Should we buy Retail stocks?

Stocks

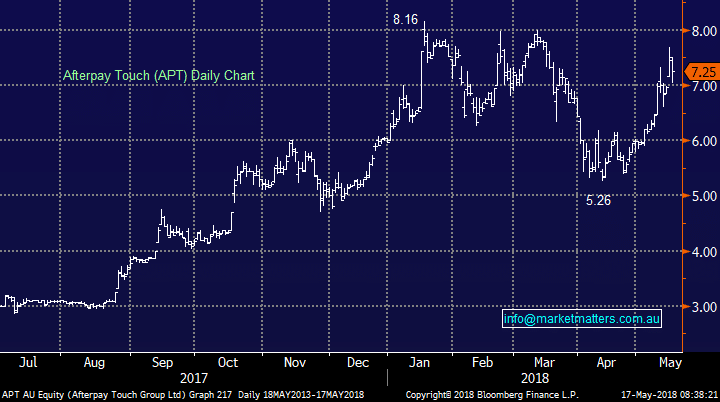

Harvey Norman (HVN) $3.58 as at 17/05/2018 Nick Scali (NCK) $6.87 as at 17/05/2018 Webjet (WEB) $12.01 as at 17/05/2018 Domino's Pizza (DMP) $44.37 as at 17/05/2018 Afterpay (APT) $7.25 as at 17/05/2018Event

When we talk about consumer discretionary / retail stocks its simply those companies that benefit from the spending of our “perceived free cash flow”, from a new TV, car upgrade to a nice holiday. Before the GFC it was commonplace to hear people saying they had re-mortgaged their house, or taken out a loan, to buy a nice, usually European new car but over recent years while retail spending has been steady the euphoric optimism around borrowing has been limited to the housing market which is now starting to cool. Most Australians at the moment are becoming increasingly nervous about money / spending with the GFC still fresh in our minds + continual talk of rising interest rates and a housing ‘bubble’. There are 2 standout issues presently keeping the locks on our wallets:1 Housing prices

It’s hard to open a newspaper at the moment without the discussion along the lines of “how far will house prices fall?”. Property prices are a huge part of Australian psych, a lot less of us play the share market compared to say our American friends but we all have an opinion on property. Again there are 2 issues within housing that concerns us:- Prices are slipping, more so in some areas – a theme we have not experienced for a while. That said, prices are way above their levels of only 5-years ago which creates a good cushion. LVR’s are currently low across the sector – just ask GMA who have a shrinking pool of mortgage insurance customers.

- The papers continue to talk interest rates higher, this will take more money from our pockets and curtail any “reckless” purchases.

At MM we believe housing prices will soften over the next few years but not crash as we commonly hear.

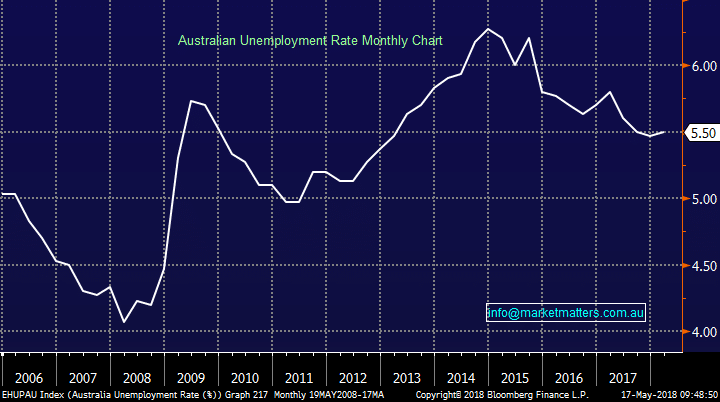

They simply rose too far, too fast, and now need time to consolidate. It can often be useful to use a real life example to highlight, and given I’ve recently sold and bought another property here’s my take (for what it’s worth). We had held a house for 7 years which appreciated in value by $1.4m. Then sold and bought within 2 months – right at the peak of the Sydney property market! We paid $1m more for the house we bought than the one we sold, however interest rates are low and we have locked in the bulk of the borrowings for 5 years at the low 4% mark – which I think is cheap. I’ve now got certainty for the next 5 years on repayments + my perception is that a 10% drop in Sydney house prices will impact me by 100k or in other words, 10% of the $1m differential between the two houses ( I appreciate the actual impact is more). Given the huge appreciation in recent years, this is a tolerable amount and importantly will not be a major impediment to my spending. (consumer spending is as much about feelings/perception/confidence) as anything else. However, if we assume I’m an employee and as a consequence of tougher economic conditions I lose my job. This is when things can start to hurt and mortgage stress can come to fruition creating a ‘spiral effect’ on the economy. This suggests that the biggest issue / threat to housing is unemployment, and therefore the biggest threat to bank earnings is exactly the same. Watch unemployment metrics carefully over the coming month / years.2 Australian debt levels

Looking more broadly, Australia’s household debt levels are now one of the highest in the world with our obsession with property the largest individual contributor - but we also do like a credit card. This level of household debt is unsustainable and we need to see a slow deleveraging process play out – which is in its infancy. For example we’re starting to see luxury car sales turning south.The coming years

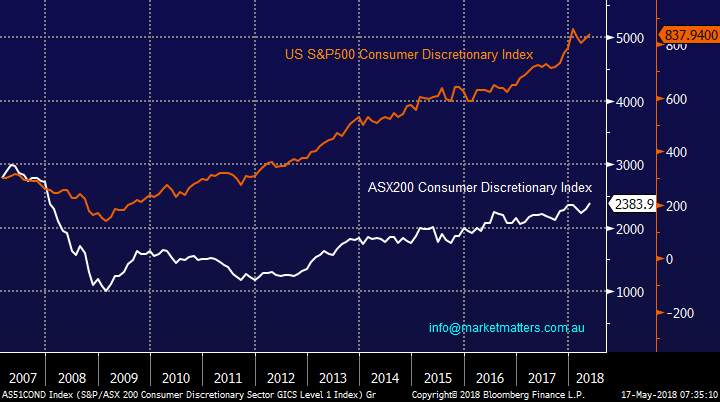

The important factor is when will we (as a nation) be back on top of our finances and start “treating” ourselves again. Remember stocks look at least 6-months ahead and once the trend becomes obvious its usually too late, especially on a risk / reward basis. Due to the 2 important points touched on above many of our stocks in the discretionary space are cheap and are poised to rally strongly when the above mentioned debt levels start to fall as the slow deleveraging process takes shape. The important factor in all of this is employment. Servicing debt in the first instance and paying it down over time requires a job, and ultimately this will underpin a lot of what needs to take place economically in Australia. We’ve seen this in the US where unemployment has hit just 3.9% and consumer stocks are booming, even though house prices have cooled. In Australia, unemployment sits at 5.5% and is trending lower. Australian unemployment rate Australian v US Consumer Discretionary Index’s Chart

Australian v US Consumer Discretionary Index’s Chart

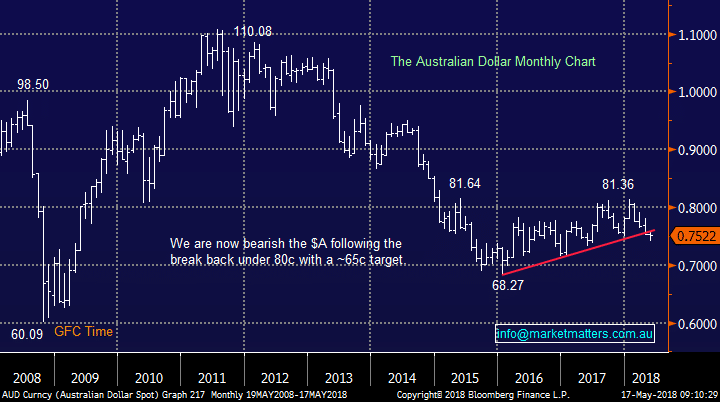

Interestingly, the weakness of the “little Aussie” battler illustrates perfectly the comparative strength of the US economy over ours. The RBA Cash Rate remains at its lowest level in history at 1.5% whereas the Fed has already hiked interest rates six times since late 2015, with another 2/3 more expected in 2018. For the first time in 17-years official interest rates in the US are above our own and the gap looks set to widen - back then the $A was at 48c!!

A weakening $A is good for our economy and exports but a lot of luxury overseas imports will go up in price, it’s always a 2-edged sword.

Australian Dollar Chart

Interestingly, the weakness of the “little Aussie” battler illustrates perfectly the comparative strength of the US economy over ours. The RBA Cash Rate remains at its lowest level in history at 1.5% whereas the Fed has already hiked interest rates six times since late 2015, with another 2/3 more expected in 2018. For the first time in 17-years official interest rates in the US are above our own and the gap looks set to widen - back then the $A was at 48c!!

A weakening $A is good for our economy and exports but a lot of luxury overseas imports will go up in price, it’s always a 2-edged sword.

Australian Dollar Chart

Although we think we’re ‘behind’ the US in terms of the recovery, discretionary stocks are cheap and are worth some consideration, but we’re not yet keen on the overall sector – we think it’s too early in the cycle.

Although we think we’re ‘behind’ the US in terms of the recovery, discretionary stocks are cheap and are worth some consideration, but we’re not yet keen on the overall sector – we think it’s too early in the cycle.

Market Matters Take/Outlook

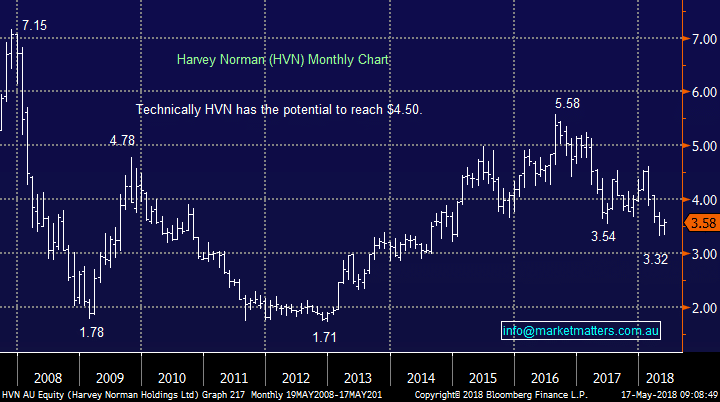

1 Harvey Norman (HVN) $3.58

HVN has had a tough time of late along with most franchise models, its currently trading on a valuation of 10.8x this years estimated earnings while yielding an attractive 6.7% fully franked.- Technically we like HVN for a bounce towards $4.50 but this is an aggressive play and we would run stops below $3.30, an 8% risk.

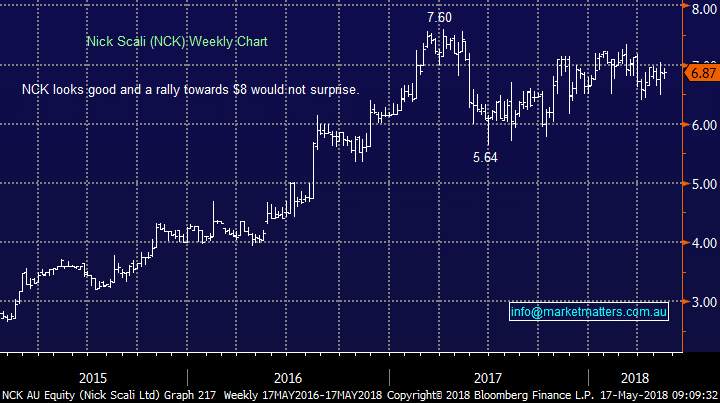

2 Nick Scali (NCK) $6.87

Nick Scali (NCK) remains in our Income Portfolio and it’s been a great example of how to stick to a core business, that you know / understand and make it work. NCK is trading on 13.6x P/E while yielding 5.2% fully franked.- The stock continues to look solid and we can see $8 on the horizon.

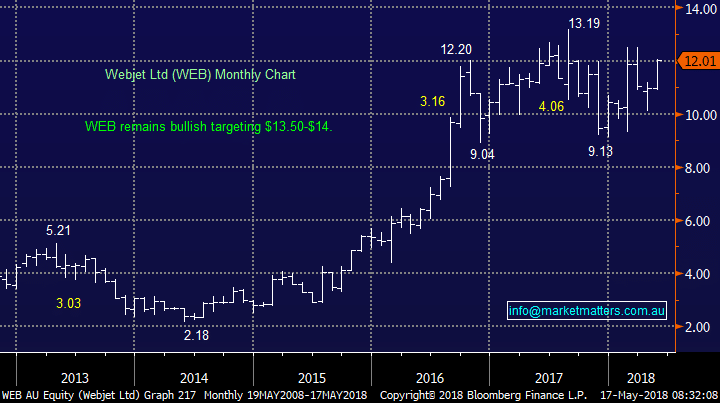

3 Webjet (WEB) $12.01

Webjet (WEB) has rallied well this month and we maintain our ~$13.50 target, over 10% higher. Store front rival Flight Centre (FLT) has soared 10% this month, to fresh all-time highs, which is a good sign that on-line based WEB can maintain its recent form.- We remain bullish WEB targeting $13.50-$14.

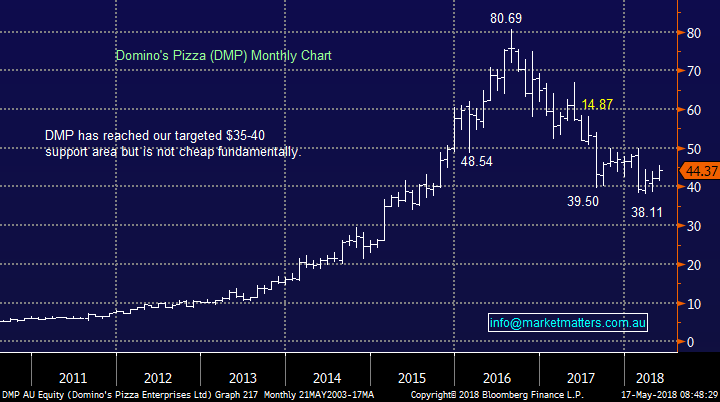

4 Domino’s Pizza (DMP) $44.37

DMP is another company suffering from the franchise stigma, and in most cases fully deserved! This franchise pizza operator is not cheap trading on a valuation of 28.5x earnings while paying a 2.3% part franked yield.- We are not a fan of DMP medium-term but can still see a pop to $50 / ~15%.

5 Afterpay (APT) $7.25

APT is the leading new on-line version of “layby” and its going gangbusters, recently announcing expansion into the US with some top quality hires to lead the growth. They “clip the ticket” on the sale and the purchaser pays later – Vanessa in our team loves it! Key retail stock in the area. As a business they debatably benefit from us wanting to buy something but feeling a touch poor today.- The stock looks to have an exciting future and good risk / reward buying below $7.