Smart Group (SIQ) sees business returning

Smart Group (SIQ) -5%: AGM today for the salary packaging and novated leasing business with the stock coming off the boil during the session. Understandably, the business took a hit with COVID, and the first half NPAT is expected to come in around $32m, 5% below last year. The first quarter was largely unscathed by the pandemic, managing to grow earnings marginally on 1Q 2019, but a 25% hit to revenue across April & May weighed on expectations for the half. The markets expectations for a full year profit of $62m may come under pressure and explains part of the weakness today.

The company said that volumes remained below historical levels, but a rebound had been seen – vague, but suggests the sizable hit to revenues seen in the current quarter are unlikely to remain to the same extent for the rest of the year. We like the business and own it in the Income Portfolio. They have net debt of just $19m with cash around $81m so the balance sheet is in good shape, and earnings are still rolling in despite the slowdown. The sell off today likely comes as a result of some recent analyst upgrades for the full year, and the stock was strong heading into the AGM.

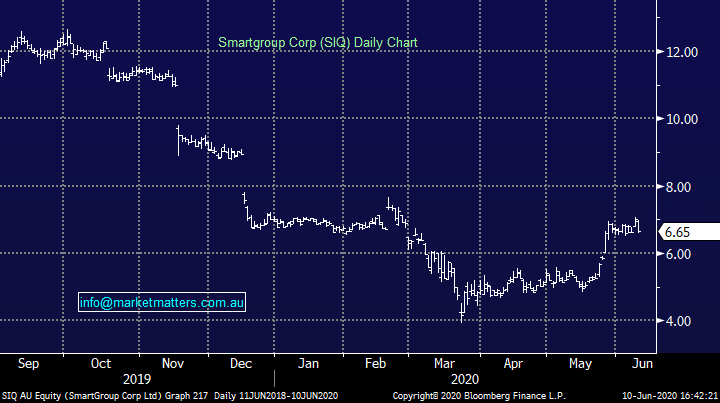

Smart Group (SIQ) Chart