RIO’s results just out – it’s a beat on first (quick) read (RIO, IGO)

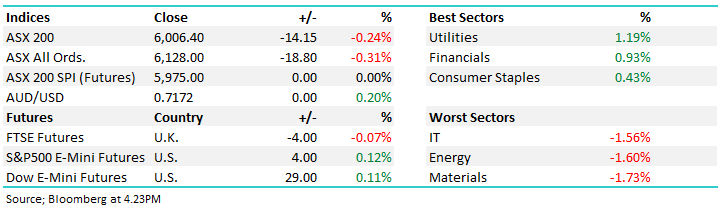

WHAT MATTERED TODAY

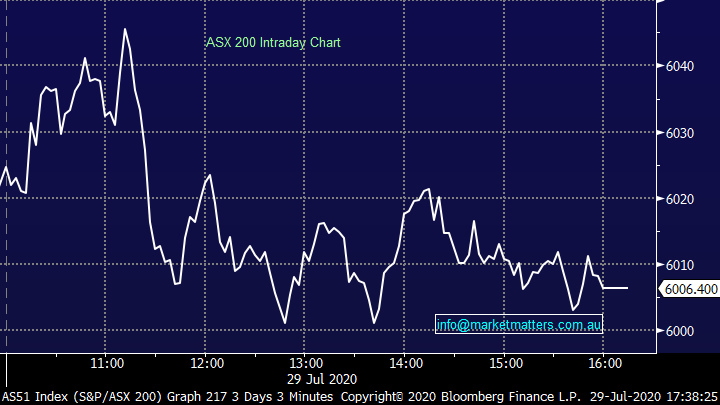

The market managed to start the day on the front foot despite the weak lead from US equities this morning but it did come off the boil pretty quickly at the time local inflation data hit the tape (11am). While the headline numbers were largely inline, the trimmed mean figures were worse than expected, printing a small negative vs the market targeting a small positive quarter on quarter.

Source: Bloomberg

Materials and energy were the laggards of the day while the banks were more supportive on the back of some better than feared direction from APRA on dividends – we discussed this in more detail in the income note today. Independence Group was the worst performer while Rio Tinto is just out with their first half result - more on these two below.

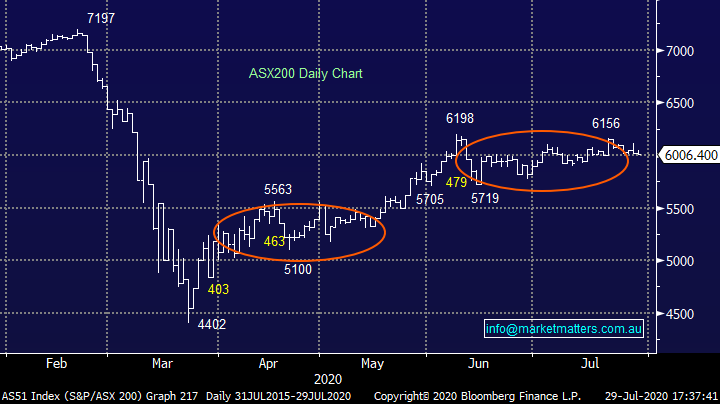

Overall, the ASX 200 added -14pts / -0.23%% to close at 6006. Dow Futures are trading up +29pts / +0.11

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

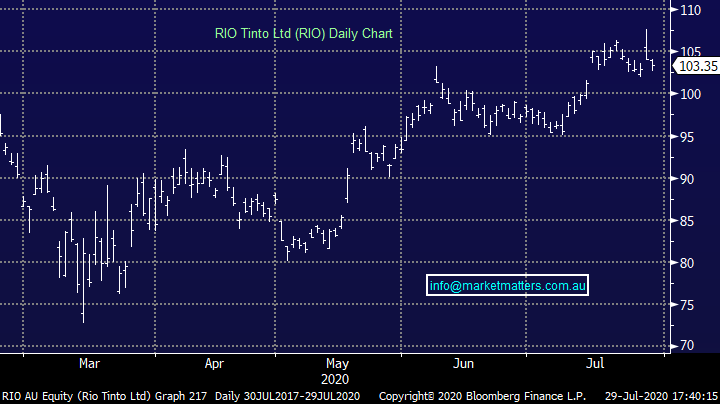

Rio Tinto (RIO) -0.73%: 1H20 results are just out for RIO and it’s a beat according to Peter O’Connor. At the earnings line, they topped expectations by around 9% and 4% at the EBITDA line. That is a good outcome. Here are Peter’s main points:

· NPAT beat saves an dividend miss. Based on consensus numbers it seemed like they’d miss on the dividend however given the beat on the NPAT line the dividend was ‘inline’

· Not just iron ore. Interestingly ALL operating divisions contributed to the beat which at the EBITDA level was a smaller 4% (~$400m). The beat was spread across iron ore, aluminium and copper broadly 1/3 each (although aluminium was the standout)

· Dividend in line. The market was expecting US$1.55 and that is exactly what they got. Based on the average 1H payout ratio of recent years a number more like US$1.47 was in store. Maybe the directors wanted to flag “confidence” in the outlook by (i) beating 1H19 dividend (US$1.51) and (ii) posting the largest 1H dividend under the new dividend system. OR a cynical observer may ponder if said dividend meet may attract more attention than recent corporate governance issues – iron ore etc.

· Earnings contributions. Iron ore is still key delivering ~80% of EBITDA a little bit lower than the 85% we expected given better outcomes in copper and aluminium.

Overall, a good start to the earnings season for the global “big miners” – Anglo tonight as well which we hold in the MM International Equities Portfolio, Glencore tomorrow and BHP in a few weeks.

Rio Tinto (RIO) Chart

Independence Group (IGO) -13.2%: todays quarterly for the nickel/gold miner came largely inline with expectations for the year gone, however it disappointed on the years ahead. well below expectations. For the final quarter the companies key nickel & copper mine, Nova, had a cracking end to the year, helping beat guidance across the board. Their gold mine, Tropicana, met expectations for the year, and a solid commodity tail wind int eh last quarter too NPAT to $155m for the full year – around in line with expectations.

The market did take issue with the forward looking statements, with the company guiding nickel production at Nova lower, and costs higher. The same is also expected in gold sales with production set to fall and costs rise on higher capex. So despite the sold finish to the year, it looks like momentum is set to stall for IGO. We prefer others for both gold or nickel exposure.

Independence Group (IGO) chart

BROKER MOVES:

· Temple & Webster Cut to Hold at Canaccord; PT A$8.50

· Brickworks Rated New Buy at EL & C Baillieu; PT A$18.25

· Virgin Money UK GDRs Raised to Buy at Bell Potter; PT A$2

· GUD Holdings Cut to Neutral at Citi; PT A$12.75

· Regis Resources Cut to Neutral at Credit Suisse; PT A$5.90

· GPT Group Raised to Buy at Jefferies; PT A$4.78

· Charter Hall Retail Raised to Buy at Jefferies; PT A$3.59

· Elders Reinstated Buy at Goldman; PT A$13.65

· Corporate Travel Raised to Buy at Ord Minnett; PT A$12.97

· Mineral Resources Cut to Neutral at Hartleys Ltd; PT A$20.23

OUR CALLS

No changes today

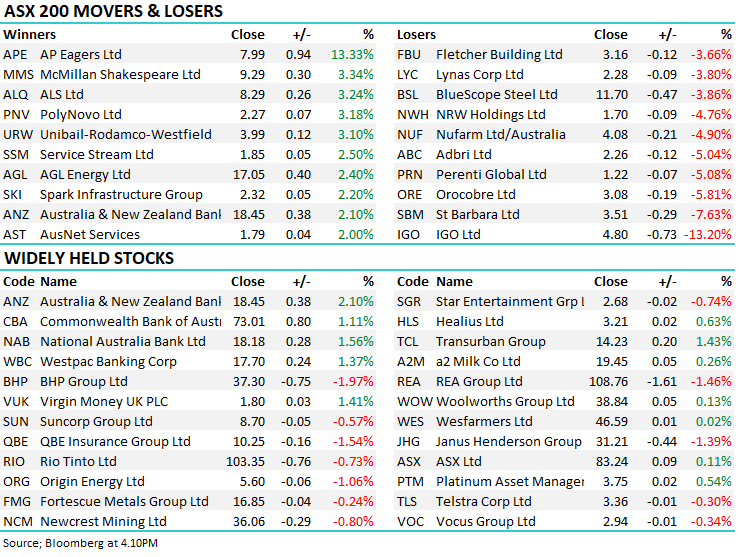

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.