Sellers dominate the week

WHAT MATTERED TODAY

**A small section of subscribers may not have received a report yesterday afternoon due a technical glitch. The report is available on our website here**

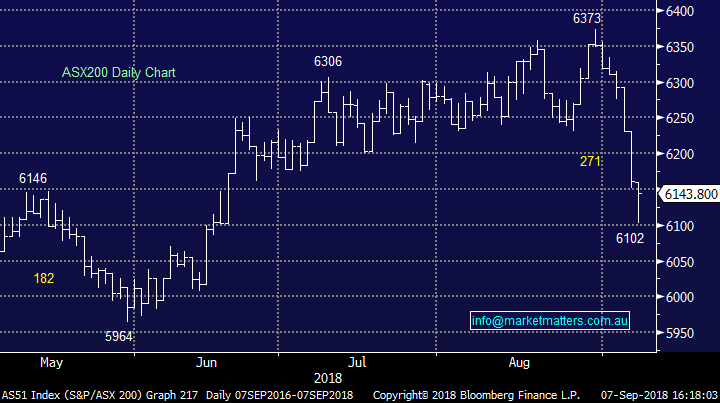

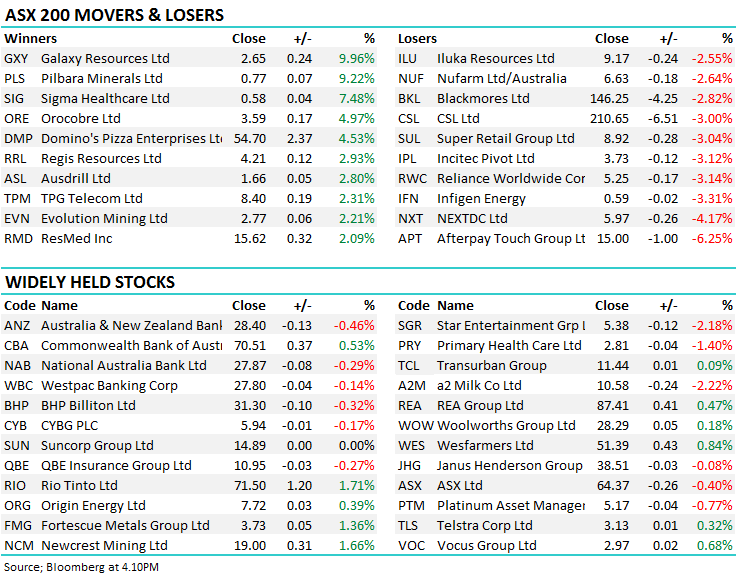

The equity sell off continued into its seventh straight day today as the local market ended today at 6143, down -176pts on the week and now down from the recent high of 6373 set on the 30th August. We witnessed a full 5 days in the red this week with falls of -0.14%, -0.28%, -1.00% -1.12% & another –0.27% today, although we did see a strong bounce from the earlier lows this morning. Growth was again on the nose with healthcare amongst the worst sectors of the day thanks largely to another 3% decline by CSL while we’ve seen some decent flow out of the resources space over the course of the week, today those with Energy exposure felt most pain. Oil has been more or less protected from the general sell-off thanks to Saudi Arabia’s target to keep oil between $70 - $80/bbl, however it cracked lower overnight and we’re now likely to see some outperformance on a relative sense from the likes of RIO and FMG versus BHP.

On the flipside today, Consumer staples copped a safety bid with Woolies up 0.18% while Wessies put on +0.84%. In other oddities, two heavy weights in the index closed higher despite the broad based nature of the recent selling – CBA closed up +0.53% while RIO added +1.71% on the back of a bounce in the Iron Ore price from oversold levels. We own RIO and CBA in the Growth Portfolio.

It seems that weakness is pre-empting an escalation in the trade war between the worlds two main super powers with the China-US ‘cease fire deal’ expiring this weekend and neither country looks like backing down at this stage. That said, markets often sell the rumour, buy the fact as the eventual outcome is less severe than originally thought – this has proved typical during Trump’s presidency.

We covered our thoughts on 6 growth stocks this morning, one being Aristocrat Leisure (ALL) concluding that we’d be a buyer around $29.25 or another ~3% below yesterdays close. This morning the stock traded down to $28.95 before closing at $29.60. We didn’t add this to the portfolio today and will re-assess early next week, however we do remain keen on the gaming technology provider.

Overall, the index closed down -16 points or -0.27% today to 6143 – down -2.78% on the week

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A few notes out on Graincorp (GNC) recently with some saying that they may get an even smaller crop in FY19 compared to FY18, which will likely impact earnings amid low carry-in volumes from the earlier period.

Elsewhere;

· AGL Energy (AGL AU): Cut to Underperform at Credit Suisse; PT A$17.70

· Challenger (CGF AU): Upgraded to Buy at Morningstar

· MOD Resources (MOD AU): Rated New Buy at Arden Partners

· Newcrest (NCM AU): Upgraded to Buy at Morningstar

· Sigma Healthcare (SIG AU): Cut to Underperform at Credit Suisse; PT A$0.48

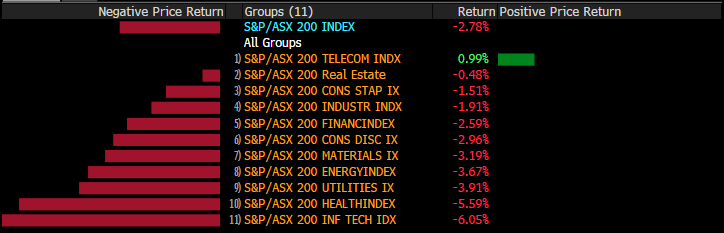

Weekly Moves – Stocks & Sectors;. On a sector level, the telcos outperformed this week, actually ending higher with the help from Telstra’s downgrade but an upgrade yesterday, while Vocus also had a great week. On the other side of the ledger, growth sectors of IT and Healthcare were both down over -6%

Sectors over the past Week

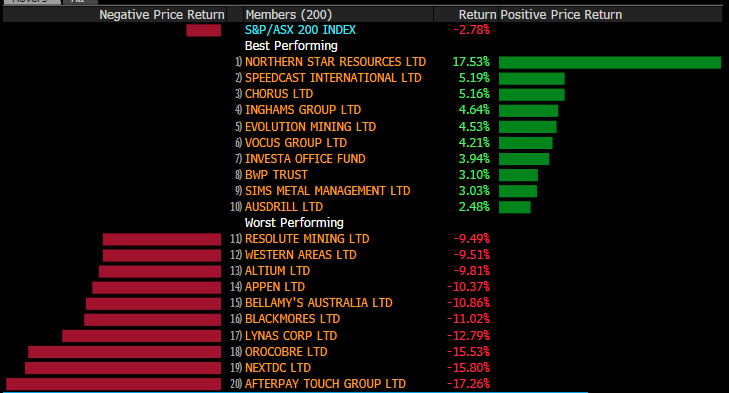

At a stock level, Northern Star was spared from the onslaught thanks to their Alaskan acquisition. Afterpay and NextDC gave back some strong performance as profit taking was on the cards and growth was sold.

Stock moves over the week

OUR CALLS

No changes the portfolios today, although we were close to pulling the trigger on ALL.

Watch out for the weekend report. Have a great night,

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.