Rio Tinto (RIO) first read of half year result

Rio Tinto (RIO) -0.73%

1H20 results are just out for RIO and it’s a beat according to Peter O’Connor - mining analyst at Shaw & Partners. At the earnings line, they topped expectations by around 9% and 4% at the EBITDA line. That is a good outcome. Here are Peter’s main points:

· NPAT beat saves an dividend miss. Based on consensus numbers it seemed like they’d miss on the dividend however given the beat on the NPAT line the dividend was ‘inline’

· Not just iron ore. Interestingly ALL operating divisions contributed to the beat which at the EBITDA level was a smaller 4% (~$400m). The beat was spread across iron ore, aluminium and copper broadly 1/3 each (although aluminium was the standout)

· Dividend in line. The market was expecting US$1.55 and that is exactly what they got. Based on the average 1H payout ratio of recent years a number more like US$1.47 was in store. Maybe the directors wanted to flag “confidence” in the outlook by (i) beating 1H19 dividend (US$1.51) and (ii) posting the largest 1H dividend under the new dividend system. OR a cynical observer may ponder if said dividend meet may attract more attention than recent corporate governance issues – iron ore etc.

· Earnings contributions. Iron ore is still key delivering ~80% of EBITDA a little bit lower than the 85% we expected given better outcomes in copper and aluminium.

Overall, a good start to the earnings season for the global “big miners” – Anglo tonight as well which we hold in the MM International Equities Portfolio, Glencore tomorrow and BHP in a few weeks.

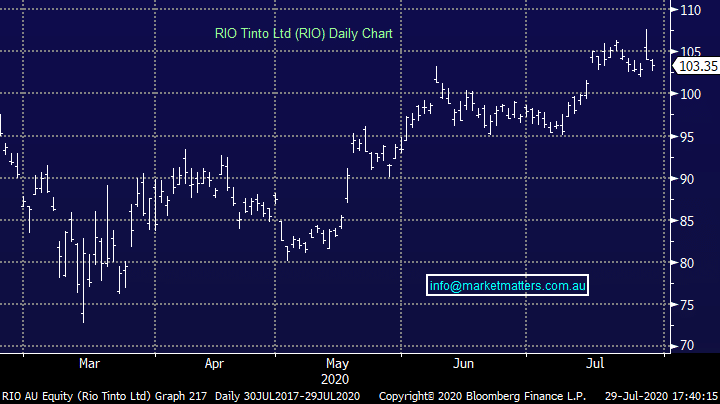

Rio Tinto (RIO) Chart