Sellers get the upper hand, ASX down more than 100pts (NAB, MYX)

WHAT MATTERED TODAY

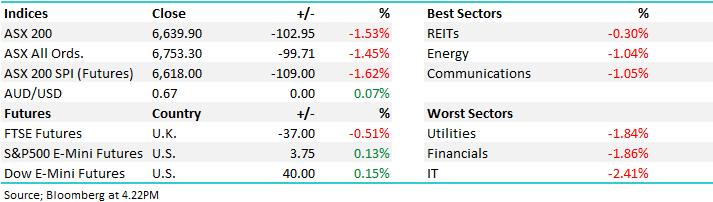

The market embraced the overseas weakness today with the local index down more than 100pts, a sell-off we’ve been targeting and a reminder that selling is often more aggressive than buying – the expression of up the stairs and down the lift springs to mind. Selling was broad based as you’d expect with the IT stocks feeling most pain down -2.41% as a sector, although from an index perspective, the financials provided most weight, the big 4 banks accounting for 25% of the markets decline with NAB the weakest link – more on that below.

US Futures was fairly quiet during our time zone, while the Chinese market is closed and the rest of Asia was down, but not materially so.

Bright spots locally were fairly limited, Gold was up on the session while the bearish ETF we recently added to the MM Growth Portfolio did its job – overall, a combination of higher cash, decent gold exposure and a negative facing ETF helped the portfolio outperform today. Tomorrow we’ll send out the monthly performance reports for the Market Matters SMA’s which are aligned with the portfolios we discuss in these notes. The growth orientated portfolio added +3.75% for the month while the Income portfolio added +2.90%. If you would like to be included on the monthly performance reports, please email [email protected]

Overall, the ASX 200 lost -102pts today or -1.53% to 6639, Dow Futures are trading up +40pts/+0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

NAB -2.29%; was the worst of the big 4 today thanks to a pre-market announcement. NAB boosted their 2H customer remediation charges to $1.2b pre-tax, taking the total to nearly $2.5b since the start of FY18. NAB looks to have taken a more lenient stance to remediation, taking on more claims even if little paperwork has been provided – something the regulator will love, but shareholders not so much.

The market was expecting a figure around half of today’s announcement which may lead to a miss at the dividend if NAB can’t replace the lost capital. The announcement also noted a significant write-off of their software assets by $494m. The bank still holds the highest value for their software at around $2.5b despite the latest write down, the closest competitor being WBC at $2.2b. This is bearish news for others in the sector including AMP & IOOF.

NAB Chart

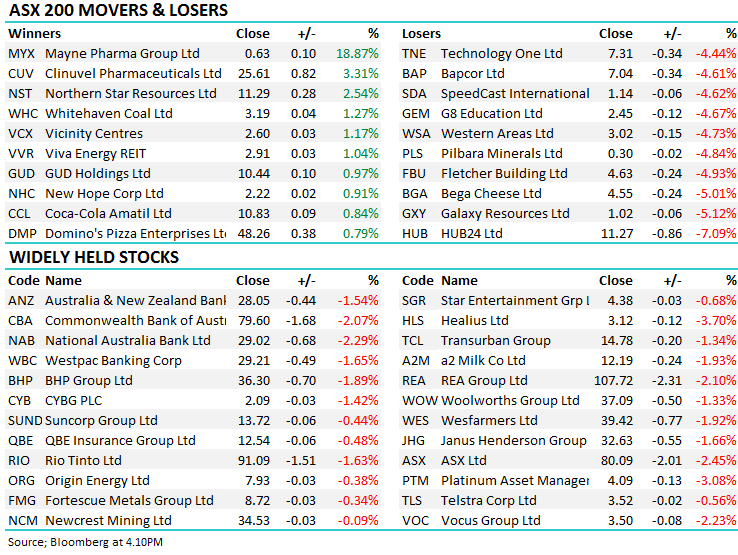

Mayne Pharma (MYX) +18.87%; A rare bright spot today after MYX inked a deal that could see plant based women’s contraceptive pill to be sold into the US. The 20-year deal with a Belgium pharmaceutical company gives exclusive supply & licence rights into the US market which is estimated to be worth over $US6bn. The new product is subject to regulatory approval and won’t start selling until 2021 at the earliest, however it does show the upside potential for Mayne’s offering + its coming off a very low base.

Mayne Pharma (MYX) Chart

BROKER MOVES;

· WiseTech Downgraded to Accumulate at Blue Ocean; PT A$35.40 – Not sure how that rating works??

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.