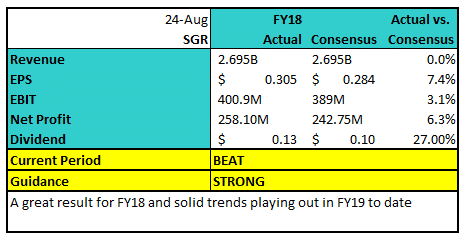

Star Entertainment (SGR) – Ripper result

Stock

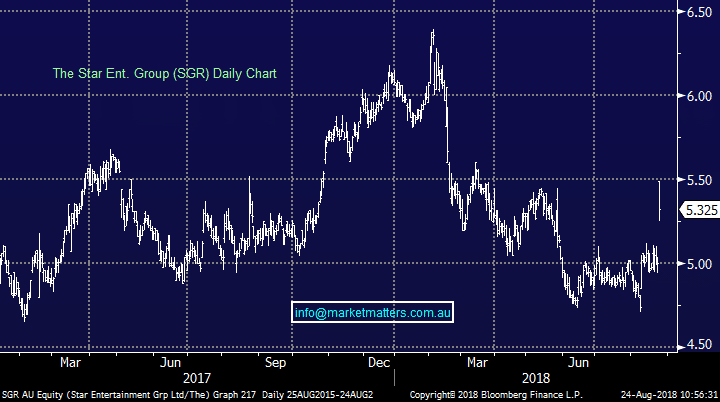

Star Entertainment (ASX:SGR) $5.32 as at 24/08/2018Event

This morning Star Entertainment (ASX:SGR) reported their full year results and they were strong on a normalised basis for FY18 while they outlined some very positive trends playing out at the start of FY19. Normalised profit after tax came in at $258.1m which was well above consensus of $242.8m. They said that group domestic revenue was up +4.1% driven by a 5.5% increase in slots, QLD table revenue was up +6.3% which was a highlight and non-gaming revenue added 15.2%. Interestingly enough, VIP revenue jumped 51.8% and is now on a stronger run rate than Crown. After a tough 12 months SGR look to have turned the corner and FY19 has started on the right foot. Whilst only early days, they say trends this year are better than last while they also guided to reduced Capex of $300-$350 which confirms that peak spending occurred in FY18.

Star Entertainment (SGR) Chart

After a tough 12 months SGR look to have turned the corner and FY19 has started on the right foot. Whilst only early days, they say trends this year are better than last while they also guided to reduced Capex of $300-$350 which confirms that peak spending occurred in FY18.

Star Entertainment (SGR) Chart

Market Matters Take/Outlook

A very good update from SGR relative to 1. Market expectations & 2. In the context of how poorly the shares have traded into the numbers. We owned SGR back in 2017 and exited for a good profit at the time. This is a stock (along with Crown) that is now back on our radar. We answered questions about Star Entertainment Group back in our subscriber questions report in June.

Market Matters Take/Outlook

A very good update from SGR relative to 1. Market expectations & 2. In the context of how poorly the shares have traded into the numbers. We owned SGR back in 2017 and exited for a good profit at the time. This is a stock (along with Crown) that is now back on our radar. We answered questions about Star Entertainment Group back in our subscriber questions report in June.