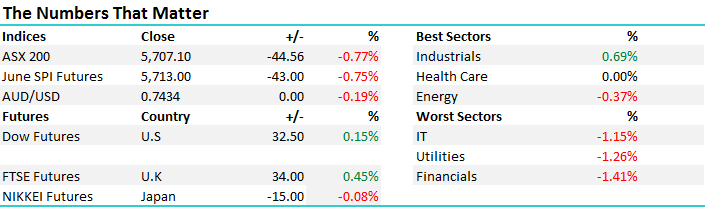

Sellers continue to dominate the ASX…

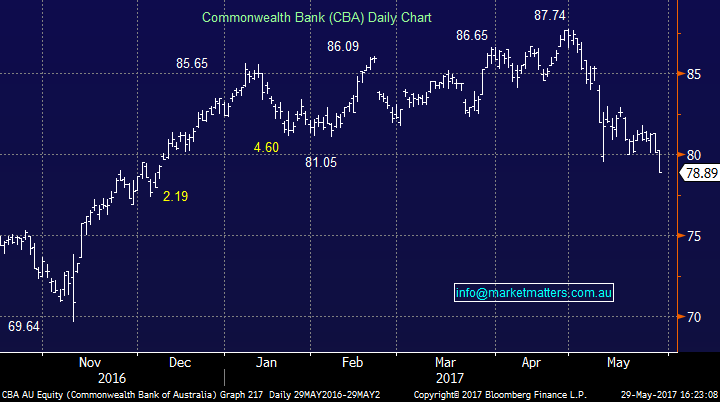

Another soft session for ASX stocks today with the market opening reasonably firm before sellers stepped in from around 11am, mostly targeted towards the banks which accounted for 21points of the markets overall decline of –44points. Com Bank traded sub $79 and we added another 2.5% to our existing 5% holding and we’re now long the stock from $79.66 after liquidating our previous holding around $87 at the back end of April. The regional banks were hit hardest in the sector with both Bendigo and Bank of QLD down more than 2% a piece following the ratings downgrade last week, and subsequent increase in funding costs for the second tier players – clearly something the Govt didn’t see coming, and although we are keen to add to our bank exposure here, we’ll be giving the regionals a wide berth.

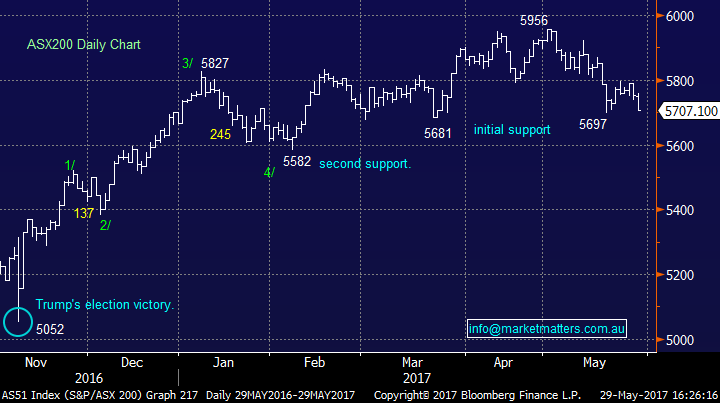

After some fleeting strength on open, the market slid into the close booking a range of +/- 51 points, a high of 5758, a low of 5707 and a close of 5707 – on the low of the day, down -44pts or -0.78%.

It’s Memorial Day in the US tonight so both the stock and bond markets are closed…

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Elsewhere, BHP traded sub $24 and RIO was down below $64, however it was Healthscope (HSO), a stock we’ve previously owned and are looking to re-enter at some stage that was taken to the cleaners today, down -3.38% to close at $2.00 after trading down to a low of $1.975. A downgrade from Credit Suisse hasn’t helped with the bank going from neutral to underperform (really a hold to a sell) and a $2.10 price target, down from $2.45. This dragged Ramsay (RHC) down as well with both stocks clearly under pressure. We were originally targeting a BUY around this ~$2 area for HSO however for now, the stock is trading poorly and price action in both HSO and RHC are flagging the potential for some looming ‘bad news’ it would seem.

The basis for the Credit Suisse downgrade came largely on a change in revenue mix, with more day surgeries compared to overnight stays having a negative impact on earnings (a 7% downgrade on their numbers). On the re-based earnings, the stock is now trading on 20x 2018 numbers which is now cheap relative to history (22x) has been their average PE. Here’s their thesis in a nutshell; While longer-term drivers remain intact (ageing population, chronically under-funded public system) the short- to medium-term outlook for private hospital services is likely to remain subdued (relative to historic average) due to affordability issues and campaigns targeting over-utilisation (e.g., Choosing Wisely).(Credit Suisse)

Healthscope (HSO) Daily Chart

Ramsay Healthcare (RHC) Daily Chart

We sent two alerts out today – one to add to our existing position in Com Bank below $79 which was filled leading into the close today, while our BUY alert of Fortescue (FMG) at $4.60 or better remained unfilled, however that alert will remain active for the remainder of the week unless otherwise notified. In terms of CBA and the other big 4 banks in general, the May / June seasonal weakness has continued to play out and Mr Morrison’s Bank Tax has clearly added to their woes. That said, this prevailing weakness is not out of the ordinary for this time of year and we’re yet to see much that will change our current view / stance. Our downside target remains 5600 for the index and we plan to reduce our cash position further into that level – but as always, we will retain an open mind. After up weighting CBA today, our cash position currently sits at 21%, and this will drop to 16% if we purchase Fortescue into further weakness.

Commonwealth Bank (CBA) Daily Chart

Fortescue Metals Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here