RIO just out with results – earnings a touch light, special dividend a win (RIO, ABC, JHG)

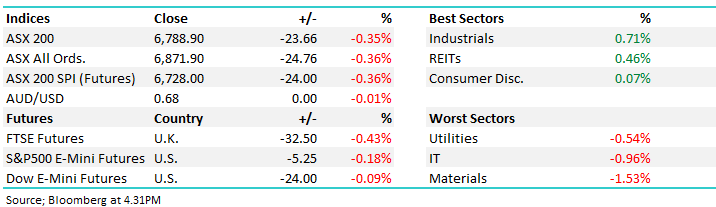

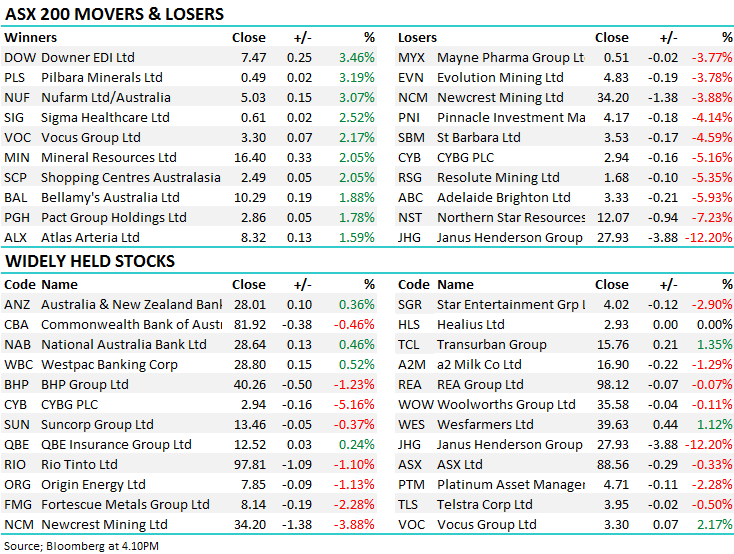

WHAT MATTERED TODAY

Another soft day for the market as earnings season continues to throw up some landmines.- this time it was Janus Henderson (JHG) who reported 2Q earnings overnight and were hit on our market today. RIO first half numbers just coming out as I type which we’ll cover in the morning post the conference call with kicks off at 7pm, however at the headline level, underlying earnings at $4.9b seems a touch light ($5bn+) was expected however they have announced a special 61cps dividend plus an ordinary dividend of US151cps. That was below the US176cps ordinary we were looking for however obviously the special makes up the ground and some…more in the morning post the call.

Rio Tinto (RIO) Chart

Today we saw the aftershocks of the US Federal Reserve who cut rates by 0.25%, the first time in a decade, however they were less dovish about future cuts than the market was positioned for. That saw the $US higher which ultimately applied pressure to commodity producers locally today – Newcrest (NCM) down -3.88%, BHP fell -1.23% and RIO off by -1.1%. Iron Ore was lower in Asia, down around 3% while US Futures were fairly quiet during our time zone, settling marginally lower at our close.

Overall, the ASX 200 lost -23pts today or -0.35% to 6788. Dow Futures are trading down -25pts / 0.30%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

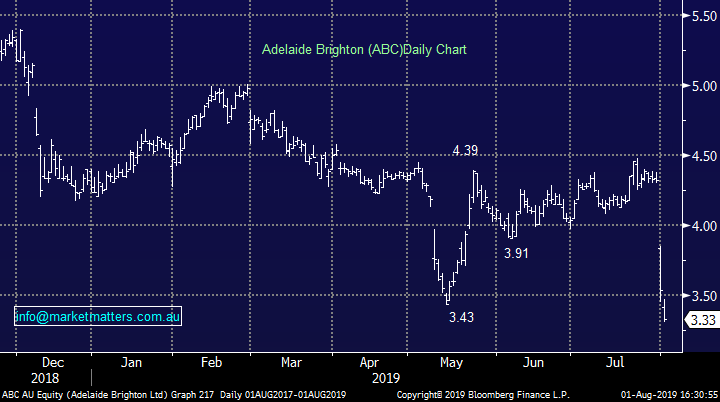

Adelaide Brighton (ABC) -5.93%: A few questions coming through the pipe on ABC today which is understandable – it was off again on the back of a raft of broker downgrades as outlined below – eventually closing near the lows of the day. Worth re-visiting our original alert here on the stock as it provides insight into our thinking now… From the alert posted on the 22nd July….As discussed in the Weekend Report, we are bullish building materials company Adelaide Brighton (ABC) targeting 15-20% upside from current levels. ABC has had a tough 12-months which has seen its shares halve due to the fall off in construction but we believe this is a quality business whose shares are now presenting decent value. There is some risk around the upcoming earnings report, hence the 3% initial weighting leaving room to add to the positon in time.

After a poor result selling often follows through for a few days - often 3 – the initial downside reaction then the influence of downgrades flowing through to models. Tomorrow an important day for the stock insofar as we should be seeing sellers dry up if the stock has found a point of perceived value. We’ll then revisit the stocks at that point.

Adelaide Brighton (ABC) Chart

Janus Henderson (JHG) - 12.20%:We covered this morning however the selling was sustained in the stock throughout the day – eventually closing near the lows. In the AM report we suggested…This is an example of a “cheap stock” remaining cheap for a while, we now prefer Pendal Group (PDL) for similar market exposure / risk, PDL is likely to be dragged lower if JHG does get smacked today – it opened down only 3.7% in the US but then slipped lower all night with the weak market. Hence the price differential for the switch is unlikely to be too painful.

That theme didn’t really play out with PDL (today at least) remaining supported (+0.26%) on a relative basis – hence no opportunity to switch. JHG now a strong chance of testing its lows ($26.96) where it traded in December. The mkt is clearly being harsh on those that miss the mark. Selling here seems overdone for the result was posted however as we often say, don’t fight the tape.

Janus Henderson (JHG) Chart

Broker moves;

- Freelancer Downgraded to Sell at UBS; PT A$0.88

- Freelancer Downgraded to Hold at Canaccord; PT A$0.95

- Independence Group Cut to Neutral at UBS; PT Set to A$5.40

- CBA Downgraded to Sell at UBS; PT Set to A$72

- CBA Downgraded to Underweight at JPMorgan; Price Target A$76

- Janus Henderson GDRs Cut to Negative at Evans & Partners

- Marley Spoon GDRs Downgraded to Neutral at Macquarie; PT A$0.68

- Genworth Australia Downgraded to Neutral at Macquarie; PT A$3.25

- Adelaide Brighton Downgraded to Neutral at Macquarie; PT A$3.75

- Adelaide Brighton Cut to Underweight at Morgan Stanley; PT A$3

- Adelaide Brighton Cut to Underperform at Credit Suisse; PT A$3

- Adelaide Brighton Upgraded to Neutral at JPMorgan; PT A$3.50

- Resapp Health Cut to Speculative Buy at Morgans Financial

- Myer Upgraded to Neutral at Credit Suisse; PT A$0.55

- Insurance Australia Cut to Underperform at Credit Suisse

- Woolworths Group Cut to Underperform at Credit Suisse

- Wesfarmers Cut to Underperform at Credit Suisse; PT A$32.55

- Coles Group Cut to Underperform at Credit Suisse; PT A$11.97

- AGL Energy Downgraded to Underweight at JPMorgan; PT A$19.75

- Origin Energy Cut to Neutral at JPMorgan; Price Target A$8.35

OUR CALLS

No changes across portfolios today

Major Movers Today

Have a great night

James / Harry & Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.