Resources & Real-Estate lead the ASX lower today (CGC, BIN)

WHAT MATTERED TODAY

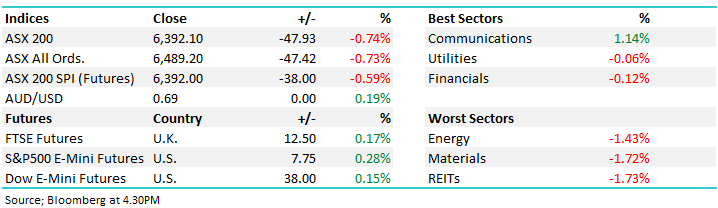

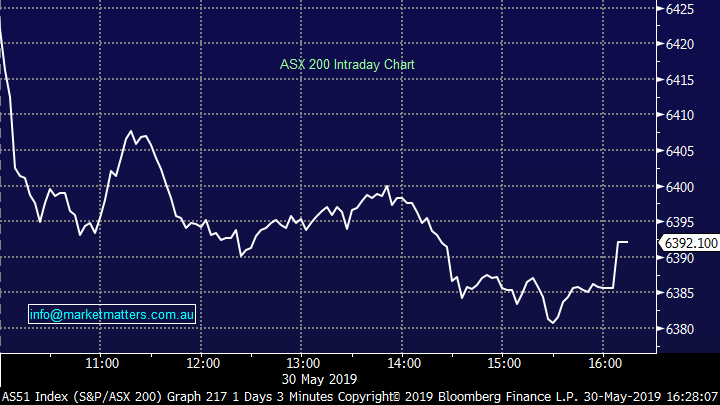

Another day of weakness for Aussie stocks with the market trading down on open and chopping around for most of the session – the mkt ticking around the 6400 region for much of the day. Stock options expiry so lots happening on the desk, plus of course Costa (CGC) downgraded earnings and was hit hard on the back of it – not good. More on that stock below.

US Futures were well behaved during our timezone today, edging higher through the session while Asian market were mostly down around ~0.5%.

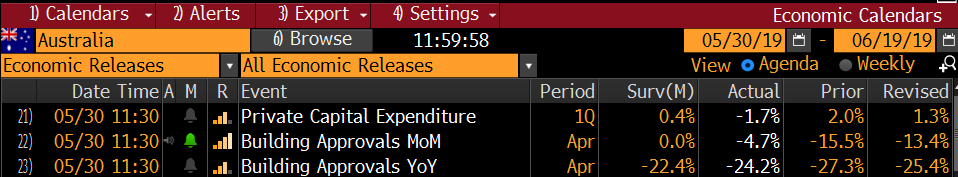

On the economic front, building approvals were weak in April however data just before the election was always going to be soft.

Economic Data Today

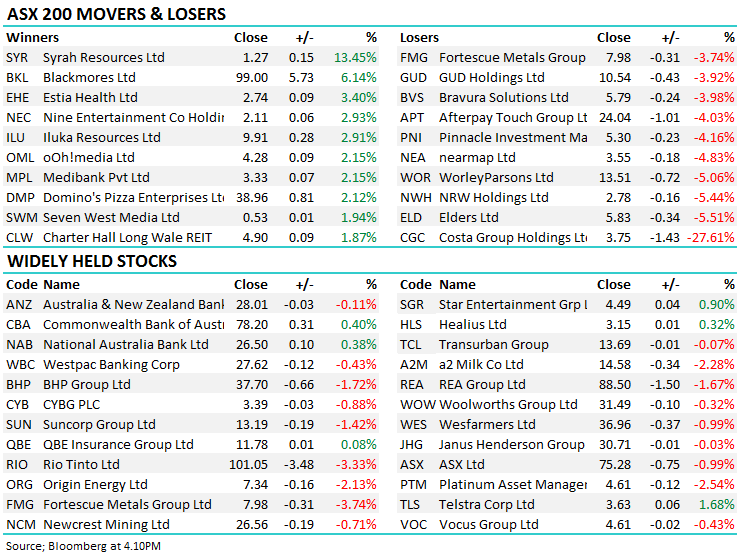

At a sector level, banks were outperformers again while the resources were on the nose for the most part – property also saw some selling after Mirvac (MGR) came online following their $750m capital raise

Overall today, the ASX 200 fell -47 points or -0.74% to 6392. Dow Futures are trading up +53pts / +0.22%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Costa Group (CGC) –27.61% Came out with an earnings downgrade at their AGM which is being held in Melbourne today and the stock has been taken to the cleaners – closing down -27% on the lows of the day. We own CGC in the growth portfolio and todays update is clearly a disappointing one. In FY18 CGC reported profit of $56.6m and this year they have now guided to profit in the range of $57-66m on EBITDA of $140-153m. Market expectations were for profit of $76m on EBITDA of $166m implying a downgrade of 19% at the mid-point on the profit line.

The downgrade is being put down to a number of cyclical factors that have reared up in the last month or so. Without going through all the specifics, they largely relate to weather and / or certain conditions in two of their product lines, raspberries and citrus.

There’s no sugar coating todays downgrade, it’s the second since January highlighting the significant number of moving parts and complexity in an agricultural business like this. Of course, this makes predicting earnings in the short term challenging, however despite these near term headwinds we continue to see medium term opportunity as the business grows and diversifies both in terms of product and geography - CGC remains the largest grower, packer and marketer of fruit and veg in Australia.

In terms of today’s selling, it was sustained throughout the day. A lot of volume through on the open at $3.94 before the stock rallied to a $4.35 high, however it was all one way traffic thereafter, and the stock closed on the low. It felt like there was a large holder with an axe to sell the stock and the massive volume supports that thesis. The top five holders of CGC are outlined below and of the top 5, only Bennelong has been a major seller during calendar 2019. They’re also the major holder of the stock with 27m shares on board. Being a substantial holder, it will be interesting if we see any changes here over the coming day – we’ll keep you posted.

Top 5 holders of CGC

Source: Bloomberg

We stepped in and averaged our position today squarely of the belief that shorter term pain is setting up an opportunity rather than signalling something more structurally wrong with the business.

Costa Group (CGC) Chart

Bingo (BIN) –2.60% also sold off today, more so than the market although fairly benign relative to Costa’s move. The waste management company was set to host a site visit today however the event was postponed following the death of a worker at the company’s newly acquired landfill site in Eastern Creek in Sydney on Monday.

While tragic, the death is unlikely to be a huge impost on the company. The site visit was scheduled for the company’s Patons Lane recycling and landfill site which is expected to be operational early next year, adding $15-$20m EBITDA for the year after. All the seats on the bus out to western Sydney had been filled which highlights the market’s desire to get to know Bingo better. The company has an image problem at the moment following the big downgrade earlier this year and needs events like this to pull investors in. We like Bingo, and own a chunk in the Growth Portfolio buying two lots at lower levels – around $1.20 & $1.60. The company is doing a decent job in shifting focus from residential waste to infrastructure where there is a huge pipeline of projects.

Trading on an FY20 PE of ~20x with 20% growth in the core business it looks cheap to us.

Bingo (BIN) Chart

Broker moves:

· Telstra Downgraded to Hold at Ord Minnett; Price Target A$3.55

· Vector Downgraded to Underperform at Forsyth Barr; PT NZ$3.15

· Charter Hall Long Rated New Buy at Citi; PT A$5.29

· Sigma Raised to Neutral at Citi; PT Kept at A$0.52

· NRW Holdings Downgraded to Neutral at Citi; PT A$3.01

· Steadfast Upgraded to Hold at Morningstar

· G8 Education Downgraded to Hold at Morningstar

· Flight Centre Downgraded to Sell at Morningstar

· Perpetual Downgraded to Sell at Morningstar

· Automotive Holdings Downgraded to Hold at Bell Potter; PT A$2.80

· Blackmores Upgraded to Equal-weight at Morgan Stanley

· GUD Holdings Downgraded to Neutral at Credit Suisse; PT A$12

OUR CALLS

We added to our existing position in CGC in the MM Growth Portfolio

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.