Selling accelerates (TCL)

WHAT MATTERED TODAY

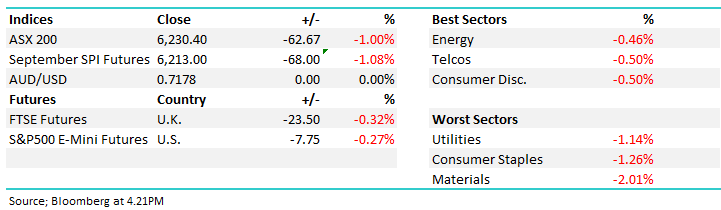

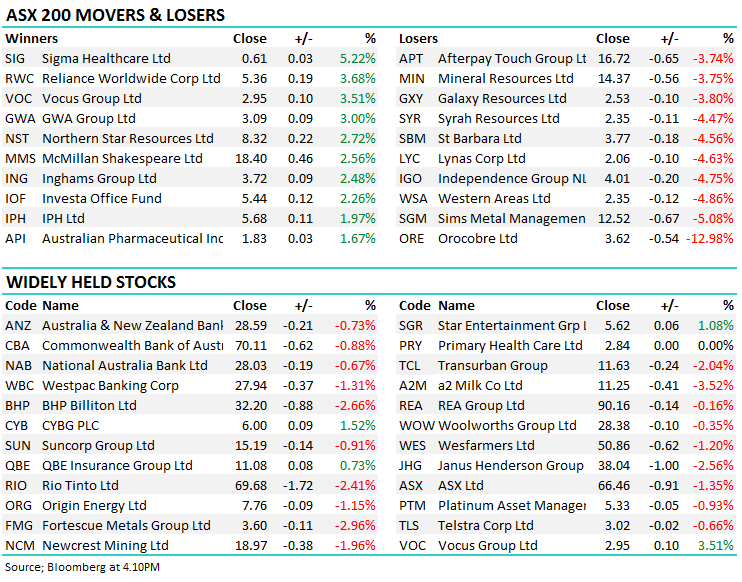

Consistent selling was the theme today as the market tracked lower throughout the day, closing on its lows. No sector was spared from the weakness, while energy was the best of the lot the sector still fell -0.45% today. Materials were the worst off thanks to weak commodity prices and traders holding risk off attitude. Not even a blockbuster GDP growth figure could halt the onslaught – GDP rose 0.9% for the quarter, up 3.4% year on year, not too many developed countries can boast growth figures like that and confirms our view that the RBA was in on the news early after alluding to the strength in yesterday’s rate announcement. Even so, stocks and currency markets shrugged the news with the AUD finishing flat against the USD. Emerging markets also took a big hit today with most Asian markets down well over 1%. That flowed through to stocks like A2 Milk which fell -3.52%.

Orocobre returned to trading late this afternoon after announcing to the market that the Argentinian Export duty that at current FX prices will hit them to the tune of ~8% of export sales revenue. The stock was the worst in the top 200, closing the day down -12.98% but at one stage falling -16.95% - although we took a loss on ORE recently, it has tracked significantly lower since. Other resource/materials names were significantly weaker as well – Western Areas (-4.86%) continued its recent slump while it appears BHP (-2.66%) has finally succumbed to the selling after being surprisingly strong in recent weeks.

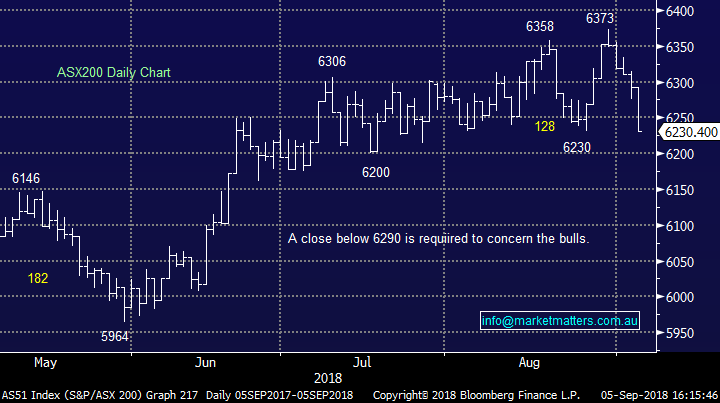

Overall, the index closed down -62 points or -1.00% today to 6230.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Evolution Mining (EVN AU): Upgraded to Neutral at Credit Suisse; PT A$2.65

· Mirvac Group (MGR AU): Downgraded to Sell at Morningstar

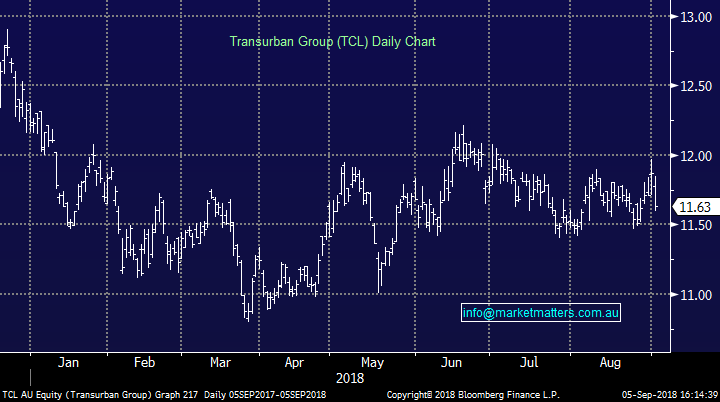

Transurban (TCL) $11.63 / -2.04%; Transurban recommenced trading today following the $4.2bil equity raise helping fund the successful $9.3bil WestConnex bid. The toll road operator saw strong demand for the raise from institutional investors, which was done at $10.80, around a 10% discount to the last traded price before the stock went ex-rights – retail shareholders have until the 18th of September to take up the new shares. We spoke about the likelihood of a capital raise from Transurban back at their result in early August, and our view has come true. It’s a big raise for a big acquisition, but it does put Transurban well clear at the top of the food chain for toll roads in Australia however the length of time it took the ACCC to rule on the deal highlights the increasing headwinds to Transurban’s Australian growth pipeline. Although the WestConnex asset will likely see other linked toll roads go to Transurban, it will limit the ability for the company to pick off other roads in the country and a push for any significant growth will have to be offshore.

Transurban (TCL) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.