Stocks bounce from daily lows – bullish move short term

What Mattered Today

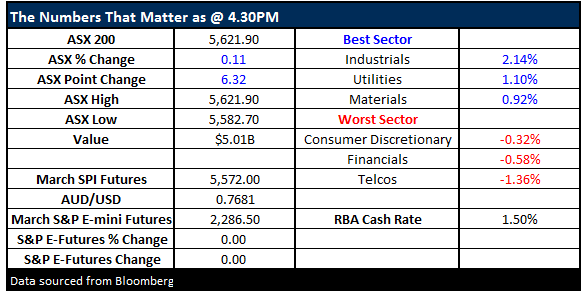

A very strong effort from the market today despite closing up just +6pts, with the index rallying +40pts from the intra session low which played out around 10.20am. From then on we saw some ebbs and flows but the market grinded higher overall with a squeeze into the close pushing the market into positive territory for the day. Yesterday’s session was weak, with a lack of any real intestinal fortitude from buyers, while today was a completely different story…A strong session and a bullish short term move for Aussie stocks.

We had a range today of +/- 39 points, a high of 5621, a low of 5582 and a close of 5621, up 6pts or +0.11%.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

We wrote a piece this morning on GOLD stocks, suggesting we’d likely add one more to the portfolio today, but we didn’t go through with it. We already have Newcrest (NCM) in the portfolio from around ~$21 and that rallied +3.31% to close at $23.69 today, however the obvious strength in the market from early lows made us second guess our call this morning to add either Regis Resources or Evolution. As always, the centrepiece of the MM service is around live SMS alerts sent when we transact on our own portfolio, and quite simply, it didn’t feel right to be adding to our GOLD exposure today, so we didn’t.

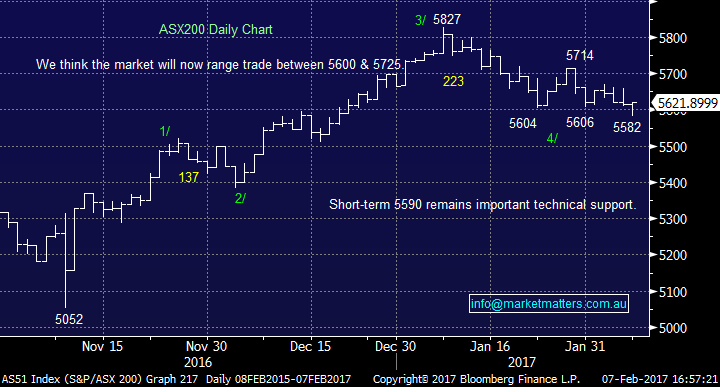

We did however pull the trigger on Star Entertainment (SGR) this morning around ~$3.76, allocating ~4% of the portfolio. We’ve been running the ruler over Star since the sector was rattled following the detainment of Crown staff in China back in October last year. Since then the sector has struggled on concerns that the crackdown on ‘marketing’ to Chinese VIPs would impact earnings, and it most likely will - the extent of which is the main variable. In our view, this represents an opportunity to start buying a quality business that could surprise to the upside when they release their interim result on the 16th February. Before the Crown incident, SGR was trading above $6, and is now more than 22% below that level.

Star Entertainment (SGR) Daily Chart

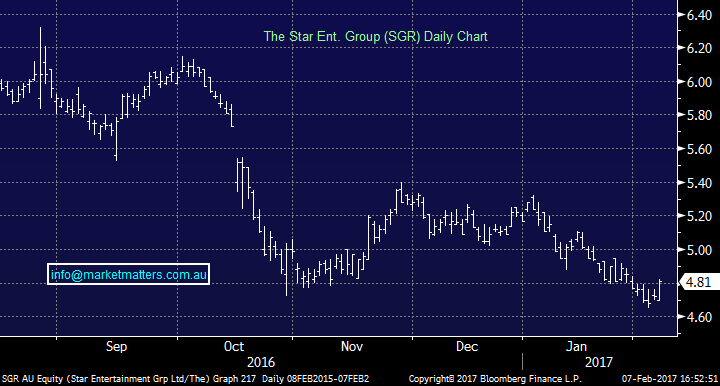

Some mixed corporate news today with Transurban (TCL) and SCA Property (SCP) reporting strong numbers and both stocks did well, while Macquarie was a tad disappointing versus the market’s upbeat expectations.

Transurban (TCL) said it would pay an interim dividend of 25c which was above expectations of 24.5c + they also increased full year payout guidance from 50.5c to 51.5c, which is clearly a positive. They have $9bn of projects on the go which are all on time and on budget however it seemed they planted the seed for some type of raise for the completion of the Western Distributor – the only project that ‘sort of’ needs funding. This stock is about distributions and in that respect, they said all the right things. A great company which we have traded recently, buying at $9.82, picking up the dividend of 25c and selling at $10.40 - a very short term gain of +8%. We simply think that interest rates are a natural headwind for infrastructure stocks that carry high debt levels, but importantly, as rates go up asset values come down which puts further pressure on balance sheets. TCL finished up +6.36% today or 66c to close at $11.04.

Transurban (TCL) Daily Chart

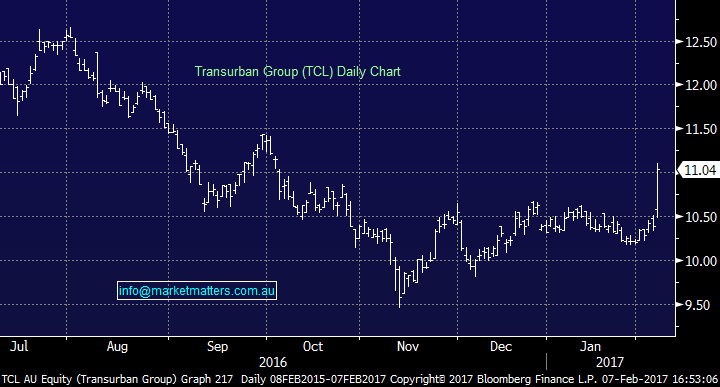

Macquarie (MQG) was less impressive and dropped more than 3% on open before recovering to end the day down -1.42% at $82.75 following a trading update. MQG has guided to flat earnings from FY16 and they were a tad lower than that, however consensus numbers were looking for +3% growth i.e the market had gotten more bullish than MQG themselves, largely a result of good results from IB’s overseas of late. Worth noting though that MQG now generates 70% of earnings from re-occurring annuity/asset management style businesses compared to just 25% in 2007 – it’s a different beast and importantly, the bulk of that is from overseas. We own MQG from lower levels and remain comfortable with the stock on 12.7 times 2018 earnings and what we think will prove to be a ‘low ball’ update today.

Macquarie Group (MQG) Daily Chart

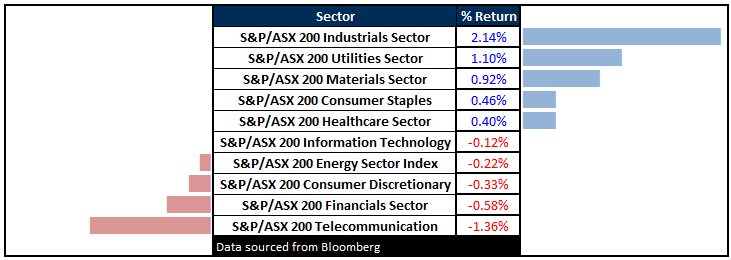

Sectors

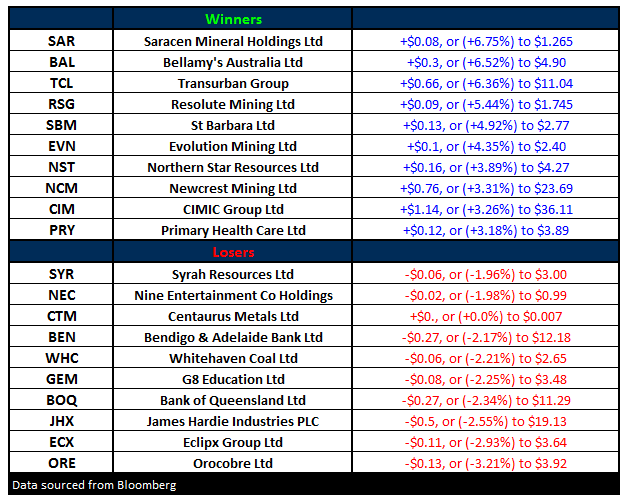

ASX 200 Movers

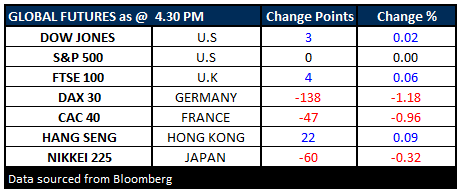

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here