RIO production numbers not good enough to push stock higher (RIO, APT, BAL, ZML)

WHAT MATTERED TODAY

It seemed like there was a decent sell order in ASX 200 Futures this morning that prompted selling amongst the large cap stocks – usually happens with an overseas fund is taking a negative bet on Australia and getting set via Futures – the weakness was obvious on open, a slight recovery when traders went to lunch then the market slid into the close. RIO reported strong Dec QTR production numbers today but ended lower on the session, Bellamy’s upgraded earnings with good margin guidance, Afterpay Touch (APT) traded up by +16% on the back of a very strong quarterly update, while some of the diversified financials did well, Perpetual (PPT) which we bought recently in the MM Income Portfolio continues to do well adding another +2.61% to close at $52.38 , BT was also strong – ditto for HUB24. The buying in Bellamy’s flowed over to other Chinese facing names with A2 Milk putting on +6.46% to close at $7.42 while Blackmores (BKL) added +6.17%. Really a day where the market collectively was soft yet a few stock specific stories helped to keep things interesting.

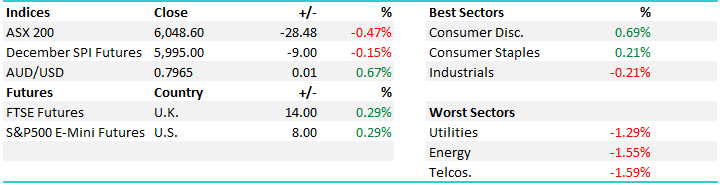

Overall, the Consumer Discretionary stocks were strong, an upbeat article in the FIN this morning on JB Hi Fi saw those shares up +1.17% however Nick Scali (+2.71%) and Harvey Norman (+1.13%) were also strong in a weak market. On the flipside, the Telco’s had a poor day, Telstra the biggest drag down -1.62% to $3.65 while the smaller players were also soft. An overall range today of +/- 35 points, a high of 6077, a low of 6042 and a close of 6048, down -28pts or -0.47%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

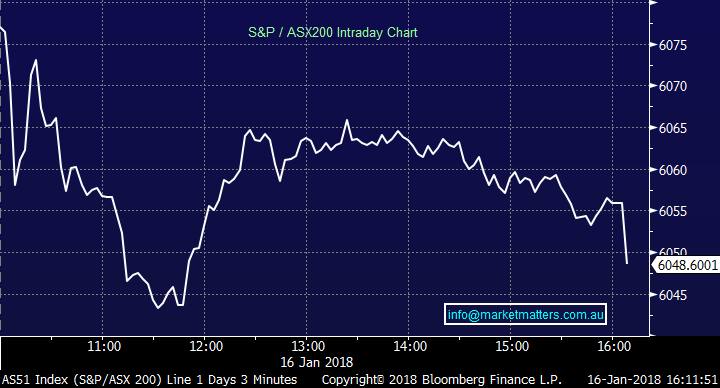

1. RioTinto (RIO) $81.26 / -0.66%; posted Q4 production numbers this morning which are important in terms of their full year results (given RIO is December year-end) with the stock down despite a good result (i.e traders already positioned for it). They met Iron Ore and Aluminium production guidance, and only a small miss on Copper which is likely to be offset by strong prices throughout the quarter. Copper wasn’t all bad with Escondida producing a higher grade despite running at a lower run rate than had been expected.

Reasonable Q4 numbers across the three main drivers of RIO point to a strong calendar year result due out in early February, and the market laggards (analysts) are likely to now upgrade price targets reflecting; 1. They beat in terms of iron Ore guidance from around 330mtpa to a range of between 330 – 340 mtpa while the spot price is running at a ~26%/$19 premium to consensus.

Thinking about RIOs leverage to the Iron Ore price, a $1 move to the average price received on Iron ore is around $250m to after tax earnings for RIO – which is massive.

In our view, todays price action shows the mkt is now long RIO (and others for that matter) however if playing the sector, which we want to do this year, we’re likely to see final December QTR upgrades (DB out today with one) + Jan revisions ahead of early Feb full year results which will focus on cash generation and capital management - so you BUY now for those themes to play out given the mkt always gets ahead of itself however don’t set and forget, look to sell in May and rotate funds back towards $US.

I covered RIO this morning on SKY BUSINESS just as the result was landing. CLICK HERE

Rio Tinto Daily Chart

RIO versus Iron Ore – clearly tracking Iron Ore prices from the ~$US40 low 15/16 with RIO now ~$81 and Iron Ore at ~$US74

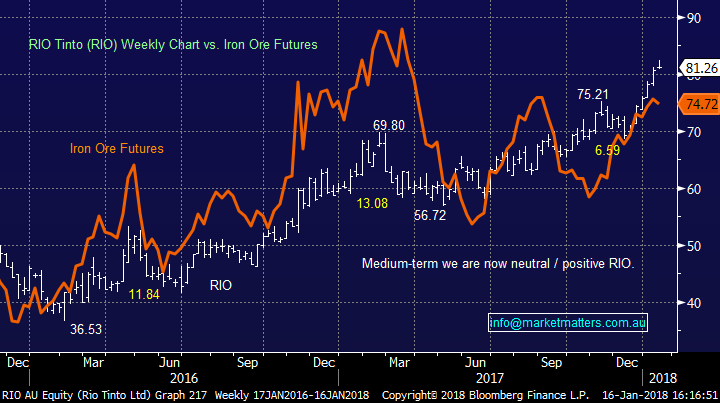

2 .Bellamy’s (BAL) $13.68 / 24.82%; Rocketed today on a big upgrade in terms of earnings + margins, although it smelt fishy yesterday, jumping nearly 6% without any news flow! A big improvement in EBITDA margin rising to 20-23%, up from 17-20% while expected revenue growth was revised to 30-35%, up from original guidance of 15-20% + the commentary was upbeat which underpinned strength across the broader sector. The stock ripped higher today and is now just ~$2 below the all-time high.

Bellamy’s Daily Chart

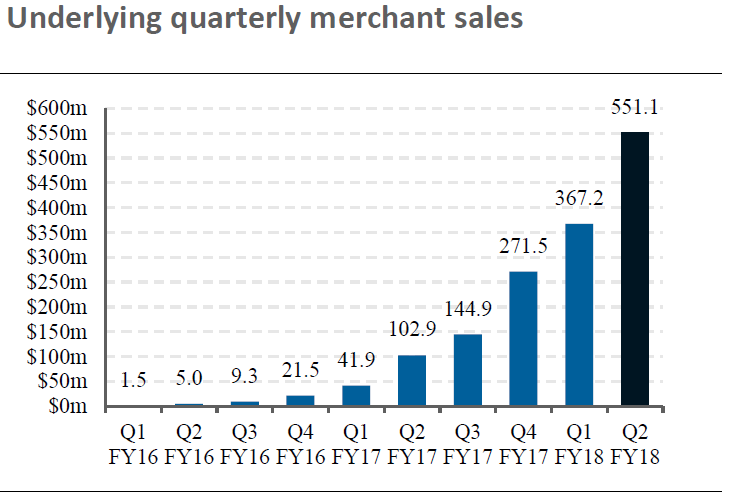

3. Afterpay (APT) $7.62 / 16.87%; The chart below says it all with Afterpay in more outlets, doing more transactions and earning more revenue than ever before – massive uplift QoQ which is obviously driving share price, some regulatory risk here in terms of Govt intervention on consumer credit however the company clearly has a lot of traction with both merchants and users - now a ~$1bn mkt cap.

Afterpay Daily Chart

The other interesting stock in the sector is ZipMoney (Z1P) capped at $230m on a run rate of $380m in transaction volume – these guys obviously smaller, and with a solid share register + bank backing look interesting around current levels.

ZipMoney Weekly Chart

4. BITCOIN; Getting more questions about BITCOIN these days however the price clearly coming back in recent weeks. Wait for to people start losing money on a sure thing then prices will really struggle!!

Bitcoin Daily Chart

OUR CALLS

No changes to the portfolio’s today, however looking to take profit in Harvey Norman in the Income Portfolio ~$4.60.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/01/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here