Some diamonds in the rough (FMG, KDR)

WHAT MATTERED TODAY

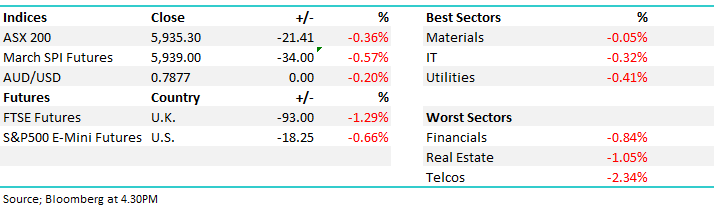

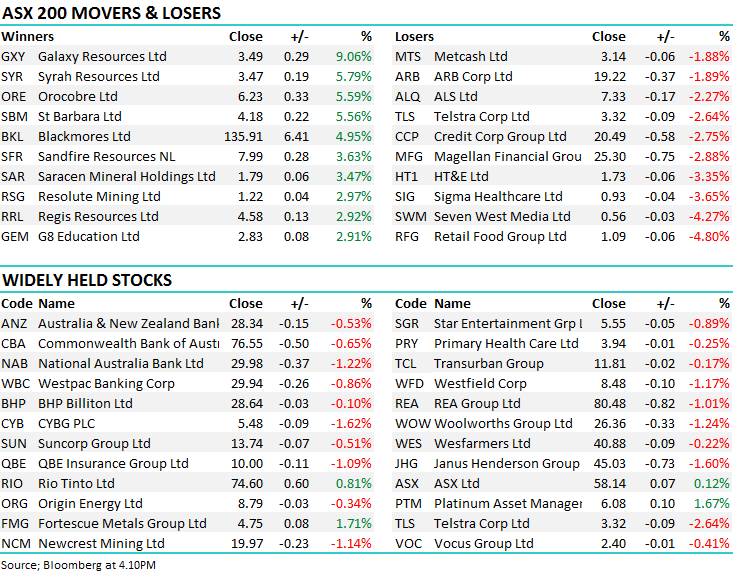

The local market was led lower by overseas trading today where the US was focussing on another Trump exit – you would think the market would be used to this by now! The continued weakness and the failed break of 6000 that occurred on Monday has us questioning our bullish call for the short term. Choppiness is expected to continue for the rest of the week with Futures and index options expiring tomorrow.

Banks were hit hard again today as the Royal Commission continues – however we think the market has priced in a very rough time for the banks and as the uncertainty begins to fade, the big four should find some buyers. There was likely to also be some lingering bitterness in investors mouths today from Bill Shorten’s franking credit cash grab he announced yesterday – we wrote about the impacts in detail in today’s income report here.

Overall, no sector finished better today, while Telco’s were the worst off, the index falling 39pts or -0.66% to 5935.

ASX 200 Chart

ASX 200 Chart

CATHCING OUR EYE

1. Fortescue Metals (FMG) $4.75 / +1.71%; FMG performed strongly today after Iron Ore broke a 7 day losing streak, adding about 1.9% in Asian trade. Iron Ore had been sluggish the past week, however we see some short term support for the base metal after Chinese steel production curtailments begin to fall off. The Chinese government has limited steel production through the winter to reduce air pollution, however many of the limits are due to come off this week. Although some regions in China will continue some restrictions to production, we expect these to be much more relaxed and will see an uptick in steel manufacturing leading to some support for Iron Ore price in the near term. We hold FMG in our Income Portfolio.

Fortescue Metals (FMG) Chart

2. Kidman Resources (KDR) $2.19 / +8.96%; The lithium names strongly outperformed the market today, with KDR and Galaxy both up around 9%. This is a huge move on the back of no news that we could at the stock level, and on a day where the rest of the market was getting hit! However on the commodity level, news broke that VW will spend 20Bil Euro on batteries from Tesla. We have been active in the lithium space over the last 6 months or so, taking a nice ~15% profit in ORE late January where we switched the funds into KDR at $1.87. Today ORE is 16% lower, while KDR trades 16% higher - a ~30% differential - highlighting our belief that investors need to remain active in the sector. We own KDR in the Growth Portfolio targetting new highs.

Kidman (KDR) Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/03/2018. 4.40PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here