1.73% and 1.87% respectively, Goodman Group (GMG) a stock we’ve discussed recently a drag off nearly ~2.5% after holding their AGM, Macquarie downgraded their PT by 9% as a result of more downbeat commentary.

US Futures traded marginally lower while Asian markets were also down around 0.50% across the board. The US Senate voted in favour of supporting Hong Kong v China which implies a grey cloud over the looming phase 1 trade deal..

Overall, the ASX 200 lost -91pts /-1.35% today to close at 6722. Dow Futures are trading marginally lower

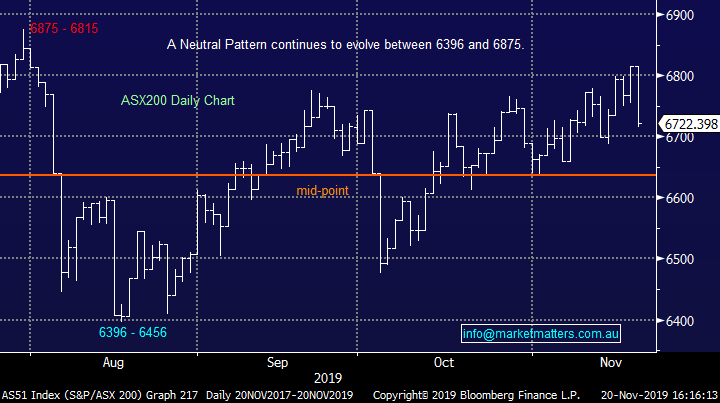

ASX 200 Chart

ASX 200 Chart – Big bearish day for the market

CATCHING MY EYE;

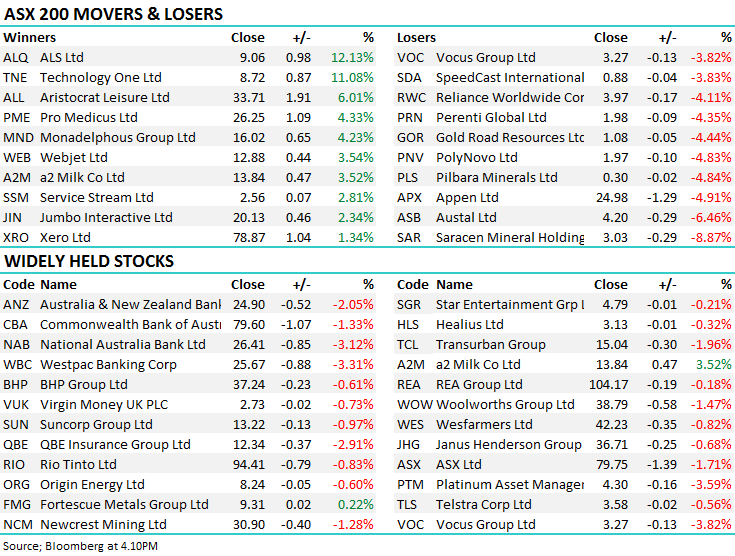

Stocks with AGM’s today: GMG -2.43%, IGO -2.89%, LLC -1.06% , MIN +0.41%, NWS -1.02%, PAN +1.37%, PTM -3.59% SVW -1.82%, SCP -1.09%, WEB +3.54%

Westpac (WBC) -3.31%: hit hard today and dragged the rest of the sector with it (and the broader mkt for that matter) after being accused of systemically breaching money-laundering laws more than 23 million times, and failing to report more than A$11 billion ($7.5 billion) in international transfers. This is the same issue that impacted CBA under the leadership of Ian Narev, they were ultimately fined $700m for 53,000 infractions. Interesting timing for the suit to be lodged by Austrac after WBC tapped the market for $2bn in new capital last week + they have the retail component underway. Austrac claim that WBC “adopted an ad-hoc approach to money laundering and terrorism financing risk management and compliance.” The headlines are poor for WBC with more to come here and this news certainly clouds the retail component of the current equity raise, the current SP now just 35c above the institutional issue price.

Westpac (WBC) Chart

Aristocrat Leisure (ALL) +6.01%: Better news for ALL today after they delivered a strong FY19 earnings report this morning. EBITDA came in close to $1.6bn, ahead of market expectations of $1.56bn and up +20% on FY18, margins were strong, net profit was a beat and they are poised for continued growth in fiscal 2020. The stock broke out to new highs today and looks strong. A growth business on a reasonable multiple…hard not to like it.

Aristocrat (ALL) Chart

Webjet (WEB) +3.54%: After a tough period for the online travel business, WEB rallied today after the CEO painted a more optimistic picture for the year ahead. For 1H20, the company now expects EBITDA to be at least $80m implying some upside to current mkt consensus which was sitting at $160m for the FY. A reasonable update from WEB.

Webjet (WEB) Chart

Saracen (SAR) -8.87%: back online today after raising $701m in an institutional raise at $2.95. The proceeds being used to partly fund the 50% acquisition of the Super Pit. Citi likes it post raise upgradi9ng to $4.10 PT.

Saracen (SAR) Chart

Broker moves;

- Monadelphous Raised to Neutral at Citi; PT A$15.90

- Saracen Mineral Raised to Buy at Citi; PT A$4.10

- Collins Foods Cut to Hold at Canaccord; PT A$9.50

- Sky Network TV Cut to Underperform at Forsyth Barr; PT NZD0.80

- Sky Network TV Cut to Neutral at Jarden Securities; PT NZD1.01

- Steel & Tube Raised to Outperform at Forsyth Barr; PT NZD1.05

- Cleanaway Cut to Sell at Morningstar

- Hub24 Raised to Buy at Citi; PT A$15.20

- Woodside Raised to Overweight at JPMorgan; PT A$38.50

- Wisr Rated New Buy at Shaw and Partners; PT 35 Australian cents

OUR CALLS

No trades today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.