RIO report just out – good numbers, as were others today…

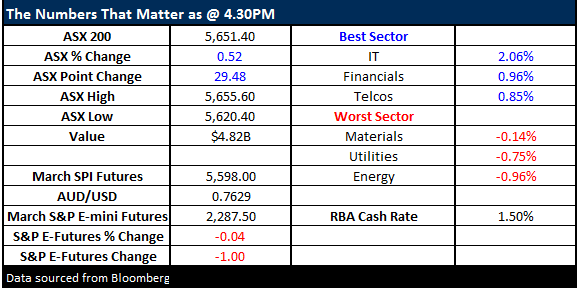

What Mattered Today

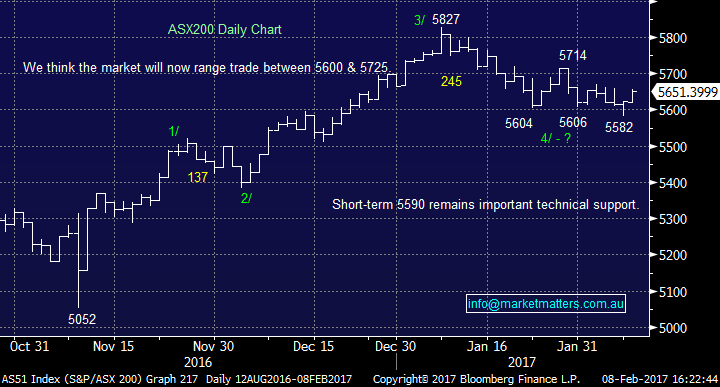

Another good session locally with the market grinding up throughout the day with a pop higher towards the close. We had a range of +/- 35 points, a high of 5655, a low of 5620 and a close of 5651, up +29pts or +0.52%.

RIO’s report has just dropped – quick overview here– FUTURES markets open and locally there is no real reaction – SPI up +5pts from today close at time of writing so there is not massive optimism obvious in the market for what was a very good result.

NPAT - $5.1bn vs $4.9bn consensus

Dividend – US170c vs $133c consensus

Buy back – UK Plc stock, US$0.5bn … lower than some were expecting

A very good result from RIO although stock price has been very strong leading into it. The divi was a clear standout, well above expectations however the small buyback ($0.5bn in London), lower than some expected may drag. Gearing incredibly low at 17% - almost under geared. A good result but not am absolute cracker!!

Rio Tinto (RIO) Daily Chart

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Elsewhere today, reports today from Carsales.com (CAR),BWP Trust (BWP) & Cimic (CIM) – all were OK

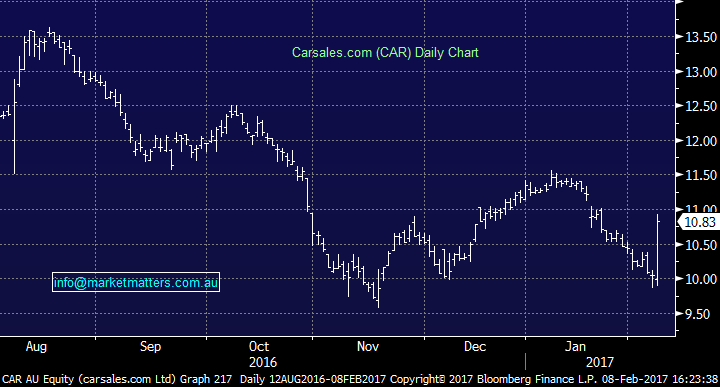

Carsales.com (CAR) is a stock we’ve been bearish on – a stock we were suggesting to SELL from above $11 as written in our outlook piece targeting $9. It dropped 10% quickly after we penned that note but rallied back +7.76% today or +78c to close at $10.83. The 1H earnings missed consensus marginally but top line growth was strong (better than we thought), largely from their overseas operations. Despite the growth, margins declined in all divisions which is clearly a concern going forward. The stock dropped 12% in the month of January – and has recouped some of that today. Still no interest

Carsales.com (CAR) Daily Chart

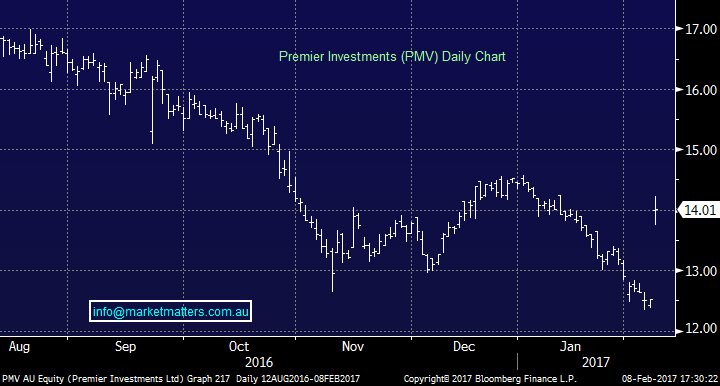

Premier Investment (PMV), the owner of Peter Alexander, Smiggles etc upgraded earnings and the stock put on 11.9% after a tough few months for the retail stocks. These guys do things well, have strong brands and is one of the better retailers in this current environment.

Premier Investments (PMV) Daily Chart

Henderson (HGG) had a very good day rallying +3.72% ahead of reporting tomorrow. In simple terms, HGG is cheap, on around 11.7 times FY17 earnings, will pay a 5.8% yield based on 65% payout. They’ve had a tough time, as have all UK based fund managers with recent flow data showing the biggest outflows since the GFC. If you want to buy a company that’s had a v’tough 12 months and is priced accordingly, but importantly is about go through a BIG company transforming transaction then HGG is worth a look. A lot have criticised our positive stance towards HGG in recent times, and it’s one of those ‘hard trades’ that feels a bit uncomfortable, but it’s a stock that offers value in an expensive market + it’s got a legitimate platform for growth in FY17 and beyond. More details in tomorrow’s result around Janus will be key…

Henderson Group (HGG) Daily Chart

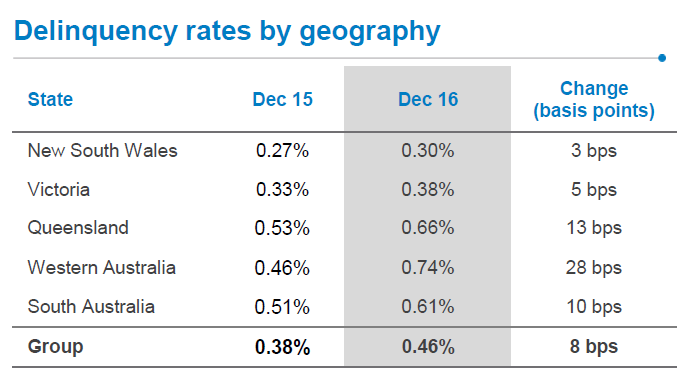

On the other side of the ledger today was Genworth (GMA) which is the mortgage insurer – down -14% on a weak set of numbers. This is the canary in the coalmine for the Aussie housing sector and the trends seem to be softening. One chart around delinquencies interesting in their chart pack today – uptick across the board with the most stress in WA. One for the housing BULLS out there!

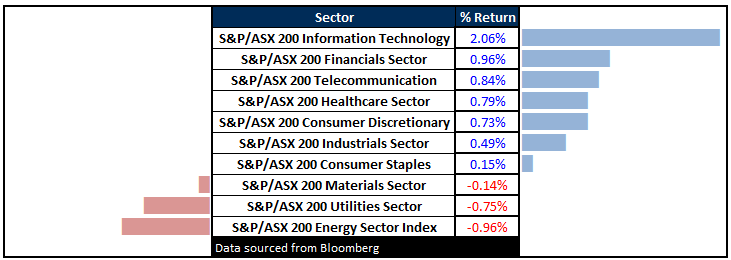

Sectors

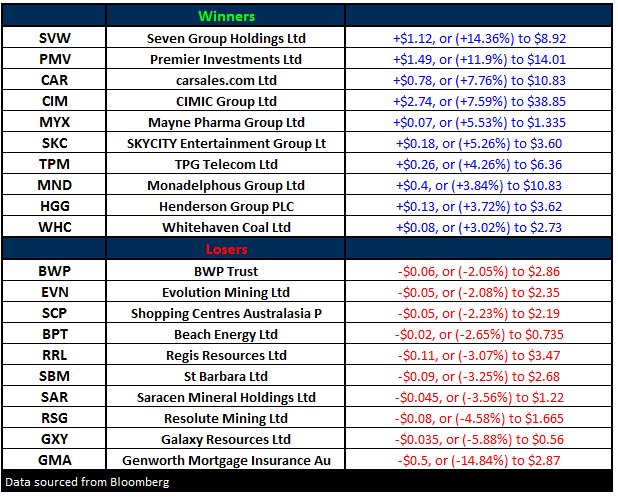

ASX 200 Movers

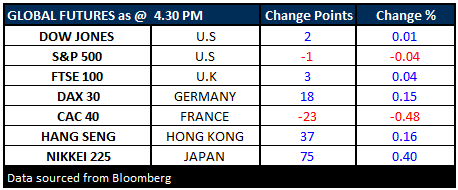

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here