Sellers dominate following soft leads (MGR, DOW, LYC)

WHAT MATTERED TODAY

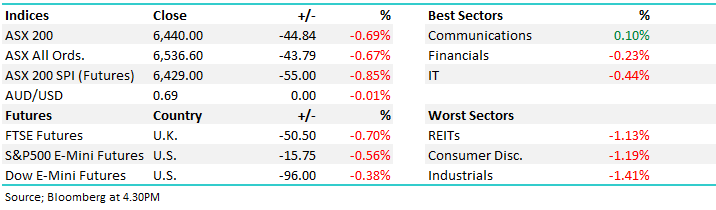

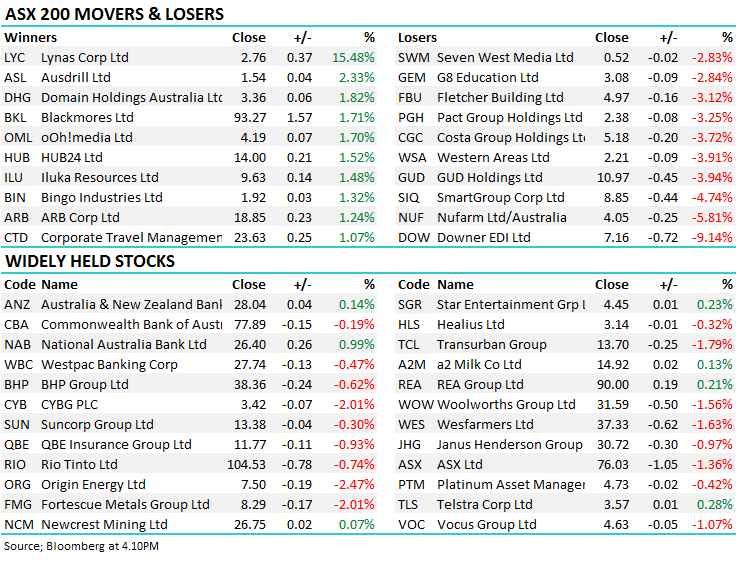

The market traded lower today thanks to weakness from overseas markets last night and again during our time zone today, however despite the day being dominated by sellers the market did recover from the mid-morning lows. A number of clear standouts on the stock side today with NAB being a strong outperformer in the banking space closing up ~1% while the rest of the sector closed in the red. Other bright spots were Iluka (ILU) which added +1.48% and Bingo (BIN) which added +1.32%.

Asian markets were a mixed bag today while US Futures are down. At a sector level, Telco’s held firm to be the only sector in the green while the industrials were the weakest link. REITs traded lower as investors no doubt make some room for the juicy Mirvac capital raise.

Overall today, the ASX 200 fell -44 points or -0.69% to 6440. Dow Futures are trading down -96pts / -0.38%.

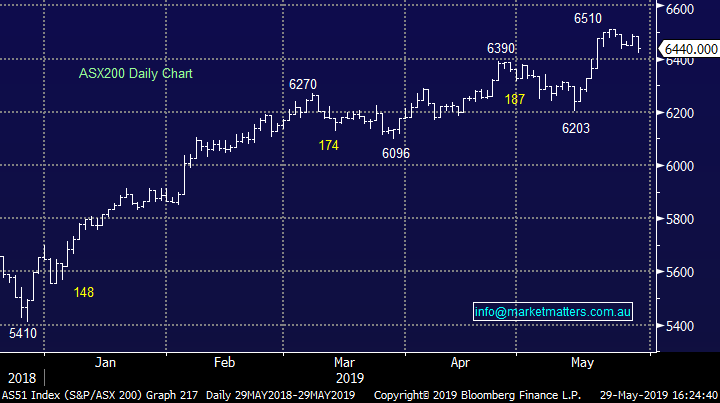

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Mirvac (MGR), 0%; shares in the real estate group Mirvac spent the day in a trading halt following the announcement of a $750m placement to the market today. The deal will be priced at $2.97, around a 4% discount to the last traded price, while MGR will simultaneously launch a share purchase plan for existing shareholders at raise $75m at $2.90/share. Mirvac owns a number of office, industrial, residential and retail sites around Australia and saw its operating profit climb 39% at the half year result to December on the back of strong performance in the Office and Industrial portfolio.

No one specific site has been flagged as the reason for the raise with the company noting it had a significant pipeline which has previously been disclosed to the market. The company has over $3b of commitments which has been fully funded, and the capital raising will open up capacity to fund additional projects, and while trading near 10 year highs raising capital makes sense. MGR guided to EPS of 17.1c, or nearer to the top of the previously guided range confirming the impressive performance continues. They expect to pay a 11.6c divided to round out the year.

Mirvac Group (MGR) Chart

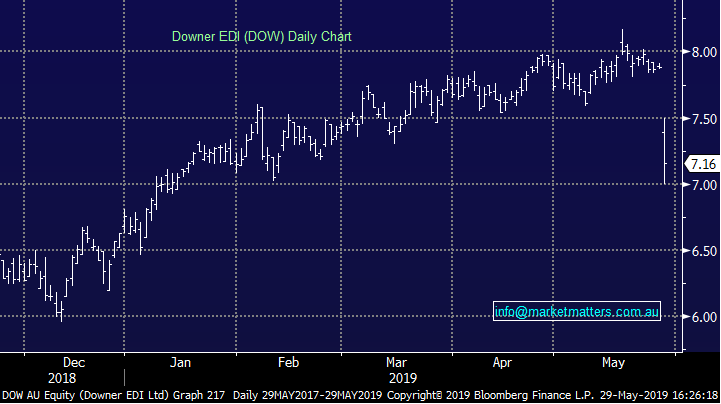

Downer EDI (DOW), – 9.14%; hit hard today after its partner in the Murra Warra wind farm filed for self-administration in Germany. The wind farm being built by Downer and German based Senvion will be one of Australian’s largest wind farms, which is located in the north western part of Victoria. It has around 116 turbines reaching up to 220m in the air.

Today’s announcement could have wider implications for Downer now Senvion has a court-appointed custodian. Credit Suisse put out a note saying that they may attempt to offload some of the cost of completing the project to Downer plus of course bank guarantees provided by Senvion on the project could hold less sway. CS went onto cast doubt on other DOW projects in what was a fairly negative note.

Downer EDI (DOW) Chart

Lynas (LYC), 15.48%; recent takeover target Lynas topped the leader boards today despite no company specific news. Shares in the rare earths miner has well and truly shot through the takeover price on $2.25 as it firms as one of the few beneficiaries from an impending China trade war. Lynas is the biggest rare earths miner & processor outside of China and the country is now threatening to use its position as supplier to 80% of the market to its advantage. The result would see demand of product from Lynas surge. LYC certainly could be used as a hedge against the trade war, but we remain optimistic of a deal being done so for the moment we aren’t looking to chase LYC.

Lynas (LYC) Chart

Broker moves:

· Audinate Rated New Buy at UBS; PT A$9.45

· Avita Medical Raised to Speculative Buy at Bell Potter

· Coles Group Upgraded to Neutral at Credit Suisse; PT A$11.83

· Downer EDI Cut to Underperform at Credit Suisse; PT A$7.10

· Metcash Downgraded to Underperform at Credit Suisse; PT A$2.69

· Sydney Airport Downgraded to Neutral at Goldman; PT A$7.35

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.