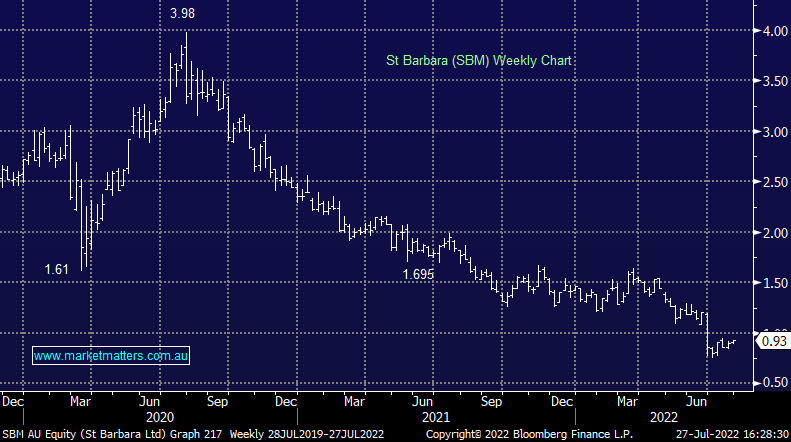

St Barbara (SBM) shares rally as they meet cost guidance and relay a positive outlook

SBM +3.33%: The gold producer was out with 4th quarter production numbers, and although they were largely pre-released there were still positives to take out of the update. Production guidance for the full year was met with 281koz of gold produced, as was cost guidance across all assets despite market fears of blowouts due to energy or labour which has weighed on the sector in recent months. Importantly their troublesome assets, Atlantic and Samberi, hit expectations for the period which should help the divestment process of each. The cash balance grew to $98m, placing the balance sheet in a very strong position despite some misconceptions in the market. St Barbara is cheap, it just needs a catalyst of higher prices or favourable corporate activity.

Wondering what Market Matters are buying and selling today?

Market Matters breaks down the latest financial developments into simple, actionable opinion that our members can rely on. We give our community access to some of the most trusted financial professionals in Australia and crucially, we invest in our own portfolios – putting real money where our mouth is.

Led by James Gerrish, the Market Matters Investment Team has decades of market experience, and every day we’ll give you our take on the market. With in-depth market analytics, clear buy, hold and sell actions members can quickly see the stocks we like, the stocks we don’t and the history behind every one of our decisions.

See for yourself – take an obligation free 14 day trial of our service – here.